Orion Energy Systems, Inc., a provider of energy-efficient LED lighting, electric vehicle (EV) charging stations and maintenance services solutions, today reported results for its fiscal 2026 first quarter (Q1’26) ended June 30, 2025, retaining its three segment reporting structure. Orion maintained its FY 2026 revenue growth outlook of 5% to approximately $84M, which should position it to approach or achieve positive FY 2026 adjusted EBITDA. Orion will hold an investor call today at 10:00 a.m. ET – details below.

Highlights

-

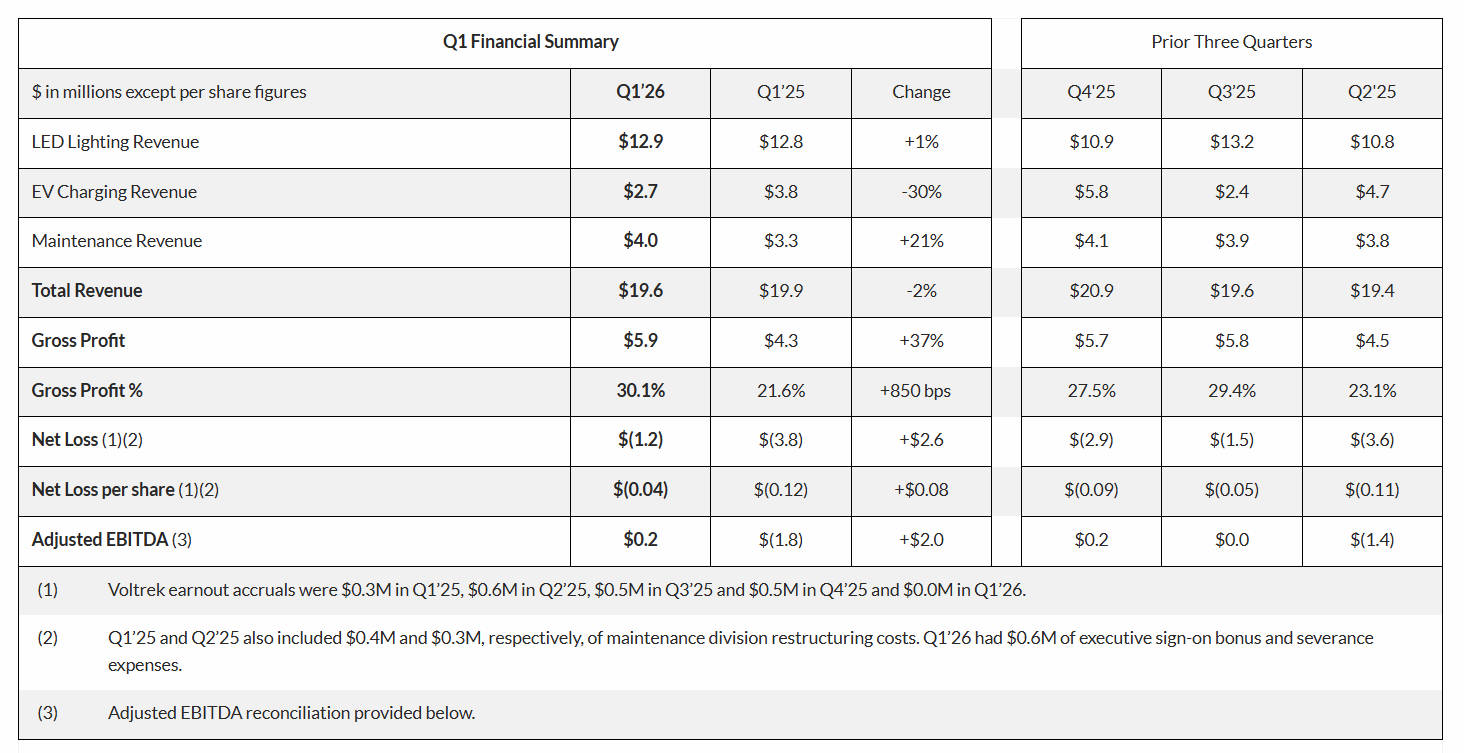

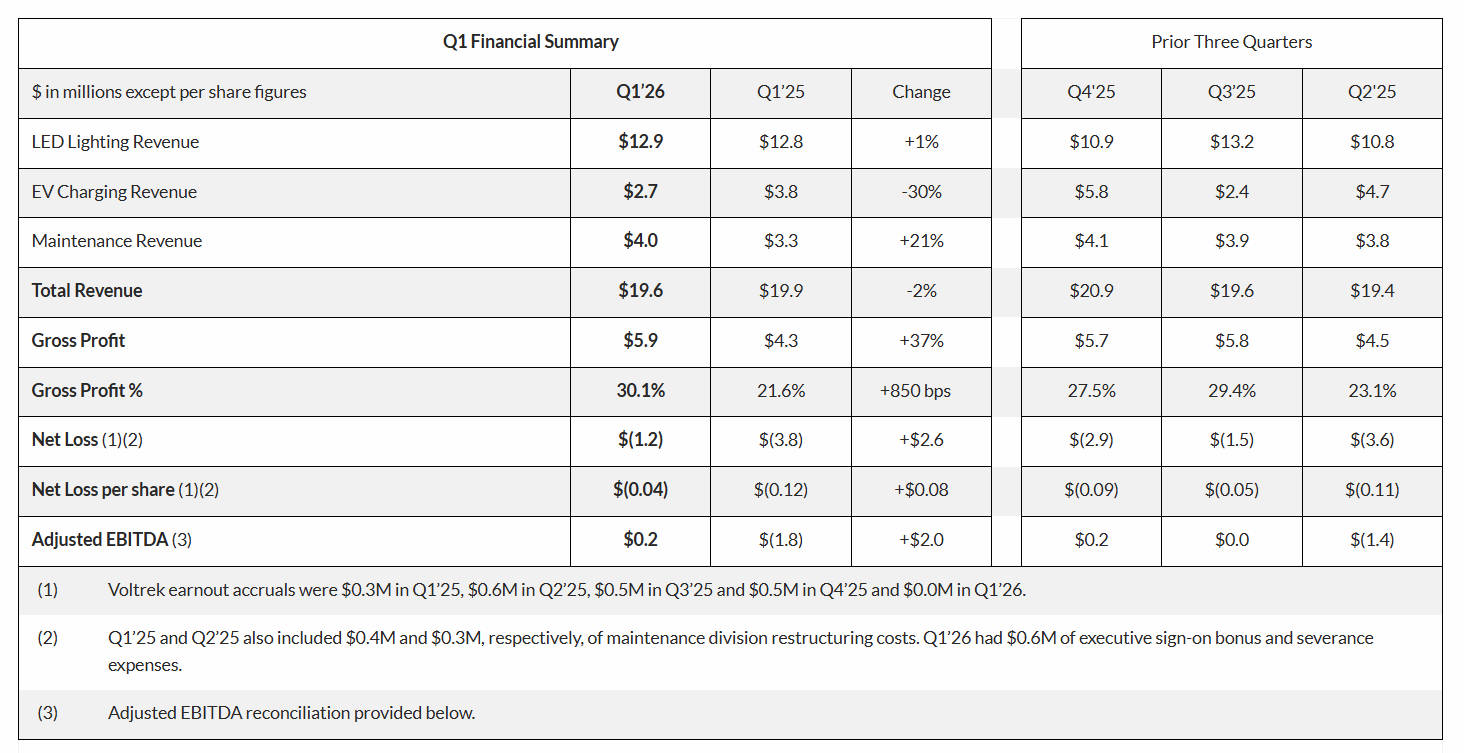

Q1’26 revenue was $19.6M vs. $19.9M in Q1’25 as higher maintenance and LED lighting segment revenue partially offset lower EV charging revenue compared to the prior-year period. The prior-year period benefitted from the startup of $11M of projects in Eversource Energy’s “EV Make Ready” program and two other significant EV project deliveries.

-

Q1’26 gross profit percentage increased to 30.1%, from 21.6% in Q1’25, reflecting pricing, revenue mix changes and cost improvements across all three segments.

-

Orion achieved Q1’26 adjusted EBITDA of $0.2M, its third consecutive quarter of positive adjusted EBITDA, compared to an adjusted EBITDA loss of $(1.8M) in Q1’25. The Company paid down $1.75M on its revolving credit facility in Q1’26.

-

Orion reiterated its FY 2026 outlook for revenue growth of approximately 5% to $84M, the achievement of which should position it to approach or achieve positive adjusted EBITDA for the full fiscal year, with potential upside should business, economic, global trade, and government policy uncertainties stabilize.

CEO Commentary

Orion CEO Sally Washlow, commented, “Our Q1 performance benefitted from pricing and cost measures implemented or planned in FY 2025 that should continue to contribute to the bottom-line as we progress through FY 2026. Our Q1’26 gross profit percentage of 30.1% was the highest quarterly margin in six years. We achieved year-over-year growth in two of three segments, while as anticipated our EV charging segment faced a tough Q1’25 comparison, as well as a slowdown in project activity. A $3M public school EV charging project did start near the end of June and is expected to be completed during our second quarter.

“We are on track to achieve our FY 2026 revenue and adjusted EBITDA outlook, and we made meaningful progress in our goal to return the business to profitability, reducing our net loss to $1.2M in Q1’26 from $3.8M in Q1’25 and $6.6M in Q1’24. We also achieved our third consecutive quarter of positive adjusted EBITDA in Q1’26.

“We have had initial success in our LED lighting distribution business through the introduction of new value-based products, such as our TritonPro™ line of fixtures designed specifically for this channel. TritonPro provides a balance of high-quality design, components and energy efficiency that has proven more compelling to customers in this price competitive channel. We are building on this success with new products, enhancing our go-to-market strategies with an enhanced sales team to leverage their broad base of experience and relationships to strengthen our LED lighting distribution operations. Under new leadership we are confident LED lighting distribution can return to a path of growth.

“We were recently awarded up to $7.0M in electrical infrastructure and LED lighting projects by three automotive customers and have submitted bids on several other projects of reasonable size. The awards demonstrate both the strength of these customer relationships as well as their confidence in expanding the role we can play in their businesses.

“Orion has a very strong platform of quality, industry-leading solutions to meet our customers’ needs for LED lighting, energy savings, workplace safety, electrical project management, maintenance services and sustainability goals. I am excited about Orion’s potential to deliver both growth and improving bottom-line performance in FY’26 and in years to come. We have made significant reductions in overhead, meaningful progress in enhancing margins though pricing and cost actions, and we have been building a diversified pipeline of revenue opportunities that support our growth goals.”

Outlook

Orion’s FY’26 outlook anticipates revenue growth of five percent to approximately $84M which, based on the Company’s gross profit percentage and operating cost improvements, should position Orion to approach or achieve positive adjusted EBITDA for the full fiscal year. Orion believes there could be potential for upside to this outlook should business, economic, global trade, and government policy uncertainties stabilize.

Below are updates and additions to contracts, projects and initiatives expected to contribute to FY’26 and future periods’ results:

-

A Multi-year LED lighting retrofit contract for a building products distributor’s 400+ locations has begun with orders in-house approaching $2M to be completed over FY’26. The project is expected to generate revenue of $12M-$18M over several years.

-

New construction and LED retrofit lighting projects in multiple U.S. Government Agency facilities have expanded from $5M to $7M in total revenue to be completed in FY’26.

-

Up to $7M in electrical infrastructure and LED lighting projects for three long-time, top-tier automotive customers are expected in FY’26. The projects are part of the customers’ ongoing updating of their LED lighting, electrical infrastructure, and managed services for manufacturing and distribution facilities in North America.

-

A major retail customer increased the number of new store construction projects over the next 5 years. Orion now expects new store construction for these new stores’ revenue potential to range from $30M-$32M over the 5-year period.

-

The 400-site LED retrofit project with a national bank has commenced with revenue potential of $2-$3M over the next 3 to 4 years.

-

Orion’s EV charging backlog was approximately $8M at the close of Q1’26. With current uncertainty around the near-term scope, pace, and funding availability for EV charging projects, Orion’s revenue outlook anticipates flat to slightly lower EV charging station-related revenue in FY’26.

Financial Results

Orion reported Q1’26 revenue of $19.6M compared to $19.9M in Q1’25, based on the following segment performance:

-

LED lighting revenue increased approximately 1% to $12.9M compared to $12.8M in Q1’25, reflecting increased large project activity offset by lower sales activity in the electrical distribution business. Orion’s expanded project pipeline as well as efforts to drive growth in its distribution business are expected to contribute to higher FY’26 LED lighting revenue compared to FY’25.

-

Maintenance services revenue increased 21% to $4.0M in Q1’26 from $3.3M in Q1’25, reflecting the benefit of new customer contracts as well as the expansion of certain existing customer relationships.

-

EV charging solutions revenue was $2.7M compared to $3.8M in Q1’25, reflecting the variability in timing of larger projects. Given current uncertainty around the near-term scope, pace, and funding availability for EV charging projects, Orion currently expects segment revenues to be relatively flat to slightly lower in FY’26 vs. FY’25.

Orion’s Q1’26 gross profit percentage increased 850 basis points to 30.1% versus 21.6% in Q1’25 primarily due to pricing and cost improvements across all three segments. Q1’26 gross profit increased to $5.9M from $4.3M in Q1’25. Q1’25 gross profit included maintenance segment restructuring costs of $0.2M.

Total operating expenses declined to $6.9M in Q1’26 from $7.7M in Q1’25, reflecting ongoing efforts to reduce infrastructure and personnel expenses. Q1’26 included $0.6M of expenses related to executive sign-on bonus and severance expenses, while Q1’25 included $0.7M of earnout and restructuring costs.

Primarily reflecting stronger gross margin and lower operating expenses, Orion’s Q1’26 net loss improved to ($1.2M), or ($0.04) per share, versus a net loss of ($3.8M), or ($0.12) per share), in Q1’25. Orion’s adjusted EBITDA improved significantly to $0.2M in Q1’26 compared to ($1.8M) in Q1’25, reflecting the benefit of the company’s financial discipline.

Balance Sheet and Cash Flow

Orion used $0.5M of cash in operating activities in Q1’26 vs. $3.0M in Q1’25, principally due to significantly improved bottom line results in the current period. Orion also paid down $1.75M on its revolving credit facility in Q1’26, bringing outstanding borrowings to $5.25M.

Orion ended the quarter with current assets of $32.7M, including $3.6M of cash, $13.5M of accounts receivable, $3.5M of revenue earned but not billed, and $10.3M of inventories. Net of current liabilities, working capital was $6.1M at June 30, 2025 vs. $8.7M at March 31, 2025. Orion’s financial liquidity was $9.8M as compared to $13.0M at year-end FY’25.

TrendForce 2025 Global LED Lighting Market Trend- Database and Player Strategies

1. Database and Player Strategies

Release Date: 15 February 2025 / 15 August 2025

Format: PDF and Excel

Language: Traditional Chinese / English

2. LED Lighting Market Dynamics Monthly Report

Release Date: 20th of Every Month

Format: PDF

Language: Traditional Chinese / English

|

If you would like to know more details , please contact:

|