To date, Mini/Micro LED hasn’t went into mass production, which is not as planned but in line with expectation. Anyhow, what matters is that the path to success has become much clearer even though arriving the destination of full-scale production still takes a period of time. In 2022, amid macroeconomic headwinds, Mini/Micro LED faced complicated challenges while embraced more opportunities. To some extent, the industry found silver linings in addressing problems at both supply and demand sides, including technical hurdles, cost issue, terminal applications and demands problems.

Eric Chou, VP of Research Department, at 2023 TrendForce Next Generation Display Industry Seminar

Mini LED Backlight: Six Applications Distinctly Separate

Among next generation display technologies, Mini LED backlight was the first to take shape, with a relatively complete industry chain covering equipment, material, chip, package, module and panel. Thanks to the joint efforts of both brands and the industry chain, Mini LED backlight products have been adopted by plentiful application scenarios in recent years, such as TV, MNT, NB, pad, automotive display and VR. Still, Mini LED is a perfect fit for specific applications but not for all.

Built on multi-years of market research, Eric Chou pointed out that currently, six applications of Mini LED backlight technology separate distinctly, so to speak.

NB & Pad: Mini LED backlight technology appears to lack growth momentum in both notebook and pad markets where Apple has set the benchmark. It’s widely accepted that Mini LED launched into these two application markets by virtue of Apple’s strong brand name effect. However, there’s an obvious sign that Apple has slowed down the pace of further adopting Mini LED backlight in MacBook and iPad recently on account of high cost. Meanwhile, OLED presents a bigger and bigger threat to Mini LED backlight.

Eric explained that OLED manufacturers have decided to invest in G8.5 production lines in a bid to further optimize the economical cutting of OLED panels. In this case, the cost of OLED production is expected to reduce, and thus, Mini LED will continue to be at a disadvantage. In his estimation, Apple is likely to choose OLED display for iPad next year, which means Apple products will enter into a stage of drastic adjustment. Aside from iPad, MacBook in 2025 may also turn to use OLED following the development of G8.5 production lines. As such, TrendForce takes a conservative attitude toward the development of Mini LED backlight technology in notebook and pad markets.

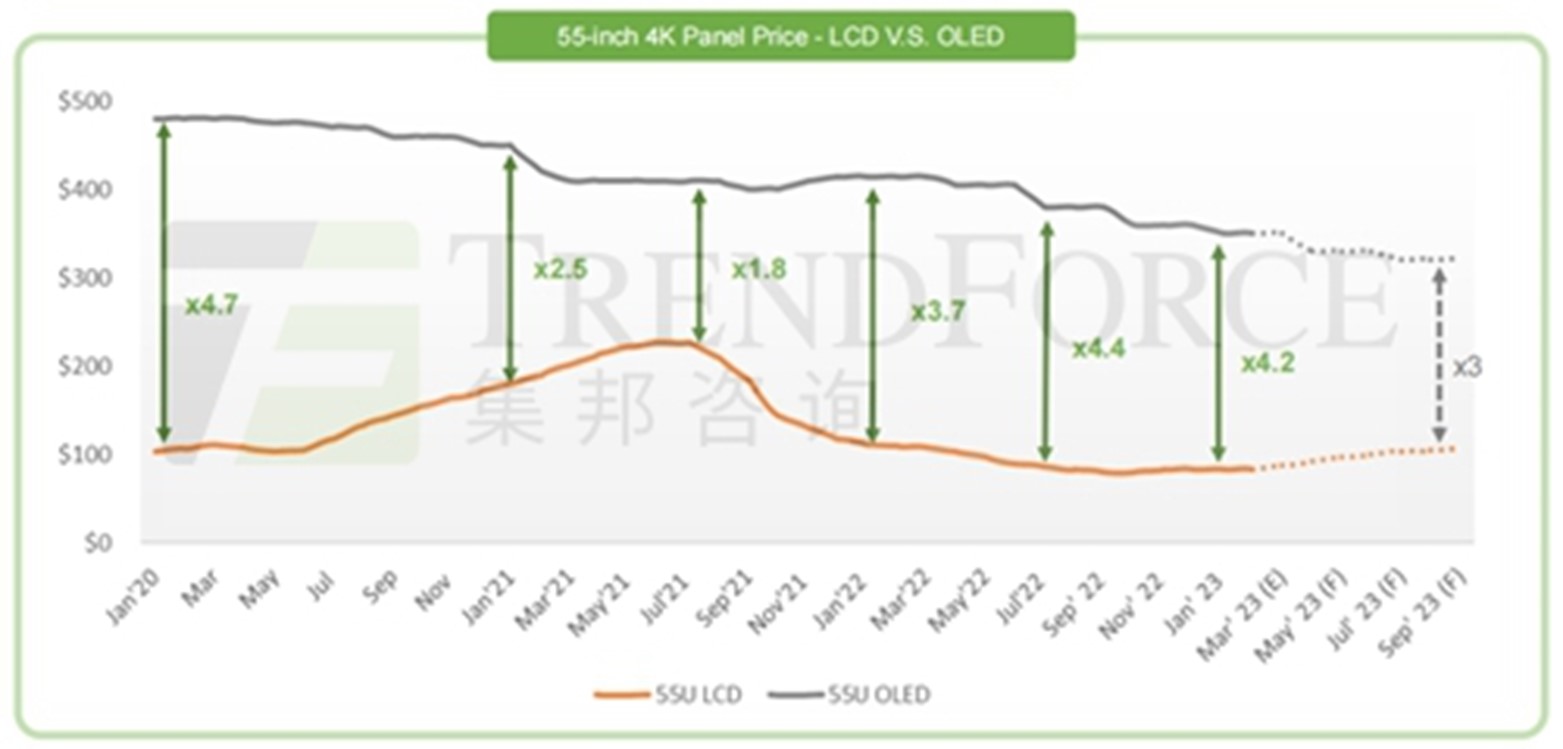

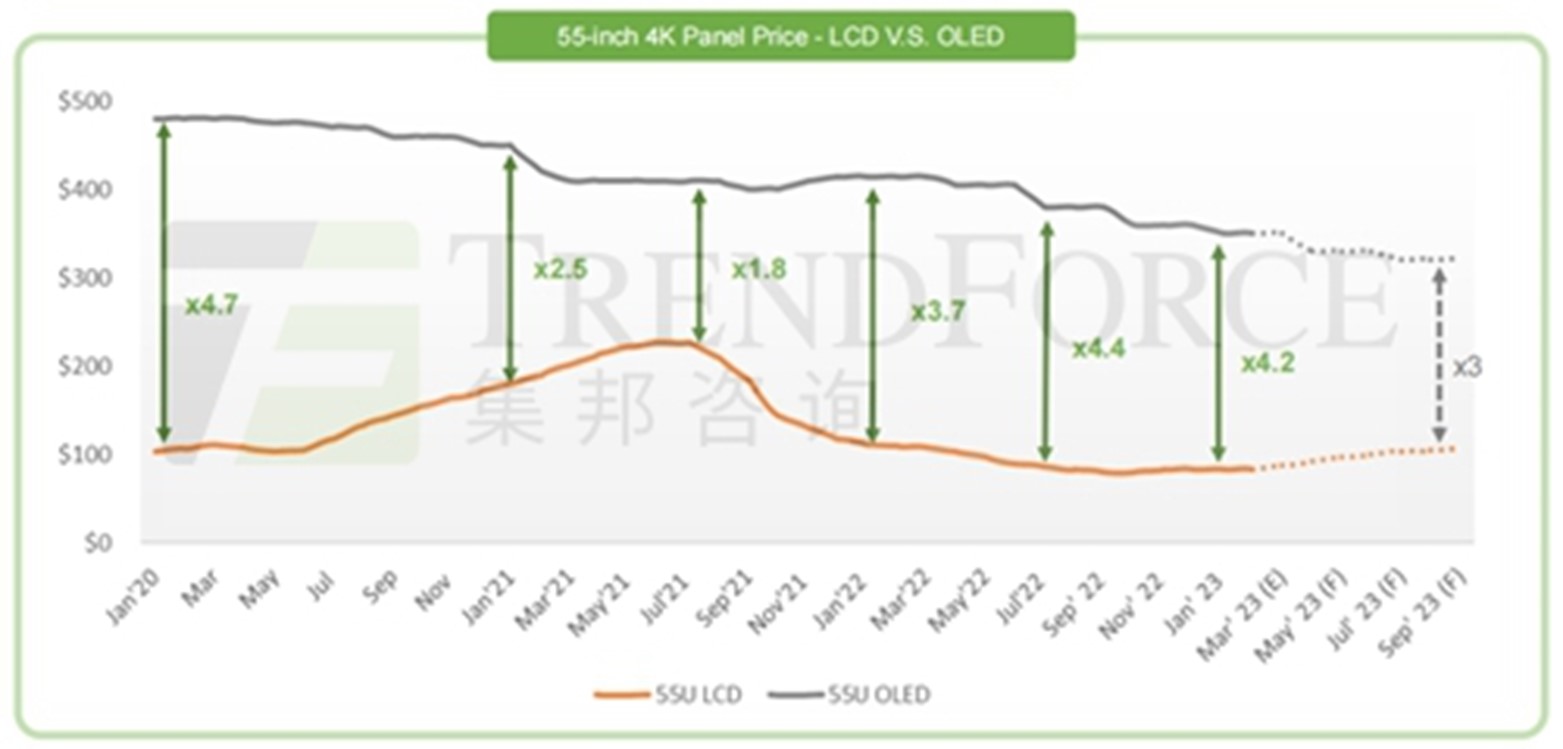

TV: Comparatively, OLED is less competitive than Mini LED in TV application, which can be exemplified by two aspects.

-

Shipment: In 2022, OLED TV market experienced a headwind with shipment only up by 0.5% YoY to around 6.7 million sets. It is estimated that OLED TV shipment may decline by 0.7% YoY to 6.3 million sets in 2023. Instead, Mini LED backlight TV shipment increased by 65% YoY to 3.5 million sets in 2022, which is forecast to reach 4.4 million in 2023, representing an increase of 26% YoY.

-

LCD: Presently, LCD still holds all the trumps in TV panel market and the price gap between LCD and OLED continues to widen. As a backlight source, Mini LED improves LCD TV’s contrast ratio, brightness and image quality, which amounts to an upgrade of LCD’s competitiveness. In the long term, Mini LED backlight technology will continuously penetrate TV market on the strength of more technical breakthroughs, better cost management and higher cost advantage of LCD panel.

MNT: Currently, both OLED and Mini LED backlight monitors are at the nascent stage with greater growth potential. But actually, it has been quite explicit that Mini LED triumphs over OLED on some fronts, which can find concrete expression in the supply chain.

On panel supply, OLED for TV and monitor share the same production line and one supplier, namely LG’s G8 line, leading to limited production capacity. Whereas, Mini LED backlight monitor boasts a complete supply chain, particularly in Chinese domestic market. On a brand shipment distribution basis, TrendForce’s data shows the monitor shipment of China-based brands accounted for up to 39% of global monitor shipment in 2022, and this proportion is expected to rise to 70% in 2023. Against that backdrop, Chinese brands will be much more efficient in promoting products and cutting cost, and hence enable Mini LED to go full steam ahead in penetrating monitor market.

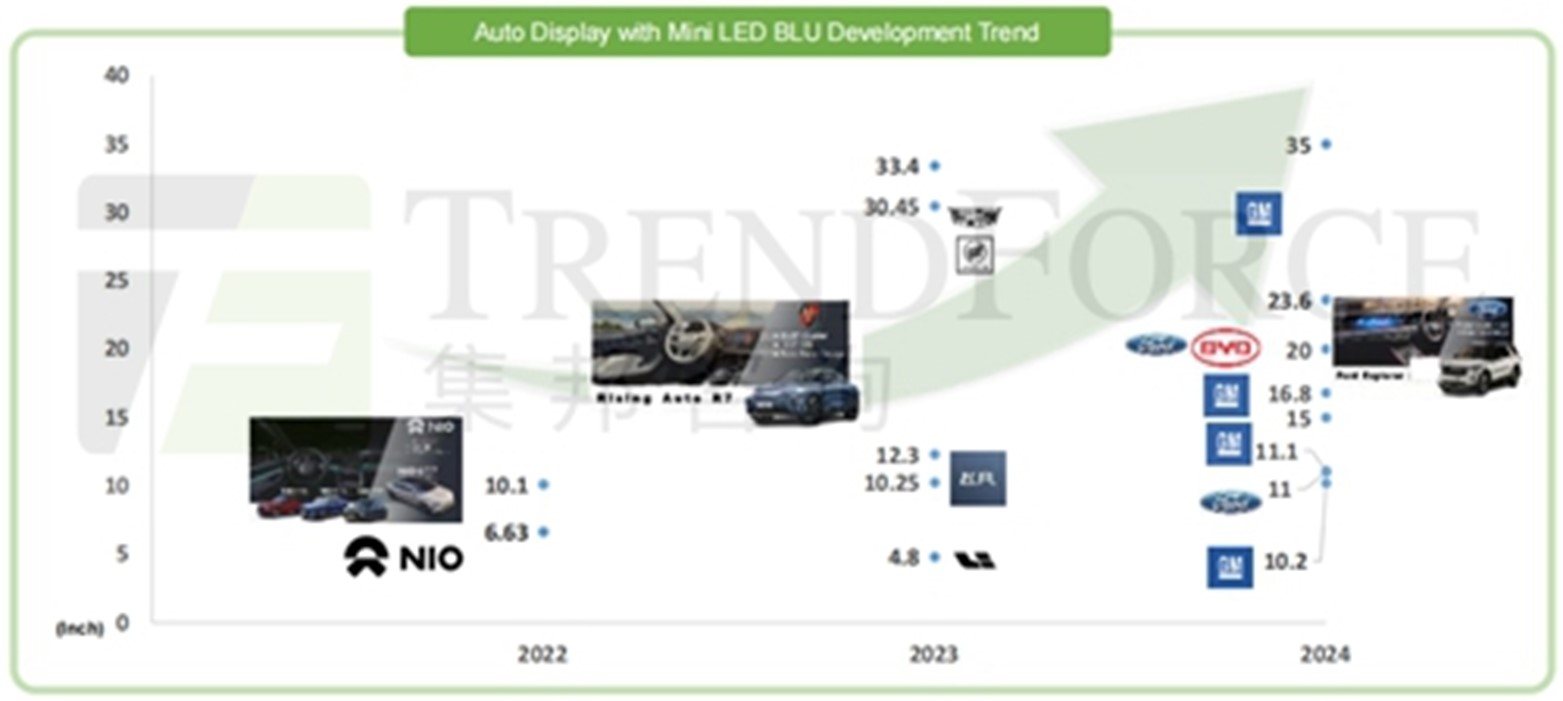

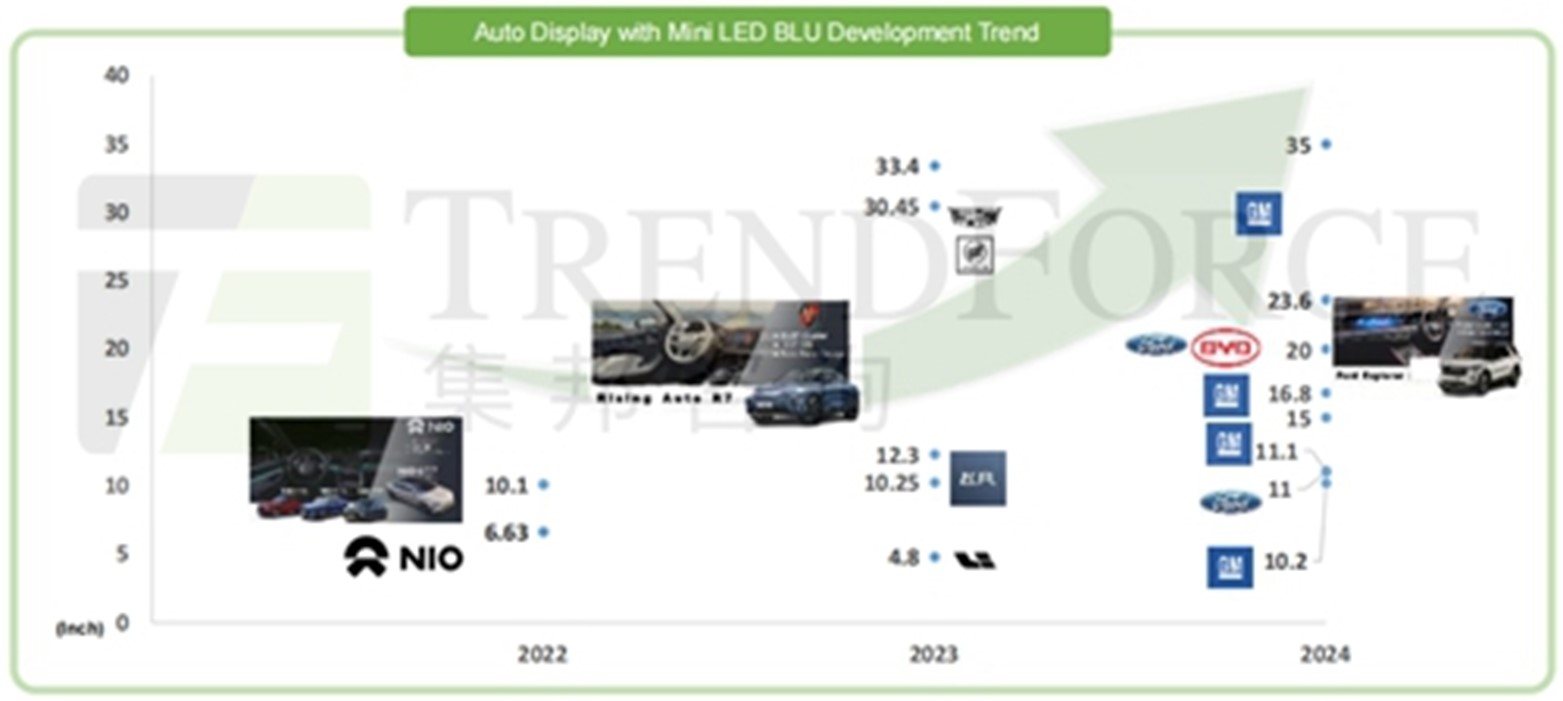

Automotive Display: Mini LED has successfully made inroads into automotive display market since the US-brand Cadillac introduced Mini LED automotive display into its new car model. Since then, Chinese auto makers have spared no efforts to accelerate Mini LED adoption in automotive display. Eric said high reliability, outstanding brightness and excellent contrast ratio make Mini-LED-backlit LCD panel an ideal solution for automotive display, which can synchronously meet both the demands of driving safety and experience. In regard to market landscape, Chinese and US brands are the forerunners followed by European and Japanese brands. According to TrendForce’s analysis, the two late comers will gradually develop Mini LED backlight automotive display after 2024 or 2025.

VR: As Meta launched its first VR device based on Mini LED backlight technology--Meta Quest Pro, the mass market becomes more desired for such a VR device. However, TrendForce’s survey found Meta Quest Pro failed to gain desirable market feedback as expected due to the prohibitive price of up to USD 1,649, including the high cost of the device itself and that of sensing components.

As to Mini LED backlight technology, it still lacks enough competitiveness in VR device market at this moment. On the one hand, Mini LED cost remains at a higher level; on the other hand, Mini LED is dwarfed by Micro LED in many aspects such as thickness, weight, volume and energy conservation. Overall, given two critical factors including consumer power and wearing comfort, TrendForce also takes a conservative attitude toward the development of Mini LED backlight technology in VR device market.

Micro LED: Large-Sized Below Expectation while Small-Sized Beyond Expectation

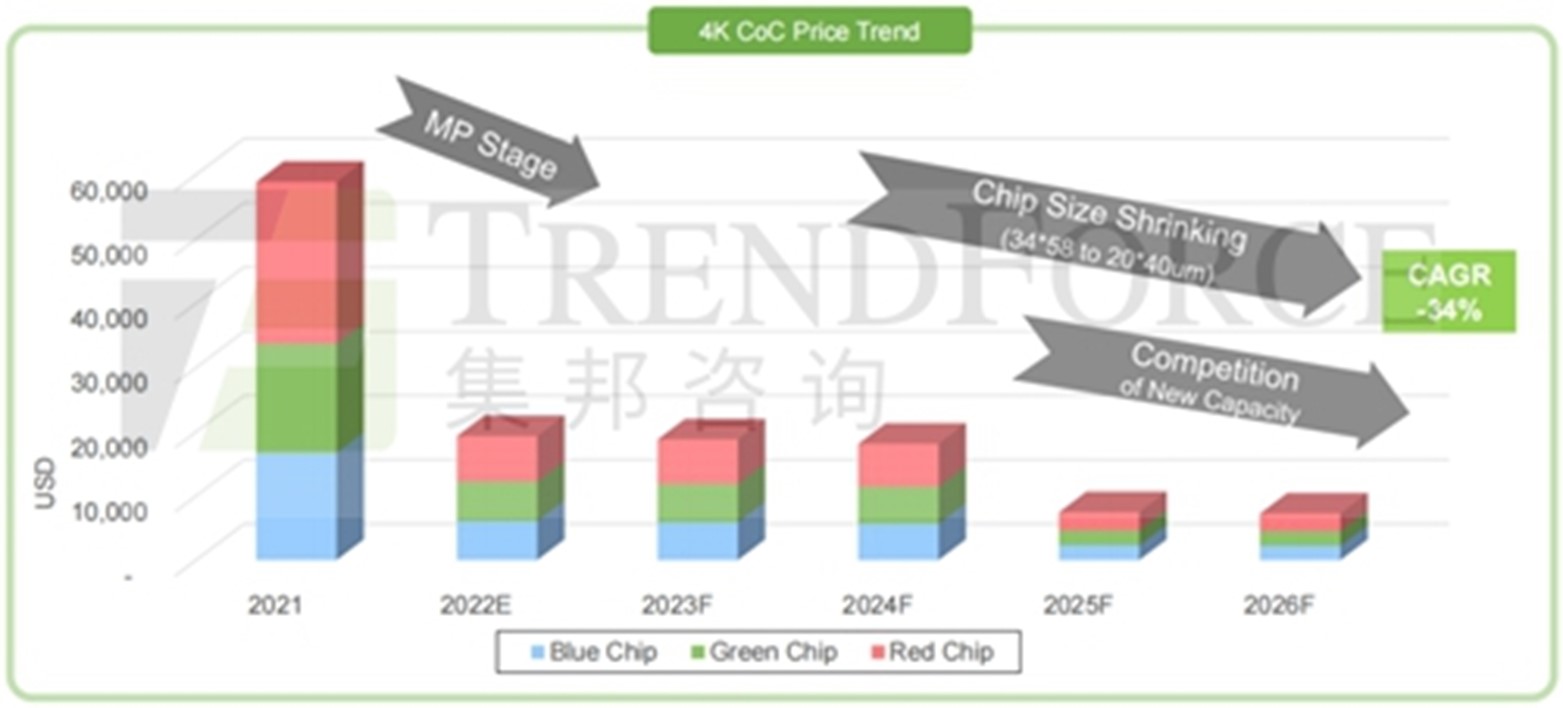

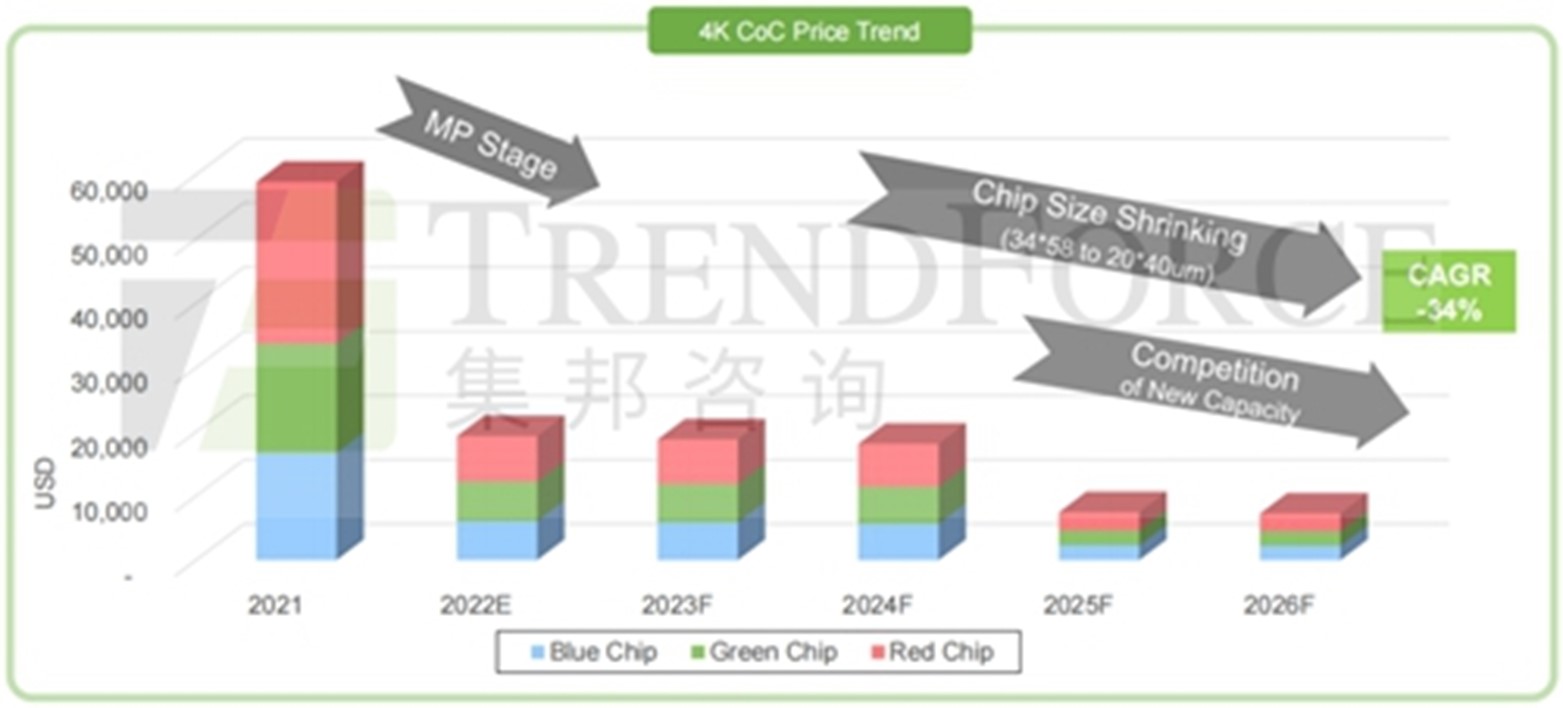

Over the past two to three years, large-sized display has been the main application for Micro LED accompanying high market enthusiasms, but it turned out to fall short of expectation. Although the roadmap of reducing chip cost gets clearer--cost is expected to decline by over 30% annually and the reduction will hit the peak during 2024 to 2025--TrendForce takes a conservative attitude toward the development of Micro LED in large-sized display market, which can be analyzed by two aspects: the relation between process yield rate and cost, the relation between cost structure distribution and brand manufacturers.

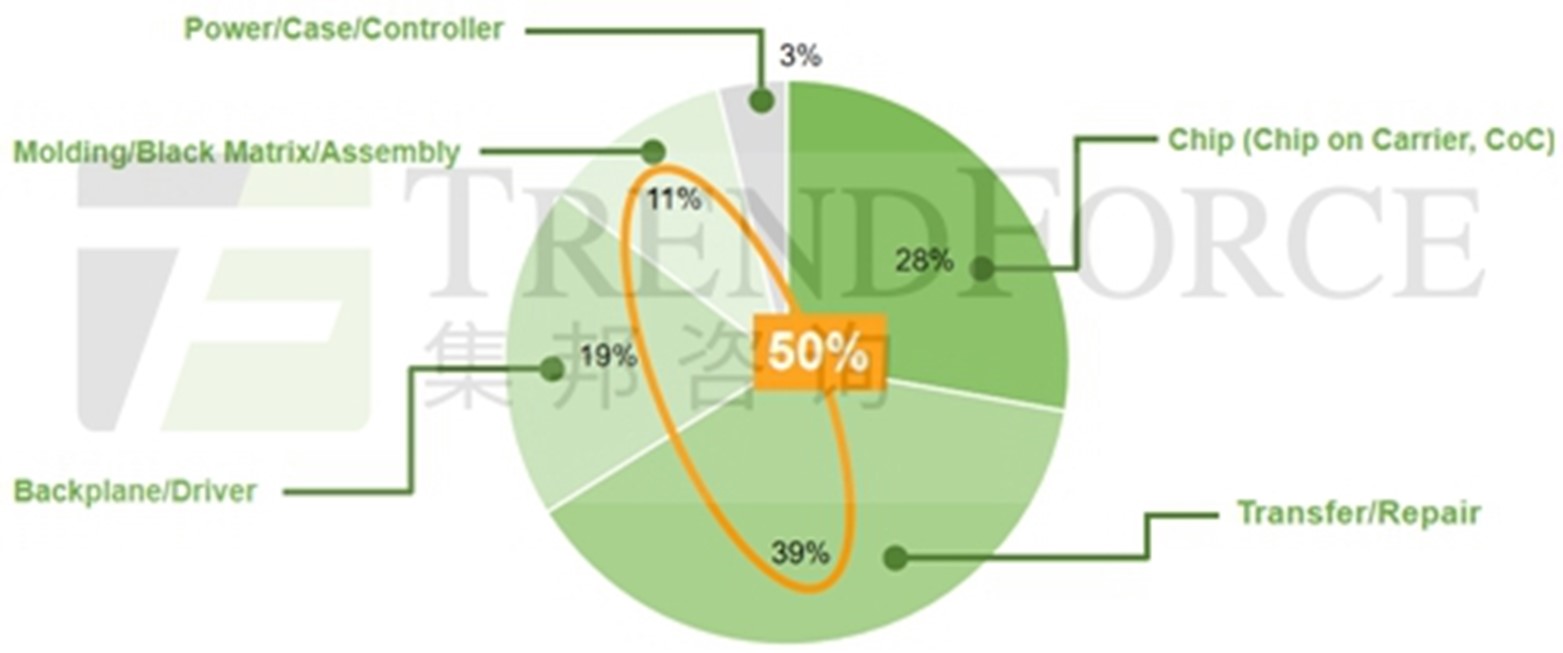

In light of Eric’s analysis, the cost structure of Micro LED comprises many other parts aside from chip, like backplane. In other words, chip cost reduction is far from enough to bring down total production cost. Samsung’ The Wall, for instance, is a large-sized Micro LED video wall assembled by numerous modules and cabinets, using 12.7-inch LCD LTPS backplane. Despite the simple manufacturing process of LTPS, other complicated processes like side wiring are required on the backplane in order to realize seamless splicing. Currently, such kinds of processes face low yield rate, which poses a challenge to manufacturers and certainly results in high cost.

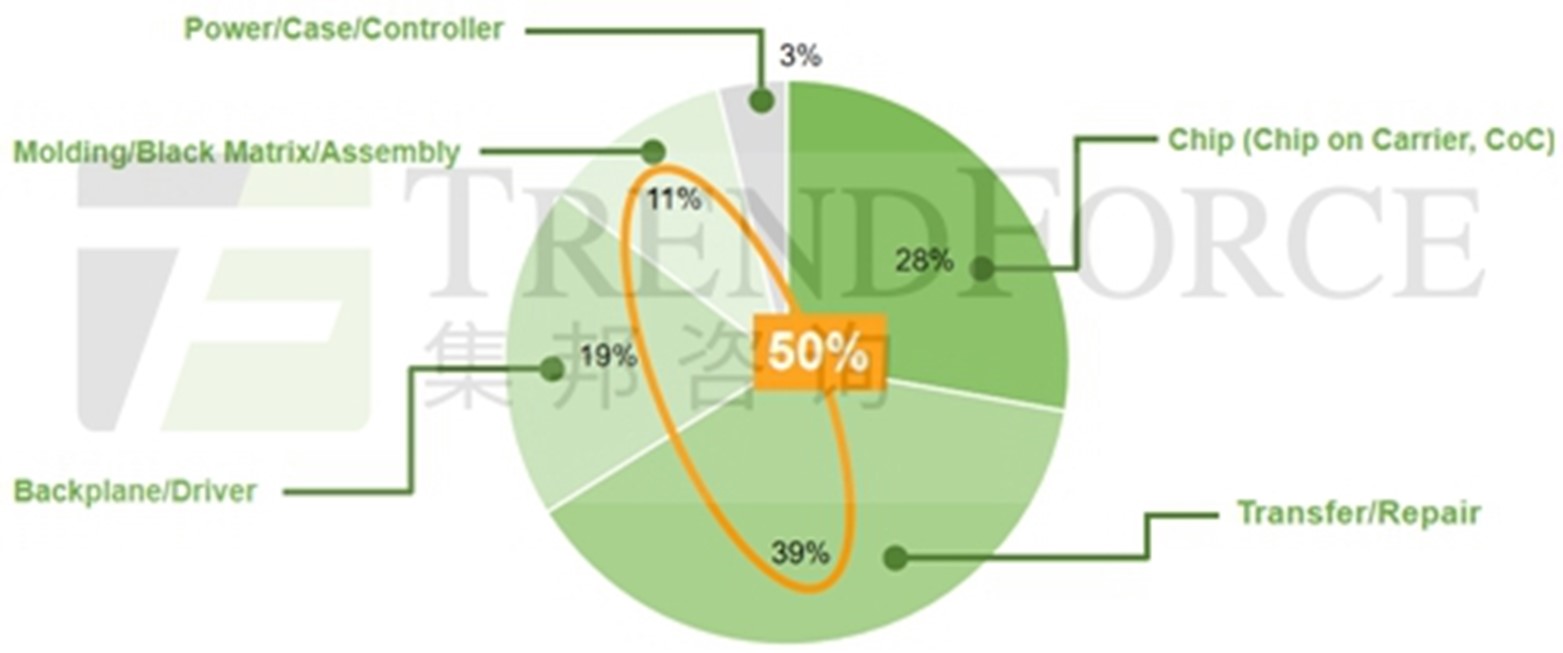

Then comes the distribution of overall cost structure. According to TrendForce, Micro LED cost structure consists of five parts: chip (28%), transfer & repair (39%), backplane & driver (19%), molding & black matrix & assembly (11%), power & case & controller (3%).

Eric explained that the cost proportion of transfer & repair and molding & black matrix & assembly totals more than 50%, and these two parts are undertook by brand manufacturers, which means they need heavy investment and vast reserves and accumulation. That is to say, it would be a high threshold for emerging brands to enter large-sized Micro LED display market in terms of learning curve and the experience on production yield rate. Thus far, other manufacturers still need a certain period of time to take root except Korea-based ones. Only when they accumulate requisite experience, will they be in a position to step into a broad road.

On the contrary, small-sized Micro LED display seemingly moves forward beyond expectation.

Over the past several months, news about Apple Watch has been lingering on. From Eric’s point of view, since its full-scale production in 2015, the new versions of Apple Watch mainly zeroed in on the innovation of size, brightness, display area and power consumption, which are quite in tune with Micro LED’s properties.

In addition, Apple’s publicized patent shows that new products later will incline to apply flexible display and sensors. As is known to all, multitudes of countries face aging problems and consumers are incrementally raising the demand for monitoring health conditions. Watch products integrating Micro LED and sensors can improve the accuracy of biological monitoring and enrich functions, and this is what to expect between Micro LED and wearable devices like Apple Watch.

According to TrendForce’s market survey, other brands are scheduled to roll out Micro LED smart watch with a size of around 1.4 inch in 2H23, ahead of Apple who is to release Apple Watch next year, which may mark the outset for Micro LED to officially launch into smart wearable device market in Eric’s estimation.

AR device is another suitable market for Micro LED. At present, most manufacturers select optical waveguide technology to accomplish slim design and transparent effect, but the conversion rate between waveguide and light is below 1%. As to light engine technology, Micro LED is born to outperform Micro OLED on brightness and reliability. Thus, not a few manufacturers worldwide have joint hands to form Micro LED alliances to accelerate Micro LED market adoption, such as Meta and Plessey, Google and Raxium, OPPO and JBD, to name just a few.

Conceivably, Micro LED is embracing a prosperous future in AR display field, but at this moment, Micro LED needs to cross many technical hurdles before it well meet the requirements of AR display, including full color effect, the EQE of red Micro LED, the selection of chip materials & structure, mass transfer & inspection technologies, backplane and drive IC architecture, etc.

Micro LED for automotive display application can be anticipated though it is relatively at a distant. Eric described that the potential of Micro LED in automotive display market can be found on vehicle’s demands for transparent and rollable and even stretchable display. It can be observed from exhibition in recent years that panel makers like PlayNitride, AUO, Innolux, and Tianma have frequently demonstrated the extensive potential of Micro LED automotive transparent display. Even if it will be a premium product, given that upscale automobiles originally have high unit price, the cost from Micro LED can be expected to be offset by the overall high price in the future.

All in all, Micro LED market takes on a scene of prosperity and manufactures are well positioned to push the limit and bear fruit.

A Long Journey and A Wonderful Prospect

The road gets visible after the mist fragments, which is akin to Micro LED development path. In spite of a long journey, Micro LED will eventually head for a wonderful future.

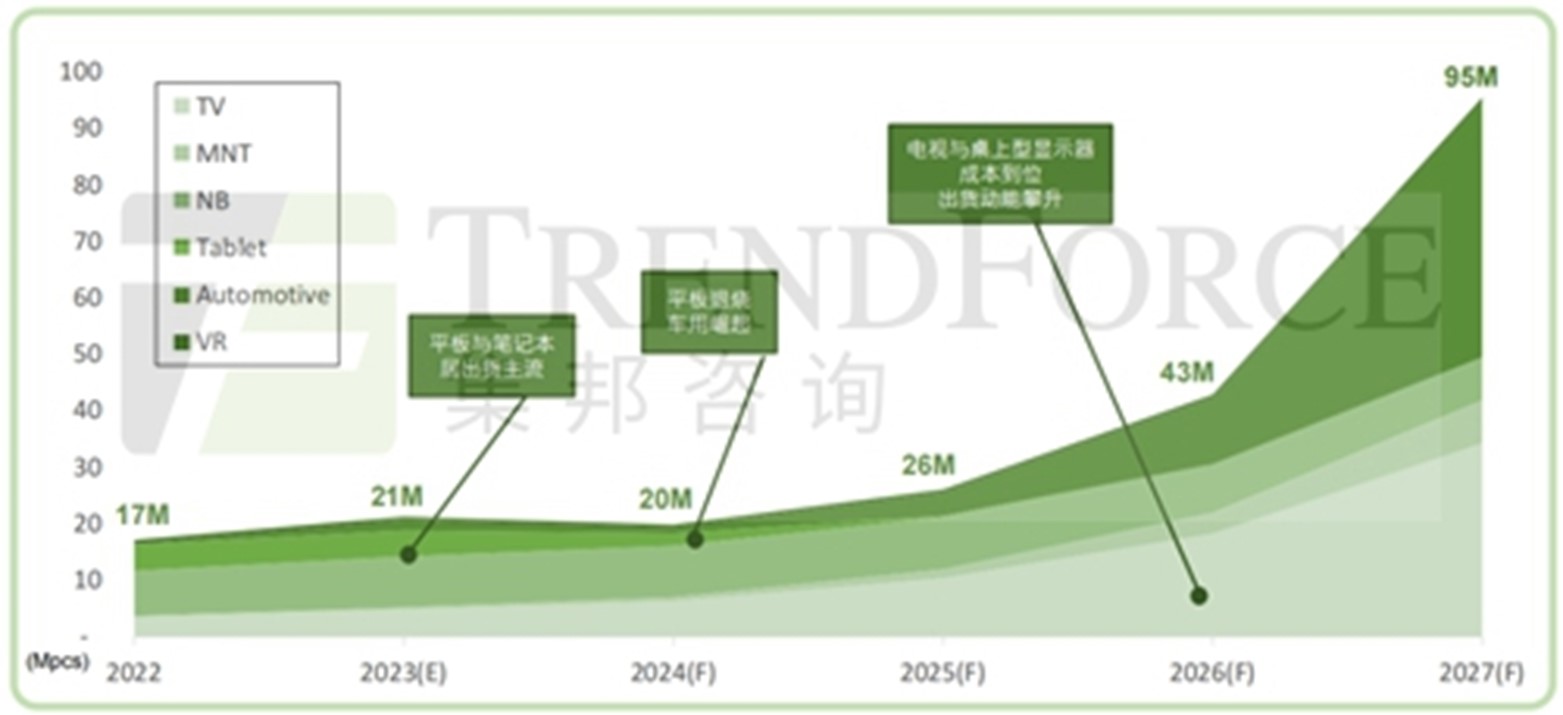

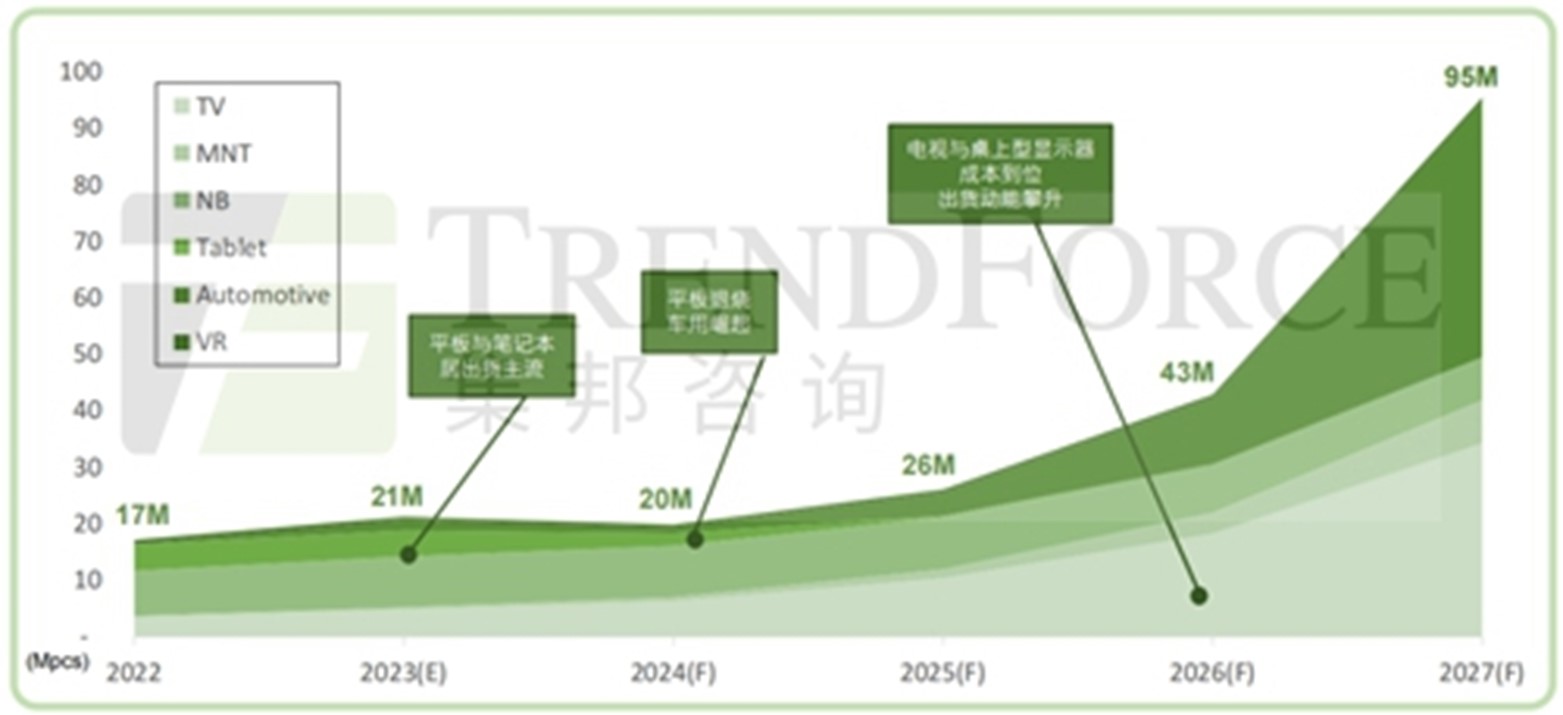

According to TrendForce 2023 Mini LED Backlight Next Generation Display Market Analysis Report, the shipment of Mini LED backlight products will increase from 17 million sets in 2022 to 21 million sets in 2023. However, it should be noted that iPad and MacBook have a profound influence on the whole market trend. Considering that Apple is very likely to change from Mini LED to OLED, TrendForce estimated the shipment of Mini LED backlight products will decline in 2024, but this will be a temporary phenomenon and after 2024 or 2025, more brands are expected to adopt Mini LED with the decreasing of cost. It’s forecast that the shipment will stand at 75 million sets in 2027.

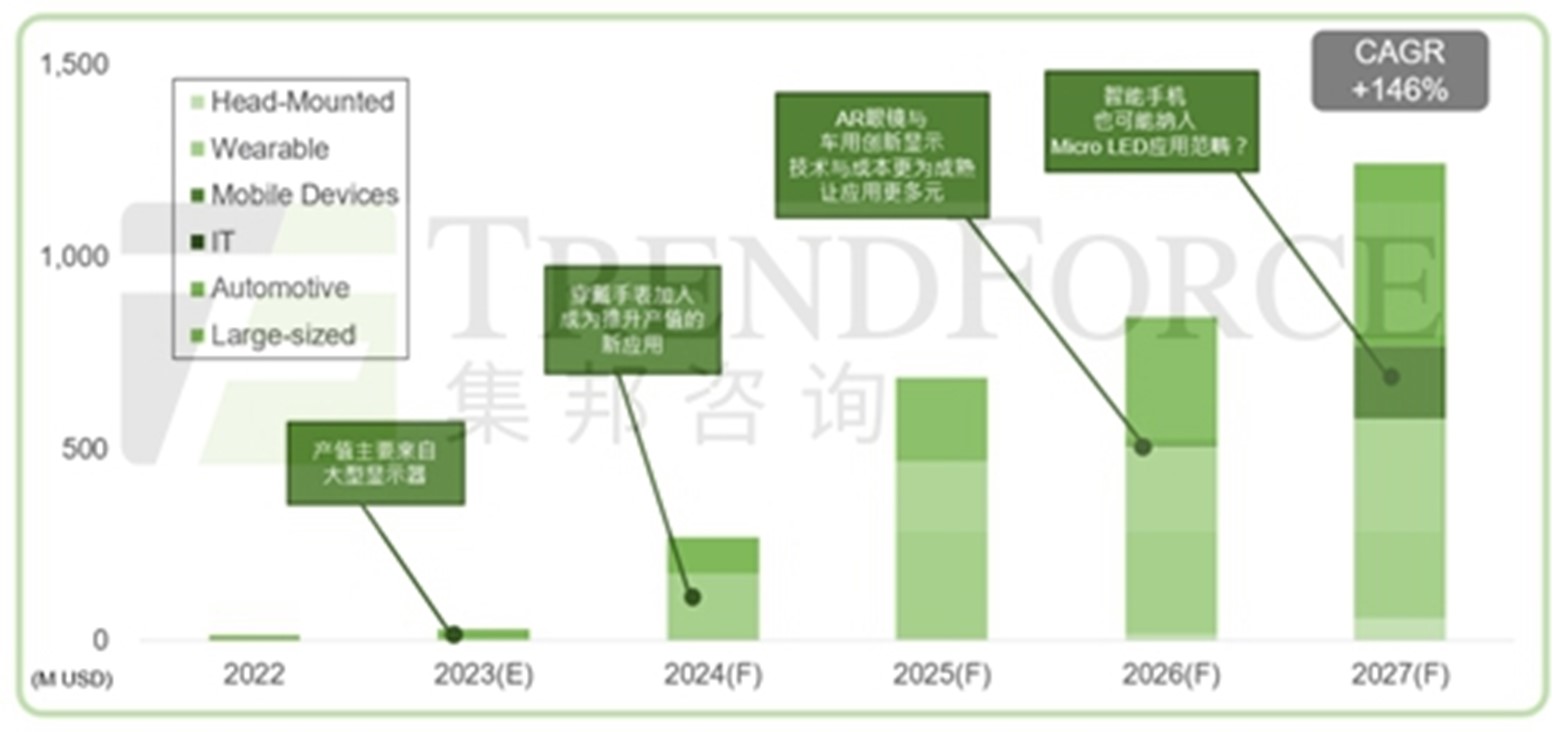

The growth curve of Micro LED is comparatively smoother. Down the road, Micro LED is expected to maintain positive growth year by year.

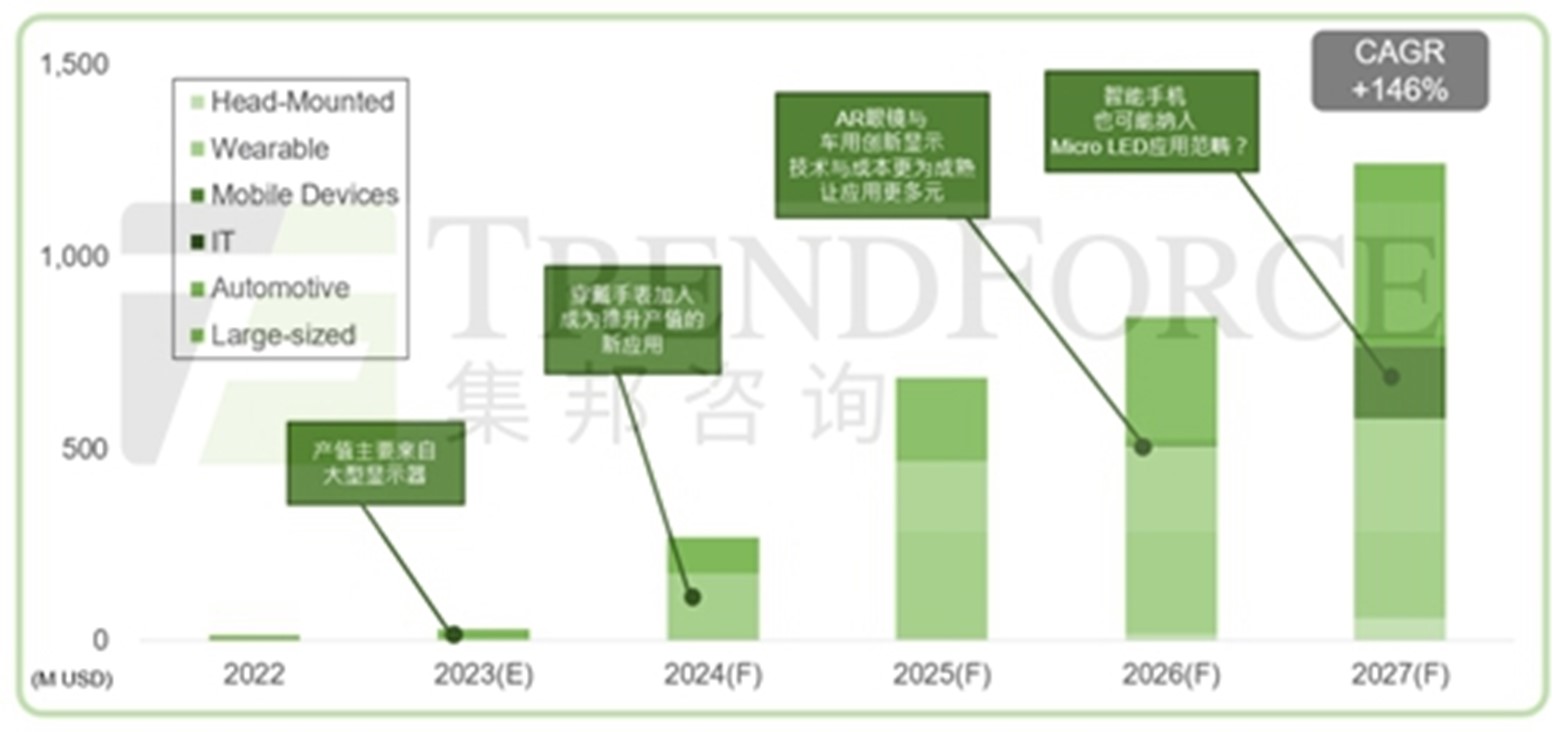

According to TrendForce 2023 Micro LED Self-Emissive Display Cost Analysis and Development Trend Analysis Report, large-sized display will remain as the main growth engine for Micro LED chip industry in 2023, and the market size will rise from USD 14 million in 2022 to USD 32 million in 2023. In 2024, wearable device will represent another growth engine after its mass production.

Looking ahead to 2026, as technical bottlenecks and cost management further improve, AR and automotive displays are expected to step into a stage of rapid growth, boosting the demand for Micro LED chip. When cost obviously falls, we can even expect smart phone to use Micro LED. On balance, TrendForce forecast that the market size of Micro LED chip will reach USD 1.244 billion with a CAGR of up to 146%. In a nutshell, Micro LED will have a promising future. (Writer/Translator: Janice)

TrendForce 2023 Micro LED Market Trend and Technology Cost Analysis

Release Date: 31 May / 30 November 2023

Language: Traditional Chinese / English

Format: PDF

Page: 160 / Year

TrendForce 2022 Mini LED New Backlight Display Trend Analysis

Publication Dates: April 30 and October 31, 2022

Language: Traditional Chinese/English

Format: PDF

Number of Pages: The two publications will total 120–130 pages

TrendForce 2023 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 28 September 2022

Language: Traditional Chinese / English

Format: PDF

Page: 238

If you would like to know more details , please contact: