As a niche application with high profit, automotive LED lighting has been under the spotlight of many LED manufacturers. With 2019 starting, LEDinside would like to share some insights of the market trend on automotive LED.

Global vehicle sales slows down due to the US-China disputes

In the first half of 2018, car sales had slowly grown as the global economy was relatively stable. However, as the extra tariffs imposed by the Trump government came to effect in July, the on-going US-China dispute has created uncertainty in the global market and affected the sales of cars.

In 2018, China was still the country where the automotive market grew the most. In 1H18, the on year growth rate of Chinese car sales was 4 percent and the growth has declined in the second half. LEDinside believes that the Chinese market will still be the driving force of global car sales as many Chinese consumers have a strong willingness to buy luxury cars and the popularity of alternative fuel vehicles is growing in China.

Other growing markets include India and Brazil whose on year car sales growth rates were over 10 percent in 2018. The vehicle sales in India surpassed Germany’s, making the country the fourth biggest automobile market in the world.

In the U.S., car sales still increased in 1H18. But it may drop in the second half due to the trade war and the price of oil. The European market has been stable in the past year and the sales of vehicles reached the peak in comparison to the past ten years.

Automotive LED market value grows in China

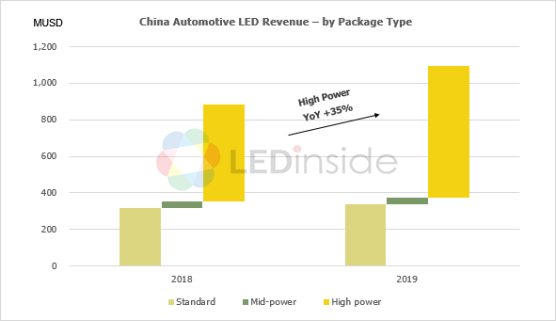

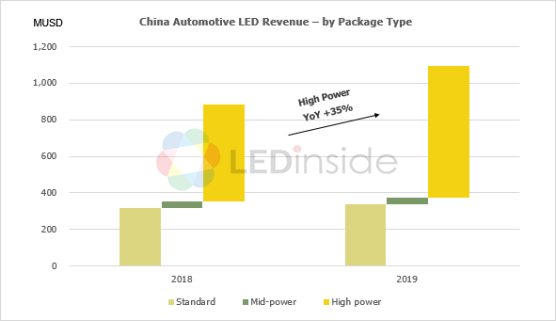

Although the market uncertainty caused by the trade war has affected global car sales, the demands for vehicles in the Chinese market will still expand; driving the growth of automotive LED in China, which LEDinside estimates will be more than 20 percent YoY. The market value of automotive LED in the Chinese market will be over US$ 1 billion in 2019.

LEDinside projects that high power and middle power LED will be growing faster than the low power ones. With increased diversity of factory-installed headlamp and the decreasing price of LED headlamps, the market value of high power LED could achieve a growth rate of 35 percent YoY. The growth rate for middle power LED is also projected to be around 20 percent with the increasing installation of lighting on side mirrors and daytime running lamps.

The market value of headlamps is the highest and its market share has been growing from 43 percent in 2018 to 49 percent in 2019, according to LEDinside. In the factory-installed market, many automobile manufacturers apply single chip or multi chips on low beam light to increase the diversity of headlamps. Meanwhile, the demands of LED headlamps in the dealer-installed market are also booming because the price of high power LED slumped.

The penetration rate of LED in rear light including high mounted lamps and rear combined lamps is the highest, about 70 or even 80 percent. Meanwhile, many Chinese automobile makers believe that adopting LEDs for daytime running lamps is equivalent to upgrading a car, so they are willing to install the applications. The penetration rate of daytime running lamps is estimated to reach 50 percent. Moreover, the penetration of automotive display is also booming. LEDinside estimates that it will reach 40 percent by 2019.

LEDinside 2018 Chinese Automotive Lighting Market Report - Passenger Car and Logistics Car Market Analysis

Release: 31 May 2018

Language: Chinese / English

Format: PDF

Page: 213