As the blue ocean for the development of

LED lighting industry, the Southeast Asian market is attracting more and more foreign manufacturers to enter eagerly. And accurate and appropriate product strategy is an indispensable tool for successfully seizing market share in Southeast Asia. Making corresponding product specifications and prices depending on varied products and countries plays a driving role in promoting manufacturers’ own brands or seeking OEM opportunities.

Overall, compared to mature markets like Europe and the U.S., Southeast Asian market has lower requirement on indoor LED product specifications and certifications, for example, the demands for LED bulbs are biased towards the products with low lumens, basic functions and high cost-performance. It can be seen that the demands for LED lighting products in Southeast Asia are mostly still in the initial stage at present. However, the streetlight projects, mainly as municipal engineering, have certain requirements on product specifications and the lighting effects. The tougher standards on products in government procurement result in quality competition pressures on manufacturers, which therefore enhance the quality and performance of products. This article will take LED bulb,

LED tube and street lamp as sample to analyze the product specification and price positioning status in Southeast Asia.

LED bulb: basic bulbs with low lumens and high cost-performance are favored by market

In Southeast Asia, especially in Thailand, Malaysia and Indonesia, LED bulbs with 250 ~ 400 lm are the most common products, mostly with service life of 15,000 hours. Except Philips and other international first-tier manufacturers who introduce dimmable bulbs, few local manufacturers in Southeast Asia have launched products with dimming function.

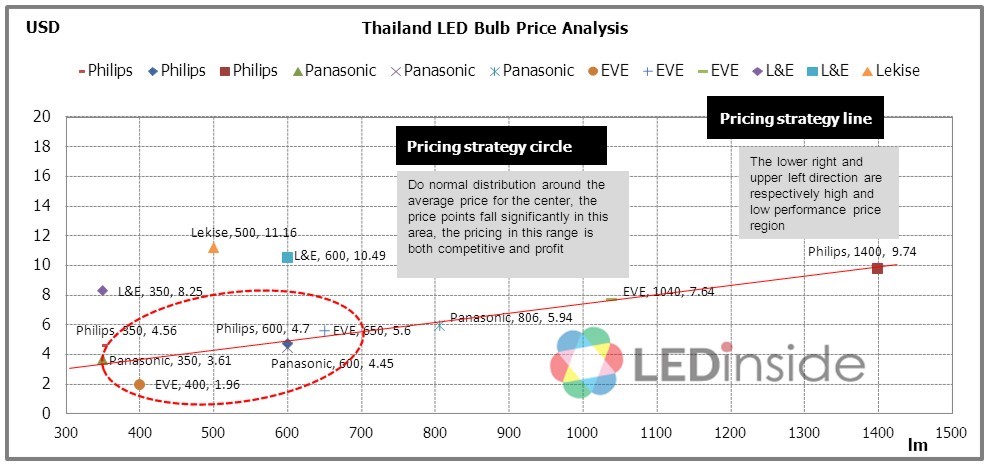

In view of pricing, Thailand makes the lowest prices, bulbs in 350lm and 600lm are sold at USD 1-6. Many international and local manufacturers have launched price-off promotions recently, aiming to expand market with low-cost advantage. It is necessary for enterprises to grasp the differences among countries while designing LED bulb specifications, moreover, basic products with low lumens and high cost-performance are powerful tools for entering Southeast Asian market.

LED Bulb Specifications and Prices in Thailand

LED Tubes: 18W and 36W equivalents are the mainstream products in market

LED T8 tubes in Southeast Asian market mostly are alternatives to 18W and 36W traditional tubes, the products made by first-tier manufacturers mostly have 40,000 hours lifetime. In terms of products price, there is great difference in Vietnam, Indonesia, Philippines and smaller difference in the other three countries. With the continuous development of commercial lighting, the proportion of 18W and 36W equivalent LED tubes will continue increasing in Southeast Asian market.

Street lights: bid-oriented, high requirements on performance

60-240W LED street lights are the most commonly used specifications in Southeast Asian market, the products launched by local manufacturers are basically with luminous efficacy of 100lm/W and IP (Ingress Protection) not less than 65. The prices of street lights vary with different project types. Therefore, manufacturers should design products based on the demand of street light tenders, which can improve the market impact of their own products.

Specified product positioning strategy, and accurately identify market demand

In summary, enterprises should firstly distinguish product types when developing product, since there may be great difference in specification and price preference for various products; what’s more, product positioning strategy should be developed based on specific characteristics of the target country. Moreover, for street lamps and other outdoor lighting, it is necessary to make different product specifications and prices according to different requirements of engineering projects. In addition, Southeast Asia has a tropical climate, which is hot and rainy throughout the year, hence manufacturers should spend more efforts on heat dissipation and waterproof design.

Besides product specification, manufacturers should also make products prices according to per capita income, electric charge, tax rates and market segment in different countries. For example, Singapore has higher per capita income, so the products prices are correspondingly higher; while the prices in Thailand are relatively lower because there are many diverse LED lighting manufacturers and fierce competition.

LEDinside 2016 Southeast Asian Lighting Market Report

Release Date: March 2016

Language: English

Format: PDF

Chapter One: Report Structure and Key Factors

Chapter Two: SEA Market Macroeconomics

Chapter Three: Lighting Market Scale and Trend Analysis

Chapter Four: Manufacturers Introduction and Strategies Analysis

Chapter Five:

LED Lighting Products Specifications and Prices Analysis

Chapter Six: Lighting-Related Policies and Regulations

Chapter Seven: ASEAN Developments and Impact on Lighting Industry

Chapter Eight: Proposal on Entering into SEA Lighting Market

Chapter One: Report Summary and Study Methods

This report has compiled various data regarding related SEA government and industry agencies, local business partners, import and export figures, to identify and analyze key market variables and offer projections. The study also integrates Market research and firsthand interview of manufacturers or agencies to examine and validate key factors, and offer recommendations, solutions and comprehensive analysis based on these findings.

Chapter Two: SEA Market Macroeconomics

Due to low labor cost and abundance of natural and human resources, SEA has become one of the most economically dynamic region with immense market potentials. SEA holds a key role in future political and economic positions. General lighting demands have grown as living standards rise in SEA countries, and energy conservation awareness and demands emerge. This will eventually lead to the proliferation and growth of the

LED lighting industry.

Chapter Three: Lighting Market Size and Market Trend Analysis

The lighting market scale of the six major SEA countries which referred to in this report was estimated USD 4.8 billion in 2015, while LED lighting market is expected to reach USD 1.5 billion. LED lighting has a very high market and import growth rates, and LED lighting penetration rate has gradually increased. Despite the slow down of growth speed in 2015 due to overall economic condition, it is estimated in the next few years, government policies and incentives will continue to spur lighting replacement demands. SEA LED lighting market penetration and import volume is expected to soar. SEA market has gradually become the main export market for Chinese lighting manufacturers.

Chapter Four: Major Manufacturers and Business Strategy Analysis

Imported Chinese lighting products, can be classified into five types in the SEA lighting industry supply chain: 1. Chinese manufacturers supply lighting components to local lighting manufacturers. 2. Semi-finished products are imported from China and locally assembled. 3. Imported light sources are assembled locally. 4. Chinese manufacturers playing the role of Original Design Manufacturer (ODM) and shipping the products to SEA countries. 5. Chinese manufacturers distribute their products through wholesale channels or construction projects. In general, due to the lack of local manufacturing capability, international brands such as Philips, GE and Toshiba have the largest market share in SEA countries, followed by major local manufacturers.

Provides major LED, LED lighting and LED industrial lighting manufacturers lists in the six countries.

Three major LED lighting manufacturers in each country, 18 in total, including ODM/OEM and in-house production line, as well as distribution channel analysis.

Chapter Five: Major LED Products Analysis (LED Bulbs, Tubes, and Streetlights)

The indoor LED lighting products certification standards and regulations in SEA market are relatively low compared to mature markets, such as Europe and the U.S., with the exception of construction projects. By and large, low lumen and high C/P ratio products are favorable in SEA lighting market. Nevertheless, municipal projects such as streetlight constructions have certain product specifications and energy efficiency effects. In addition, the prices of LED lighting products vary across SEA countries.

Summarizes local manufacturers’ streetlight specifications (take one major manufacturer’s products in each country as example).

Chapter Six: Lighting Policies and Regulations

SEA countries have developed national LED standards that are based on IEC regulations to meet each country’s specific needs. In addition, upon the establishment of ASEAN Economic Community, the ASEAN Harmonized Electrical and Electronic Equipment Regulatory Regime (AHEEERR) will be implemented as guidance for electronic equipment policies and standards. Electronic devices can be sold in other ASEAN countries upon receiving approval in one of the ASEAN countries. The introduction of uniform standards undoubtedly benefits the market of Southeast Asia. Besides, SEA countries have set energy conservation targets and initiated several energy saving projects, which lead to local demands for new energy saving lighting products. This has in turn raised new products quality and performance.

Chapter Seven: ASEAN developments and its impact on lighting industry

Association of South East Asian Nations (ASEAN) Economic Community is established in 2015, and has become the second global single market aside from EU. ASEAN nations have signed bilateral agreements with China, some of the agreements have lowered tariff or tariff-free on LED products. The lifting of tariffs frees investment and finance flows, plus human resources and transportation facilities and infrastructures. All these can become points of entry into the ASEAN market for Chinese LED lighting manufacturers. Lighting manufacturers have also implemented different strategies, for instance package manufacturers have taken the opportunity to enter local lighting manufacturers supply chain or invested in local factories. Lighting OEMs have also shifted towards new modes of transport that have shortened freight time and distance by directly ship products to emerging markets. Southeast Asian market lighting manufacturers can adapt a single agent, or they can construct local factories and make Southeast Asia their manufacturing hub.

Chapter August: General Strategy for Southeast Asian Lighting Market

For these manufacturers which are planning to enter SEA market, it need to choose the right distribution channel based on the brand and channel condition; take initiatives to develop and maintain good relations with government; prepared product certification and examination to meet local market requirements; plan for products’ retail prices and specifications in accordance to local market demand. Manufacturers have to focus on their own market positioning based on their company strategy and every aspect mentioned above. Whether it is high end or low end product positions, distribute through construction project or retail, acting as an brand or ODM / OEM, choosing the right positioning strategy is a key factor in entering SEA market.

Further information, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912