With the development of global

LED lighting industry, nowadays, the

LED industry in all regions has formed new pattern. The market is no longer occupied by Europe and the United States and other developed countries, many new blue ocean markets are emerging.

Most countries in Southeast Asia except for Singapore are with poorly developed economies. However, with abundant human and natural resources, Southeast Asia becomes one of the most dynamic and promising regions in the present world economic development. In future, Southeast Asia will become more prominent in the new world political structure and economy situation. Moreover, Southeast Asia is a southern neighbor of China, as the friendly relations between China and Southeast Asian Nations are developed, their cooperation will endure and be closer.

The overall electricity price level in Southeast Asia is high, which results in significant demand for lamp replacement in Southeast Asian Nations. With the rapid improvement in the economy of other Southeast Asian countries, the per capita demand for lighting will increase accordingly, and the enhanced energy-saving awareness and demand will make the

LED lighting industry to achieve rapid growth and popularity in Southeast Asia. In addition, Southeast Asia has large infrastructure investment and very attractive policy, so it is becoming the emerging market considered promising by Chinese domestic manufacturers.

LED Lighting Scale Improved Rapidly, with Penetration of 37% in 2016

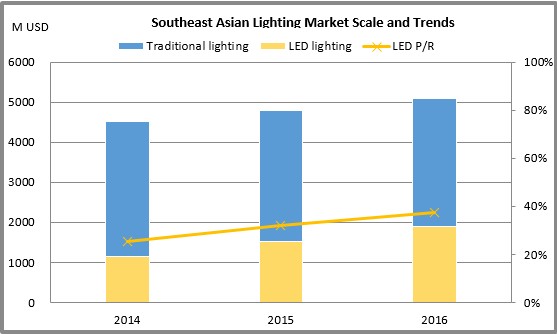

According to LEDinside's statistics, calculated by six major countries (Thailand, Singapore, Malaysia, Vietnam, Indonesia, Philippines), the overall lighting market size of Southeast Asia in 2015 is about USD 4.8 billion, of which LED lighting takes up about USD 1.5 billion, and is expected to grow to USD 1.9 billion in 2016. During 2014-2016, the Southeast Asian LED lighting market share has increased significantly, and the penetration rate is expected to grow from 25% to 37%.

Except for Singapore, the overall lighting scale of other South Asian countries showed an upward trend in recent years, but the traditional lighting scale universally declined, and LED lighting becomes the major growth momentum. Indonesia takes the first place in overall lighting scale and LED lighting scale, with LED lighting market scale is expected to approach USD 460 million.

Vietnam achieved the rapidest growth in LED lighting market share among the major Southeast Asian Nations, maintaining y-o-y increase of more than 60% in 2013-2015. In consideration of the growth impetus brought by government subsidy and market demand growth, the improvement in penetration of LED lighting will accelerate

The Future Trend is Optimistic, and Southeast Asia will become a major export market for Chinese Manufacturers

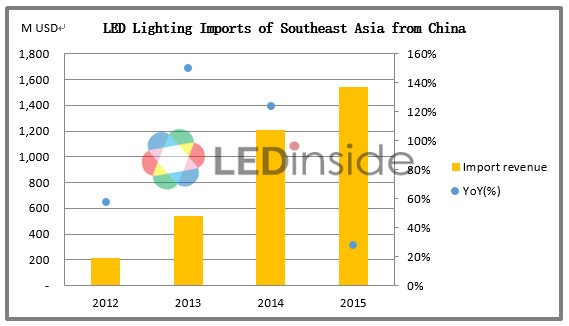

LEDinside expressed, observing the LED lighting product imports of Southeast Asian Nations from China, the total import revenue of the six major countries reached USD 1.54 billion in 2015. All countries achieved rapid growth in imports in 2013 and 2014, while the growth slowed in 2015 due to factors including exchange rate and economic environment.

Among the major countries, Vietnam has obtained rapid growth in LED lighting product imports from China in the recent two years because of its large population and rapid demand growth, taking the first place in growth among the major countries in 2013-2015. The imports from China is expected to exceed USD 300 million in 2015.

In view of market scale and import revenue, LED lighting has increased significantly in recent years, and the effort to replace traditional lighting has gradually strengthened. For Southeast Asia that mainly depends on import and has poor local productivity, the increased demand for LED lighting results in significant growth in import demand, in addition, the imports from China saw rapid growth because of advantages in price, manufacturing capability and geographic position.

Although affected by the overall economic environment in 2015, the growth in market and import scale slowed down, it is expected that LED lighting penetration and import revenue in Southeast Asia will continue to improve rapidly in the next few years due to policy incentives and growth in replacement demand. Consequently, Southeast Asia is becoming a major target market for Chinese manufacturers to export LED lighting products.

LEDinside 2016 Southeast Asian Lighting Market Report

Release Date: March 2016

Language: English

Format: PDF

Chapter One: Report Structure and Key Factors

Chapter Two: SEA Market Macroeconomics

Chapter Three: Lighting Market Scale and Trend Analysis

Chapter Four: Manufacturers Introduction and Strategies Analysis

Chapter Five:

LED Lighting Products Specifications and Prices Analysis

Chapter Six: Lighting-Related Policies and Regulations

Chapter Seven: ASEAN Developments and Impact on Lighting Industry

Chapter Eight: Proposal on Entering into SEA Lighting Market

Chapter One: Report Summary and Study Methods

This report has compiled various data regarding related SEA government and industry agencies, local business partners, import and export figures, to identify and analyze key market variables and offer projections. The study also integrates Market research and firsthand interview of manufacturers or agencies to examine and validate key factors, and offer recommendations, solutions and comprehensive analysis based on these findings.

Chapter Two: SEA Market Macroeconomics

Due to low labor cost and abundance of natural and human resources, SEA has become one of the most economically dynamic region with immense market potentials. SEA holds a key role in future political and economic positions. General lighting demands have grown as living standards rise in SEA countries, and energy conservation awareness and demands emerge. This will eventually lead to the proliferation and growth of the

LED lighting industry.

Chapter Three: Lighting Market Size and Market Trend Analysis

The lighting market scale of the six major SEA countries which referred to in this report was estimated USD 4.8 billion in 2015, while LED lighting market is expected to reach USD 1.5 billion. LED lighting has a very high market and import growth rates, and LED lighting penetration rate has gradually increased. Despite the slow down of growth speed in 2015 due to overall economic condition, it is estimated in the next few years, government policies and incentives will continue to spur lighting replacement demands. SEA LED lighting market penetration and import volume is expected to soar. SEA market has gradually become the main export market for Chinese lighting manufacturers.

Chapter Four: Major Manufacturers and Business Strategy Analysis

Imported Chinese lighting products, can be classified into five types in the SEA lighting industry supply chain: 1. Chinese manufacturers supply lighting components to local lighting manufacturers. 2. Semi-finished products are imported from China and locally assembled. 3. Imported light sources are assembled locally. 4. Chinese manufacturers playing the role of Original Design Manufacturer (ODM) and shipping the products to SEA countries. 5. Chinese manufacturers distribute their products through wholesale channels or construction projects. In general, due to the lack of local manufacturing capability, international brands such as Philips, GE and Toshiba have the largest market share in SEA countries, followed by major local manufacturers.

Provides major LED, LED lighting and LED industrial lighting manufacturers lists in the six countries.

Three major LED lighting manufacturers in each country, 18 in total, including ODM/OEM and in-house production line, as well as distribution channel analysis.

Chapter Five: Major LED Products Analysis (LED Bulbs, Tubes, and Streetlights)

The indoor LED lighting products certification standards and regulations in SEA market are relatively low compared to mature markets, such as Europe and the U.S., with the exception of construction projects. By and large, low lumen and high C/P ratio products are favorable in SEA lighting market. Nevertheless, municipal projects such as streetlight constructions have certain product specifications and energy efficiency effects. In addition, the prices of LED lighting products vary across SEA countries.

Summarizes local manufacturers’ streetlight specifications (take one major manufacturer’s products in each country as example).

Chapter Six: Lighting Policies and Regulations

SEA countries have developed national LED standards that are based on IEC regulations to meet each country’s specific needs. In addition, upon the establishment of ASEAN Economic Community, the ASEAN Harmonized Electrical and Electronic Equipment Regulatory Regime (AHEEERR) will be implemented as guidance for electronic equipment policies and standards. Electronic devices can be sold in other ASEAN countries upon receiving approval in one of the ASEAN countries. The introduction of uniform standards undoubtedly benefits the market of Southeast Asia. Besides, SEA countries have set energy conservation targets and initiated several energy saving projects, which lead to local demands for new energy saving lighting products. This has in turn raised new products quality and performance.

Chapter Seven: ASEAN developments and its impact on lighting industry

Association of South East Asian Nations (ASEAN) Economic Community is established in 2015, and has become the second global single market aside from EU. ASEAN nations have signed bilateral agreements with China, some of the agreements have lowered tariff or tariff-free on LED products. The lifting of tariffs frees investment and finance flows, plus human resources and transportation facilities and infrastructures. All these can become points of entry into the ASEAN market for Chinese LED lighting manufacturers. Lighting manufacturers have also implemented different strategies, for instance package manufacturers have taken the opportunity to enter local lighting manufacturers supply chain or invested in local factories. Lighting OEMs have also shifted towards new modes of transport that have shortened freight time and distance by directly ship products to emerging markets. Southeast Asian market lighting manufacturers can adapt a single agent, or they can construct local factories and make Southeast Asia their manufacturing hub.

Chapter August: General Strategy for Southeast Asian Lighting Market

For these manufacturers which are planning to enter SEA market, it need to choose the right distribution channel based on the brand and channel condition; take initiatives to develop and maintain good relations with government; prepared product certification and examination to meet local market requirements; plan for products’ retail prices and specifications in accordance to local market demand. Manufacturers have to focus on their own market positioning based on their company strategy and every aspect mentioned above. Whether it is high end or low end product positions, distribute through construction project or retail, acting as an brand or ODM / OEM, choosing the right positioning strategy is a key factor in entering SEA market.

Further information, please contact: