In early May, MLS took the lead in announcing a price increase of 5% to 10% for its entire product line, triggering a wave of price increases in the LED industry from top to bottom.

According to a survey conducted by TrendForce, several LED manufacturers have implemented price hikes primarily focused on lighting LED chips in the upstream sector. Price increases have been the highest among low-power lighting chips with an area of 300 mil² or below, ranging from approximately 3% to 5%. Specialized chips have experienced a price increase of up to 10%.

A total of 17 manufacturers—including package providers such as DSBJ, Ruisheng Optoelectronics, Kinglight and BMTC as well as LED display makers such as Leyard, GLUX, Ledman, BOE Jingxin, and CAI LIANG—have officially announced price increases for LED display products. The price hikes are estimated to be around 5% to 10%.

Conversely, package manufacturer Nationstar and LED display maker Absen have announced price reductions. Nationstar has lowered the prices of certain RGB products by 3.5% to 11.5%, while Absen has decreased prices for its commercial display series, the AbsenCP, by 10%.

-

Summary of Price Adjustments Announced by LED Companies (as of July 10, 2023)

|

Sector

|

Company name

|

Product

|

Range of adjustment

|

Effective date (mm/dd)

|

|

Packaging/application

|

MLS

|

All product lines

|

↑5–10%

|

5/1

|

|

Packaging/application

|

All product lines

|

↑15–20%

|

6/1

|

|

Packaging

|

DSBJ

|

Indoor products

|

↑10–15%

|

6/26

|

|

Packaging

|

Outdoor products

|

↑10%

|

6/26

|

|

Packaging

|

All products

|

↑10%

|

5/12

|

|

Packaging

|

Ruisheng

|

All models

|

↑10%

|

5/16

|

|

Packaging

|

Nationstar

|

Some RGB products

|

↓3.5%–11.5%

|

5/25

|

|

Packaging

|

Kinglight

|

Two indoor channel-based products (1212 and 1415)

|

↑10%

|

5/27

|

|

Packaging

|

BMTC

|

Some products

|

Price increase

|

5/29

|

|

Module

|

HVAS

|

LED display modules

|

Price increase

|

5/4

|

|

Display

|

GLUX

|

All products

|

Price adjustment

|

7/1

|

|

Display

|

Leyard

|

All models

|

Price hikes of different levels

|

7/1

|

|

Display

|

Mini LED displays

|

↑10%

|

5/19

|

|

Display

|

All models

|

Price hikes of different levels

|

5/18

|

|

Display

|

Ledman

|

All models

|

Price hikes of different levels

|

5/18

|

|

Display

|

BOE Jingxin

|

BOE MLED displays

|

Price adjustment

|

7/1

|

|

Display

|

LED displays

|

Price adjustment

|

5/15

|

|

Display

|

Skyworth

|

All models

|

Price hikes of different levels

|

5/20

|

|

Display

|

HANSHI

|

LED displays

|

↑5–10%

|

5/12

|

|

Display

|

Jing Yu

|

All product lines

|

Price adjustment

|

5/19

|

|

Display

|

FeuVision

|

LED displays

|

Price adjustment

|

5/24

|

|

Display

|

CAI LIANG

|

Some products

|

Price adjustment

|

5/30

|

|

Display

|

CHWAT

|

LED displays

|

Price adjustment

|

5/20

|

|

Display

|

Qiangli Jucai

|

LED displays

|

Price adjustment

|

7/10

|

|

Display

|

Absen

|

AbsenCP

|

↓10%

|

7/10

|

Summarized by LEDinside

Figure credit: LEDinside

Notably, some package providers and display companies have also implemented a secondary price increase for LED products, including MLS, Leyard, GLUX and DSBJ.

With players from the upstream, midstream and downstream sectors joining in, a new round of price increases in the industry has been initiated. To determine whether this trend indicates that the LED sector has overcome the lowest point in recent years and is about to enter a new growth cycle, we have to explore the underlying logic behind this wave of LED price increases.

#1. Increase in Raw Material Prices and Decrease in Product Prices

The global end-market demand for LEDs plunged in 2022, with the LED lighting and LED display markets remaining sluggish. Such slow demand exacerbated competition in the industry, prompting manufacturers to heavily discount their products in order to reduce inventory.

Over the past three years, various industries have faced supply chain imbalances because of macroeconomic conditions, geopolitical issues and many other factors. This has resulted in material shortages and continuous cost increases, putting pressure on suppliers worldwide.

In their price increase letters, LED manufacturers mentioned that the fluctuation in raw material prices and the continuous decline in prices of business-oriented products were among the main reasons for price hikes.

Regarding LED packaging component suppliers, DSBJ, for example, explained in a price increase announcement in May that the price of LED chips has been continuously decreasing since early 2022, causing significant difficulties in their operations. To ensure high-quality products and better services, and to cope with the current pressure and challenges, the company decided to raise product prices.

In June, DSBJ announced another price increase, indicating that although the inventory of each model has returned to a normal level, it could hardly cover the cost after a long time of low utilization and high inventory. Consequently, the supplier had to raise product prices again.

BMTC said that it raised the delivery prices for certain products due to increases in the costs of chips, some materials and labor. Ruisheng Optoelectronics stated that despite the continuous decline in product prices over the past year, commodities have become increasingly expensive, causing significant impact on the industry chain and resulting in a serious cost-price inversion.

Price increases in the upstream packaging and chip sectors have prompted LED display makers to raise their product prices accordingly. Leyard expressed that the rising supply costs of major upstream raw materials (mainly semiconductor chips and LEDs) have led to a continuous increase in the manufacturing costs of their LED display products.

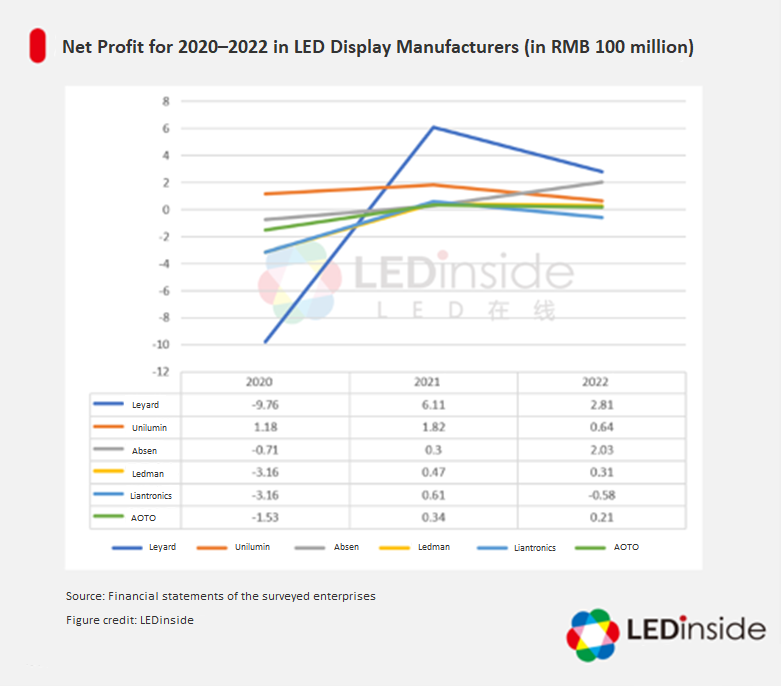

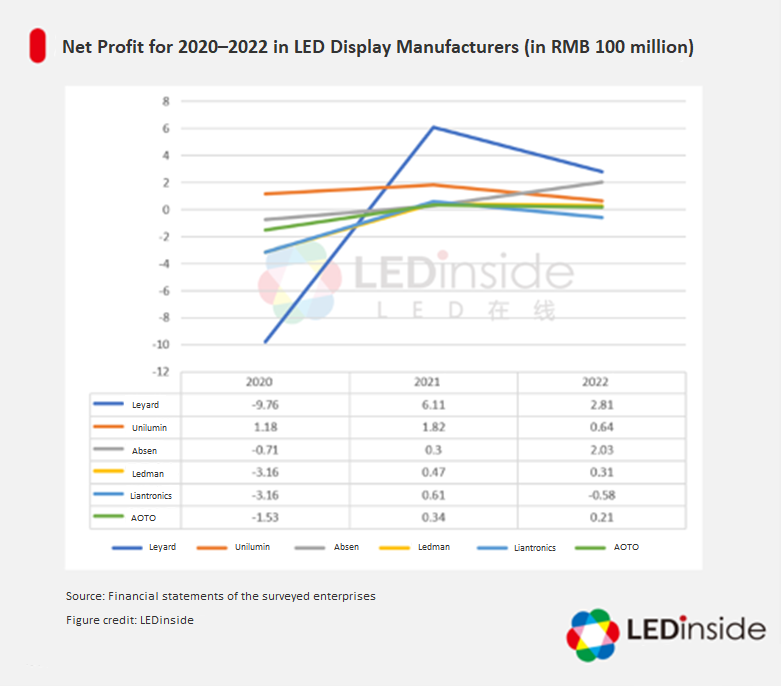

Faced with the fluctuations in end-market demand, companies have been maintaining normal operations through price reductions and promotions. In the long run, however, such strategies have not brought much positive impact to the companies and have further compressed their profits under the continuous fluctuation of raw material prices.

#2. Sluggish Market Has Put Pressure on LED Suppliers

As demand has slumped amid the bleak economy, price reduction strategies fail to shield most LED companies from a decline in performance.

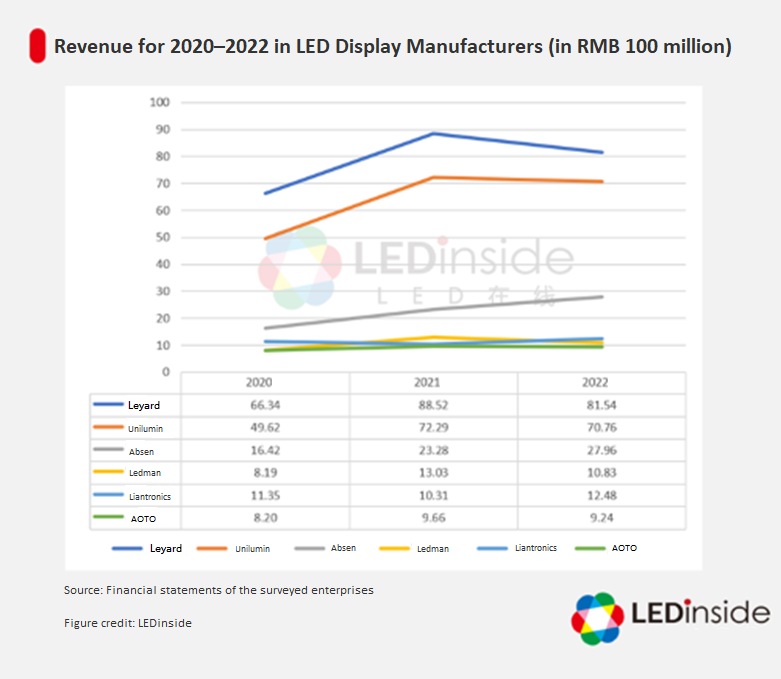

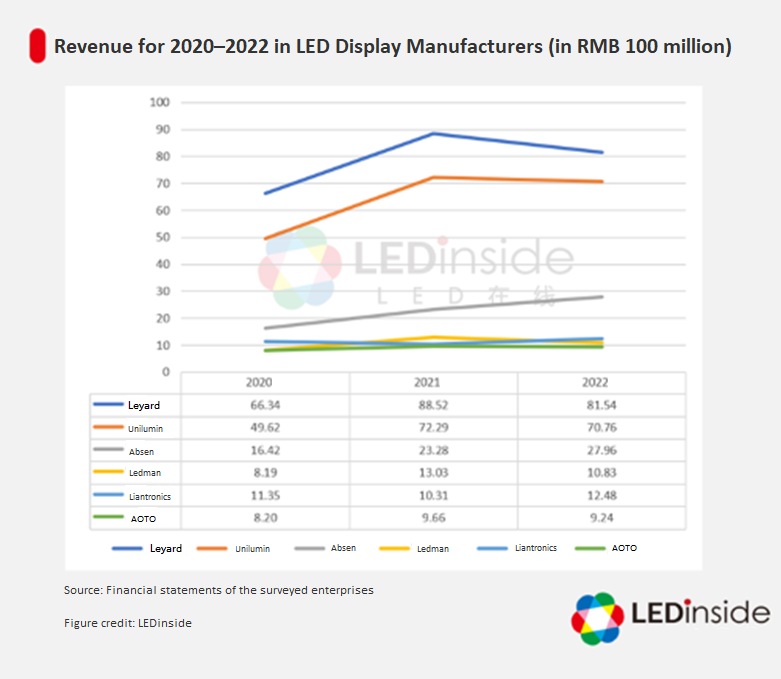

Relevant data show that only 63 out of the 140 listed LED-related companies in 2022 achieved year-on-year revenue growth, and 60 achieved year-on-year net profit growth, accounting for approximately 45% and 42.86% of the total number of companies, respectively.

In the LED display sector, demand remained low in China despite the rapid recovery of overseas market demand in 2022, consequently slashing revenue and net profit for most companies.

In the LED lighting sector, the overall LED lighting market size has showed a downward trend. According to TrendForce's report "2023 Global LED Lighting Market Analysis - 1H23," multiple factors caused a drop in the global LED lighting market size to $61.4 billion in 2022, down 5% relative to a year earlier.

The downstream demand slump led to a chain reaction causing a decline in LED business for midstream and upstream package and chip manufacturers. Examples include chipmakers like Changelight, Jiangsu Azure Corporation and Focus Lightings in the upstream segment, as well as midstream package suppliers like DSBJ, Nationstar and MLS, all of which experienced a decline in revenue and profit in their LED business in 2022.

TrendForce mentioned that the decrease in end-market demand led to lower utilization rates of LED chip production capacity in the upstream sector, resulting in oversupply and continuous price declines. According to TrendForce’s research, the decline in both quantity and price led to a 23% annual decline in the global LED chip output in 2022, amounting to only $2.78 billion.

The global LED packaging market size in 2022 was $14.2 billion, down 19% from the year before, with the LED lighting packaging sector experiencing the most significant decline. In the LED display packaging segment, squeezed by price drops and reduced downstream orders, the market size for the entire year amounted to $1.45 billion, a 16% year-on-year drop.

Entering 2023, life has returned to normal, while several companies are still experiencing a decline in performance in the first quarter. According to relevant data, 128 listed LED-related companies announced their earnings for 1Q23, with only 41 achieving year-on-year revenue growth and 57 achieving year-on-year net profit growth, accounting for approximately 32.03% and 44.53% of the total, respectively.

The downturn in the LED industry from 2022 to the first quarter of this year has resulted in continued pressure on company performance, partially prompting some LED companies to raise product prices. From a long-term perspective of business and industry development, however, the price increase decision made by manufacturers allows them to return to a relatively normal state of operation, reducing the negative impact of raw material price fluctuations, enhancing profitability and delivering high-quality products to customers while driving the industry to return to a healthy competitive environment.

#3. Demand Returns with the Rise of New LED Applications

In addition to the decline in corporate profitability, the recent recovery in market demand is also one of the reasons for the price increase in the LED industry chain. In 2023, the LED industry has gradually recovered, especially in the LED lighting market, where demand has shown a noticeable improvement.

According to TrendForce's analysis, commercial use has been the fastest-growing application throughout the LED lighting market. From the supply side, the LED lighting industry has been in the low point since 2018, leading to the exit of some small and medium-sized businesses. Other suppliers in the conventional lighting supply chain have also transformed and developed towards the display and other high-margin markets, resulting in a reduction in supply and low inventory levels.

Since most global LED lighting chip suppliers are concentrated in China, it is the Chinese market that has experienced the initial price increase in low-power lighting chips. In the short term, this is seen as a measure taken by businesses to improve their profitability. In the long run, companies are adjusting the supply-demand balance and enhancing industry concentration to gradually restore normalcy to the industry.

Regarding LED displays, the demand has been gradually recovering in 2023, driven by continuous growth in overseas markets and the normal operation of the Chinese market. Recent reports from Jufei Optoelectronics indicate that their Mini LED business is progressing smoothly, with increasing shipments each month. The company’s Mini LED backlight technology has seen rapid application and promotion.

Leyard stated that the Asia, Africa, and Latin America markets showed strong growth in 1Q23. In China, direct sales have recovered rapidly since March, with several major industries such as military, education, and energy showing good performance in terms of order growth.

Leyard also mentioned that the prices of their Micro LED products—which have been on the market for over two years—are continuously decreasing while maintaining stable and excellent performance, and customer satisfaction is high. Due to the overwhelming demand for the products, the company issued a price increase notice specifically.

Unilumin, in a recent conference call, stated that their orders gradually recovered in the first quarter, and market demand is steadily picking up. Display manufacturer AOTO revealed that the demand for their products in the xR (extended reality) advertising production market and short video live streaming market is gradually increasing.

TrendForce’s research indicates that the downstream demand for LED displays is rebounding, leading to a rise in the demand for upstream LED chips in June, thus an increase in chip manufacturers’ capacity utilization rate.

In addition to lighting supply shortages and the gradual recovery of both Chinese and overseas markets, another reason causing the resurgence of LED demand is the rapid rise of emerging applications in LED lighting and displays. As LED performance continues to improve and costs decrease, with the gradual optimization of Mini LED/Micro LED technologies, companies are rapidly exploring various niche markets.

In the LED lighting market, various segments such as horticultural lighting, UV lighting, smart lighting, human-centered lighting, and automotive lighting have shown good potential regarding their applications. Automotive lighting, in particular, has become a focal point for companies as it experiences continuous growth in demand, stimulated by the CASE (connected car, autonomous vehicle, sharing/subscription and electrification) automotive trends and the need for domestic production.

In the LED display market, novel applications such as xR virtual production, glasses-free 3D, all-in-one machines, cinema screens, rental displays, transparent screens, and flexible displays are becoming the main driving forces for the growth of the LED display market. As for consumer electronics such as monitors, televisions, AR/VR glasses and smart wearables, they are eagerly awaiting further advancements in Mini/Micro LED.

Price Increase Is a Sign of Soaring Demand for the LED Industry

In the short run, the price increase reflects the dual pressure faced by LED companies due to the downturn in the industry and intensified market competition, as well as the negative impact on performance caused by the decline in product prices and cost increases. However, the gradual increase in market demand provides LED companies with an opportunity to return to normal operations and a healthy market environment.

In the medium term, the price increase indicates that companies have confidence in the continued recovery of LED demand in the future. Despite the complex international situation and the current weak macroeconomic conditions, markets in both China and other countries are relatively stable compared to the past three years. This increases the possibility of LED industry demand continuing to rise in the second half of this year and the next two to three years.

In the long term, the price increase has indicated companies’ positive attitudes towards the further expansion of LED technology applications. Currently, LED technologies are mainly applied to lighting, displays, and backlights, and it holds significant advantages over other technologies in these sectors. With continuous optimization of performance and cost, along with the emergence of Mini/Micro LED technology, LED will accelerate its penetration in various applications.

More time is needed to determine whether the price increase indicates that the LED industry is entering a new growth cycle. However, for LED companies, the price increase is a necessary adjustment for their current and future development. As people have become increasingly aware of environmental and energy efficiency issues, the LED market is bound to continue expanding. LED businesses need to improve their operational capabilities and product quality, foster healthy competition within the industry and promote the sustainable development of the LED industry, patiently waiting for the arrival of an era with even greater demand for LEDs.

(By Irving from LEDinside)

Gold+ Member Report

Gold+ Member Report

|

Content

|

Publication

|

|

and Supply Database

|

PDF / Excel

|

2023-2027 Demand Market Forecast

|

|

Supply Market Analysis:

|

|

2. WW New GaN LED and As/P LED MOCVD Chamber Installations / WW Accumulated GaN LED and As/

3. GaN LED and As/P LED Wafer Market Demand

4. GaN LED and As/P LED Wafer Market Demand and Supply Analysis

|

|

and Capacity

|

PDF / Excel

|

Top 10 LED Chip Manufacturers by Revenue and

LED Package Market Analysis:

|

|

Top 10 LED Package Providers by Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED

|

|

Price Survey- Sapphire / Chip / Package (Backlight, General Lighting, Agricultural Lighting, Automotive, Video Wall, UV LED, IR LED, VCSEL)

|

1Q (Mid Mar)

2Q (Early Jun)

3Q (Early Sep)

4Q (Early Dec)

|

|

Quarterly Update

|

PDF

|

EU / U.S- Lumileds, ams OSRAM, Cree LED

JP- Nichia, Citizen, Stanley, ROHM

|

|

ML- Dominant

|

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, MLS

|

|

Exhibit Report

|

PDF

|

<20 Pages

|

If you would like to know more details , please contact: