Transaction will allow Wolfspeed to focus on U.S. capacity expansion to support silicon carbide power device and materials businesses

DURHAM, N.C. August 22, 2023 -- Wolfspeed, Inc. (NYSE: WOLF) today announced that Wolfspeed has entered into a definitive agreement to sell its radio frequency business (Wolfspeed RF) to MACOM Technology Solutions Holdings, Inc. (Nasdaq: MTSI) for approximately $75 million in cash, subject to a customary purchase price adjustment, and 711,528 shares of MACOM common stock, valued at $50 million based on the 30 trading day average for MACOM’s common stock through August 21, 2023. The company expects to close the transaction by the end of this year.

“Given the significant growth we’ve seen in automotive, industrial and renewable energy markets, we believe this is the right time to further focus on scaling our Power device and materials businesses to meet this accelerated demand,” said Wolfspeed President and CEO Gregg Lowe. “This transaction also represents a tremendous opportunity for our RF team to grow and operate at scale, leveraging MACOM’s diverse customer base, RF engineering leadership and operational efficiencies.”

Wolfspeed RF’s technology and innovation engine drives a strong product development pipeline, with deep domain expertise supporting a competitive gallium nitride (GaN) on silicon carbide product portfolio optimized for next generation telecommunications infrastructure, military and other commercial applications. Leveraging MACOM’s diverse customer base and operational expertise, Wolfspeed RF will be well positioned to continue to deliver industry leading products at scale.

The transaction is subject to the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (“HSR”) and satisfaction of customary closing conditions. MACOM will assume control of Wolfspeed’s 100mm GaN wafer fabrication facility in Research Triangle Park, North Carolina (the “RTP Fab”) approximately two years following the closing of the transaction to accommodate Wolfspeed’s relocation of certain production equipment. Prior to such transfer, the shares of MACOM’s stock that Wolfspeed receives at closing will be subject to restrictions on transfer.

In connection with the transaction, J.P. Morgan Securities LLC is acting as financial advisor and Smith Anderson LLP is acting as legal advisor to Wolfspeed.

Business Outlook

Based on the agreement to sell Wolfspeed RF, the operations of the RF business will be classified as discontinued operations. As a result, Wolfspeed is updating its guidance to reflect continuing operations only.

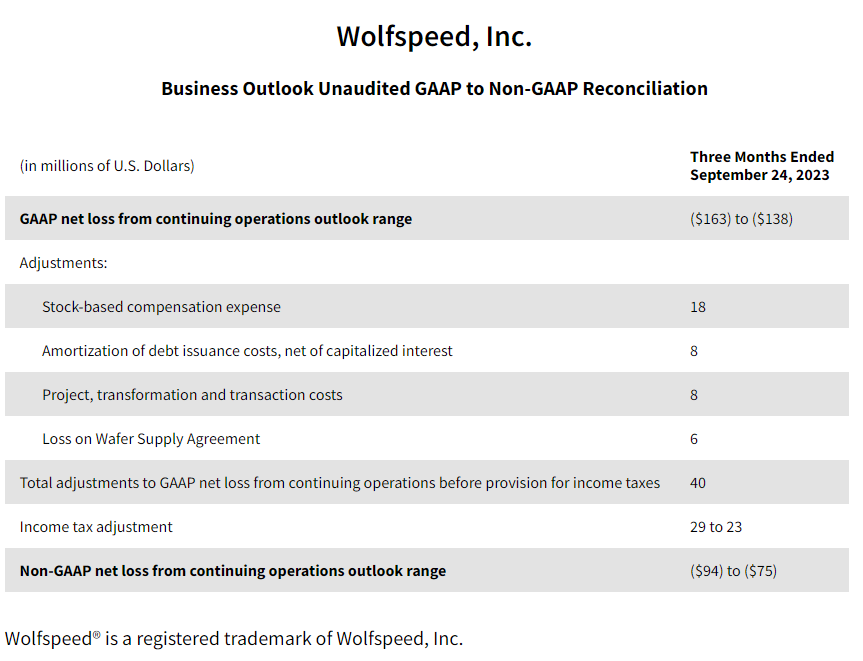

For its first quarter of fiscal 2024, Wolfspeed targets revenue from continuing operations in a range of $185 million to $205 million. GAAP net loss from continuing operations is slightly improved from our August 16, 2023 business outlook, and is targeted at $138 million to $163 million, or $1.10 to $1.30 per diluted share. Non-GAAP net loss from continuing operations remains unchanged from our August 16, 2023 business outlook, and remains targeted at $75 million to $94 million, or $0.60 to $0.75 per diluted share. Targeted non-GAAP net loss from continuing operations excludes $63 million to $69 million of estimated expenses, net of tax, related to stock-based compensation expense, amortization of debt issuance costs, net of capitalized interest, project, transformation and transaction costs and loss on Wafer Supply Agreement.

About Wolfspeed, Inc.

Wolfspeed (NYSE: WOLF) leads the market in the worldwide adoption of silicon carbide and GaN technologies. We provide industry-leading solutions for efficient energy consumption and a sustainable future. Wolfspeed’s product families include silicon carbide and GaN materials, power devices and RF devices targeted for various applications such as electric vehicles, fast charging, 5G, renewable energy and storage, and aerospace and defense. We unleash the power of possibilities through hard work, collaboration and a passion for innovation. Learn more at www.wolfspeed.com.

About MACOM Technology Solutions Holdings, Inc.

MACOM (Nasdaq: MTSI) designs and manufactures high-performance semiconductor products for the Telecommunications, Industrial and Defense and Datacenter industries. MACOM services over 6,000 customers annually with a broad product portfolio that incorporates RF, Microwave, Analog and Mixed Signal and Optical semiconductor technologies. MACOM has achieved certification to the IATF16949 automotive standard, the ISO9001 international quality standard and the ISO14001 environmental management standard. MACOM operates facilities across the United States, Europe, Asia and is headquartered in Lowell, Massachusetts. To learn more visit www.macom.com.

Non-GAAP Financial Measures

This press release includes Wolfspeed’s business outlook on both a GAAP and a non-GAAP basis. The GAAP results include certain costs, charges and expenses that are excluded from non-GAAP results. By publishing the non-GAAP targets, management intends to provide investors with additional information to further analyze Wolfspeed’s performance, core results and underlying trends. Wolfspeed's management evaluates results and makes operating decisions using both the GAAP and non-GAAP measures included in this press release. Investors and potential investors are encouraged to review the reconciliation of non-GAAP targets to the most directly comparable GAAP targets attached to this press release.

Forward Looking Statements

This press release contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause Wolfspeed’s actual results to differ materially from those indicated in the forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the anticipated benefits of the transaction, including future financial and operating results. Actual results, including with respect to Wolfspeed’s ability to complete the transaction on time or at all, Wolfspeed’s realization of the value of MACOM’s stock received in connection with the transaction, the continued growth of Wolfspeed’s power products business, and Wolfspeed’s ability to achieve its targets for the first quarter of fiscal 2024 could differ materially due to a number of factors, including risks associated with divestiture transactions generally, including the inability to obtain, or the delay in obtaining, HSR clearance; fluctuations in the market price of MACOM’s common stock; the risk that a portion of the shares of MACOM common stock are forfeited by Wolfspeed in the event that the transfer of the RTP fab is not completed within four years following the closing date; issues, delays or complications in completing required carve-out activities to allow Wolfspeed RF to operate as part of MACOM after the closing, including incurring unanticipated costs to complete such activities; risks associated with integration or transition of the operations, systems and personnel of Wolfspeed RF, each, as applicable, within the term of the post-closing transition services agreement between MACOM and Wolfspeed; unfavorable reaction to the sale by customers, competitors, suppliers and employees; the risk that costs associated with the transaction will be greater than Wolfspeed expects; ongoing uncertainty in global economic and geopolitical conditions, including the ongoing military conflict between Russia and Ukraine, infrastructure development or customer or industrial demand that could negatively affect product demand, including as a result of an economic slowdown or recession, collectability of receivables and other related matters as consumers and businesses may defer purchases or payments, or default on payments; risks associated with Wolfspeed’s expansion plans, including design and construction delays and cost overruns, timing and amount of government incentives actually received, issues in installing and qualifying new equipment and ramping production, poor production process yields and quality control, and potential increases to Wolfspeed’s restructuring costs; the risk that Wolfspeed does not meet its production commitments to those customers who provide it with capacity reservation deposits or similar payments; the risk that Wolfspeed may experience production difficulties that preclude it from shipping sufficient quantities to meet customer orders or that result in higher production costs, lower yields and lower margins; Wolfspeed’s ability to lower costs; the risk that Wolfspeed’s results will suffer if it is unable to balance fluctuations in customer demand and capacity, including bringing on additional capacity on a timely basis to meet customer demand; the risk that longer manufacturing lead times may cause customers to fulfill their orders with a competitor's products instead; product mix; risks associated with the ramp-up of production of new products, and Wolfspeed’s entry into new business channels different from those in which it has historically operated; Wolfspeed’s ability to convert customer design-ins to sales of significant volume, and, if customer design-in activity does result in such sales, when such sales will ultimately occur and what the amount of such sales will be; the risk that the economic and political uncertainty caused by the tariffs imposed by the United States on Chinese goods, and corresponding Chinese tariffs and currency devaluation in response, may negatively impact demand for Wolfspeed’s products; the risk that Wolfspeed or its channel partners are not able to develop and expand customer bases and accurately anticipate demand from end customers, which can result in increased inventory and reduced orders as Wolfspeed experiences wide fluctuations in supply and demand; risks related to international sales and purchases; risks resulting from the concentration of business among few customers, including the risk that customers may reduce or cancel orders or fail to honor purchase commitments; the risk that Wolfspeed’s investments may experience periods of significant market value and interest rate volatility causing it to recognize fair value losses on its investment; the risk posed by managing an increasingly complex supply chain (including managing the impacts of ongoing supply constraints in the semiconductor industry and meeting purchase commitments under take-or-pay arrangements with certain suppliers) that has the ability to supply a sufficient quantity of raw materials, subsystems and finished products with the required specifications and quality; risks relating to the ongoing COVID-19 pandemic, including the risk of disruptions to Wolfspeed’s operations, supply chain, including our contract manufacturers, or customer demand; the risk Wolfspeed may be required to record a significant charge to earnings if its remaining goodwill or amortizable assets become impaired; risks relating to confidential information theft or misuse, including through cyber-attacks or cyber intrusion; Wolfspeed’s ability to complete development and commercialization of products under development; the rapid development of new technology and competing products that may impair demand or render Wolfspeed’s products obsolete; the potential lack of customer acceptance for Wolfspeed’s products; risks associated with ongoing litigation; the risk that customers do not maintain their favorable perception of Wolfspeed’s brand and products, resulting in lower demand for its products; the risk that Wolfspeed’s products fail to perform or fail to meet customer requirements or expectations, resulting in significant additional costs; risks associated with strategic transactions; and other factors discussed in Wolfspeed’s filings with the Securities and Exchange Commission (SEC), including Wolfspeed report on Form 10-K for the fiscal year ended June 26, 2022, and subsequent reports filed with the SEC. These forward-looking statements represent Wolfspeed's judgment as of the date of this release. Except as required under the U.S. federal securities laws and the rules and regulations of the SEC, Wolfspeed disclaims any intent or obligation to update any forward-looking statements after the date of this release, whether as a result of new information, future events, developments, changes in assumptions or otherwise.