The lighting-use LED market contracted 5-16% in the fourth quarter, while backlighting-use LED products fell 4-13% according to a new report from LEDinside, a division of the Taiwan-based market intelligence firm TrendForce. The average price of lighting-use LED products is falling with the arrival of the non-peak season and as competition intensifies among manufacturers, said Jack Kuo, an assistant research manager at LEDinside. “Orders are falling and profits are being squeezed,” he said. “For manufacturers to increase their market share, they need to introduce more new products.”

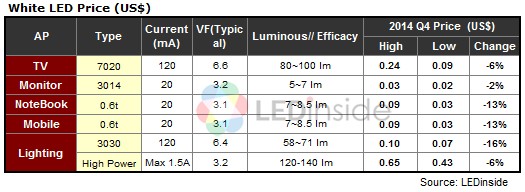

Prices declined across the board in the lighting-use LED market in the fourth quarter due to increasing lighting product inventory. As demand in the 3030 market gradually fell, it increased the speed of price declines and overall the market contracted 16%. 5630 prices also fell, but only by 5%. High power LED products did not fall notably in price for the most part, but the 1500mA was an exception, decreasing 6%. Moreover, prices of backlight-use LED products used in mobile phones and tablets dropped by 13%. LED specs for smartphones, tablets and PC are very similar, and can actually be shared in these applications, Kuo said. 0.6t LED prices fell $ 0.035. Furthermore, LED price for monitor application was fairly stable, decreasing just 2%. LEDinside predicts LED specs for TV applications will be further standardized in 2015. 7020 LED, representing LED specs in the edge-type LED TV sector, fell 6% to $ 0.113 in the fourth quarter. Meanwhile, the direct-type LED TV penetration rate is expected to reach 60% in 2015. 3528/3030 LED package prices fell 10% in the fourth quarter.

The lack of MOCVD experts in China to operate MOCVD equipment is no longer an issue, since the Chinese have been able to continue producing LEDs with high utilization rates, Kuo said, adding: “Even if the machines’ production yield is not optimized, Chinese manufacturers have still achieved economies of scale because of their high production volume and low manufacturing costs, which is putting enormous pressure on Taiwanese, Japanese and Korean LED manufacturers.” Looking ahead to 2015, LED manufacturers will face a number of challenges, Kuo said. They will need to figure out to maintain their competiveness in a saturated market, where low prices are common. Additionally, there are 5 LED manufacturers in the industry that have most of the patents: Nichia, Cree, Toyoda Gosei, Philips and Osram. It will be imperative for other vendors to form strategic alliances with them to avoid patent lawsuits and expand into new markets.

2015 Chinese Lighting E-commerce Market Analysis

Release: January, 2015

Language: English

Format: PDF

Pages: 261

Chapter 1 Report Introduction and Research Approaches

-

Key Factors of Chinese Lighting Products in E-commerce Platform

-

Key Factors

-

Key Drivers

-

Key Restraints

-

Research Approaches and Strategy

Chapter 2 Chinese E-commerce Market Development

-

Summary of Chinese E-commerce Market Development

-

Sub-sector Structure of Chinese E-commerce Market in 2013

-

Chinese E-commerce Market Scale

-

Analysis on Total Retail Sales of Consumer Goods in China and Penetration Rate of E-commerce Market

-

Comparison of Growth Rate between Chinese E-commerce Market and Consumer Goods Market

-

Chinese E-commerce Market Structure Analysis

-

Distribution of Chinese E-commerce Market Share in 2013

-

Mobile Internet Shopping Market Scale Analysis

-

Analysis on the Proportion of Mobile Shopping in Online Shopping

Chapter 3 Introduction of Major Chinese E-commerce Platforms

-

Current Situation Overview of Major E-commerce Platforms

-

Analysis of Three Major E-commerce Sales Models

-

Business Mode Analysis-Taobao (C2C)

-

Business Mode Analysis-Tmall (B2C)

-

Business Mode Analysis-JD (B2B2C)

-

Comparison of LED Lighting Product Amount in Four B2C Platforms

-

TMALL.COM

-

JD.COM

-

SUNING.COM

-

DANGDANG.COM

-

AMAZON.COM

-

Company Profile

-

Charging Standard

-

Documents Required

-

Logistics System

-

Promotion

-

Comparative Analysis of Chinese Major E-commerce Platforms

-

Introduction of Major Payment Processes and Platforms

-

Comparative Analysis of Major Logistics Systems for Chinese E-commerce

Chapter 4 Chinese Lighting E-commerce Development Trend

-

Chinese Lighting E-commerce Development Trend

-

Chinese Lighting E-commerce Market Scale and Growth Trend

-

Proportion Analysis of Chinese Lighting Online Shopping Channel

-

Analysis of Chinese Lighting E-commerce Market Structure in 2014

-

Distribution of Lighting Products Sellers and Buyers Network-wide (Taobao + Tmall)

-

Analysis of Lighting Products Consumers' Gender and Age

-

Analysis of Lighting Products Purchased Time and Client Source

-

Transaction Volume of Light Source Products and Luminaires on Taobao in 2014

-

Transaction Volume of Light Source Products and Luminaires on Tmall in 2014

Chapter 5 Consumers Behavior Survey on Chinese Lighting E-commerce Market

-

Introduction

-

Analysis of Chinese Consumers' Lighting Brand Image

-

Analysis of Chinese Consumers' Lighting Brand Awareness

-

Approaches of Chinese Consumers Gathering Lighting Products Information

-

Consumer Acceptance of Network Platform Obviously Increased

-

Market Share Analysis of Major Lighting Brands in China

-

Proportion Analysis of Consumers willing to Buy LED Lights through Network Platform

-

Analysis on Key Factors Attracting Consumers to Purchase Lighting Products Online

-

Role Analysis of Consumers When Buying Lighting Products

-

Model Analysis of Consumers' Decision to Purchase Lighting Products

-

Consumer Satisfaction Analysis of Lighting Product Brands

-

Analysis on Consumer Concerned Factors When Buying Lighting Products and the Brand Most Likely to be Purchased Next Time

-

Analysis of Reasons Why Consumers Refusing to Purchase Lighting Products Online

-

Analysis of Mainstream E-commerce Platforms Where Consumers Purchasing Lighting Products and Shopping Situation

Chapter 6 Popular Brands and Hot-selling Products in Chinese Lighting E-commerce Market

-

Analysis of Major Lighting E-commerce Brands and Hot-selling Products

-

Market Share of Lamps and Luminaires in Tmall in 2014

-

Market Structure of Lamps and Luminaire Products

-

Single Lamp / Bulb, Tube, Down Light, Ceiling Light

-

Top Ten Products in Terms of Network-wide Transaction Amount in 2014

-

Product Features

-

Unit Transaction Price Distribution

-

Gender and Age Characteristics of Buyers

-

Geographical Distribution of Buyers

-

Geographical Distribution of Sellers

Chapter 7 Case Study of Lighting Brands’ E-commerce Channel

-

Case A: Philips Lighting

-

Case B: NVC Lighting

-

Case C: Opple Lighting

-

Case D: Panasonic Lighting

-

Case E: AOZZO

-

Critical Success Factors Analysis

-

Light Source Products - Lamp /Tube; Luminaire Products - Down Light / Ceiling Light

-

Hot-selling Products Distribution

-

Unit Selling Price Distribution

-

Age and Gender Distribution of Buyers

-

Geographical Distribution of Buyers

-

Geographical Distribution of Sellers

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972 joannewu@trendforce.com

CN

TW

EN

CN

TW

EN