Rising Utilization Rates but still Limited Order Visibility

Highest 2012 Order Intake and Revenues Recorded in Q4/2012

Management Focus on Cost Control and Cash Flow

Continuing R&D Investments into Future Market Opportunities

AIXTRON SE (ISIN DE000A0WMPJ6), a leading provider of deposition equipment to the semiconductor industry, today announced revenues of EUR 227.8m and an EBIT loss of EUR -132.3m for the fiscal year 2012.

A slow recovery of revenues but a virtually flat order intake throughout the year reflects a reluctant investment attitude by customers and a continuation of macroeconomic uncertainty. Despite an improving market consensus on the potential outlook for the back end of 2013, Management is unable at this stage to offer a precise revenue and EBIT margin guidance for the year, due to the prevailing low visibility.

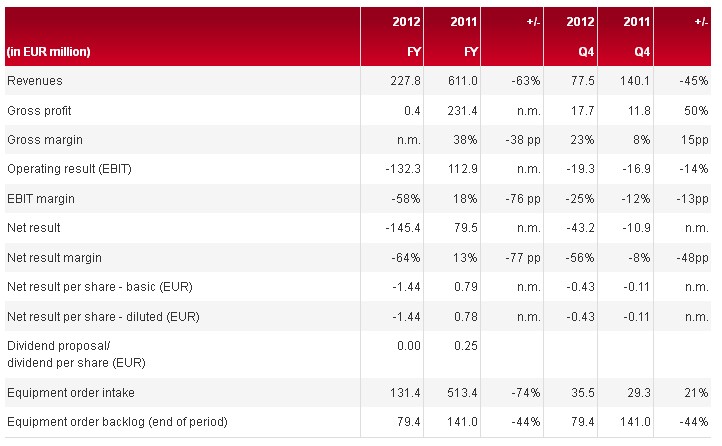

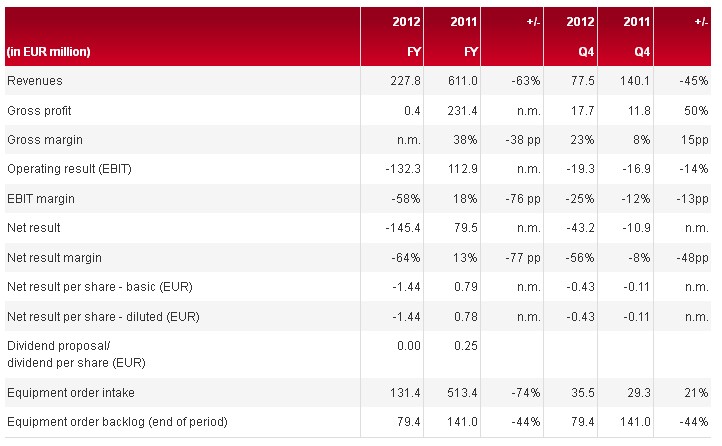

Key Financials

Financial Highlights

Throughout fiscal year 2012, AIXTRON customers remained hesitant in adding significant LED manufacturing capacity, despite increasingly high utilization rates at some mainline Asian manufacturers. AIXTRON recorded revenues of EUR 227.8m for the full year 2012, which although nearly EUR 8m higher than the Q3 forecast for the full year, still represents a decrease of EUR 383.2m, or 63%, compared to EUR 611.0m in 2011. H2/2012 revenues were however c. 58% higher than H1/2012.

Total order intake in 2012 was EUR 131.4m, 74% down compared to 2011 (EUR 513.4m) although H2/2012 orders were c. 14% higher than H1/2012.

The year-end order backlog stood at EUR 79.4m on December 31, 2012; 44% lower than at the same time in 2011 (December 31, 2011: EUR 141.0m). One third of this percentage point reduction came from the EUR 19m order backlog adjustment made in Q3/2012.

The second half order intake development that became clearer in Q3/2012 did not constitute the expected second half market recovery and was catalyst for a thorough internal review into the immediate outlook. The Management conclusion, announced in October 2012, was that the opening year objective of remaining EBIT profitable in 2012 was not achievable. The accompanying risk assessment that was conducted as part of this business review also concluded that the likelihood of ongoing subdued demand necessitated the reduction in value of certain work in progress assemblies, components and spare parts. As a result, the Company executed a significant write-down of inventories in Q3/12.

The subdued business environment, evident throughout the year 2012, had the consequent effect on AIXTRON’s 2012 earnings. Gross profit declined to EUR 400 thousand (2011: EUR 231.4m) and EBIT turned negative to EUR -132.3m (2011: EUR 112.9m). The Company continues to implement cost reduction measures which include both efficiency improvements and cost reductions measures throughout the organization.

The 2012 net result of EUR -145.4m, was considerably down from the EUR 79.5m recorded in 2011 and resulted in a basic loss per share of EUR -1.44 (2011: earnings of EUR 0.79).

Appropriation of Net Loss

AIXTRON’s Executive and Supervisory Boards will propose to the shareholders’ meeting that the 2012 loss should be carried forward and consequently no dividend for 2012 will be distributed.

Management Review

Management expects demand for MOCVD production equipment to potentially improve as demand for LEDs increases later in the current year. On the same timeline, Management also envisages incremental equipment demand coming from non-LED emerging MOCVD applications and other technology markets, including Silicon and Organic Semiconductor applications. Nevertheless, the exact timing of that order intake pickup is difficult to predict whilst order visibility remains so low.

Paul Hyland, President & Chief Executive Officer of AIXTRON: “2012 proved to be an exceptionally challenging year for AIXTRON, largely due to the severe and extended macroeconomic headwinds that the whole world has been suffering from. Our original expectation that 2012 would develop into a transitory year with the prospect of a significantly better second half has evidently not materialized.

However, the ongoing, albeit low level of demand we have seen in the second half of 2012 and into 2013, encourages us to reiterate our view that we have reached the bottom of the current cycle and that we might reasonably expect to see further market recovery at some point during 2013 driven by increasing demand for LED manufacturing equipment.

We also remain confident that we will see increased demand for our manufacturing equipment for non-LED applications such as power electronics, silicon or organic applications going forward. Despite the current short-term challenges, we will continue to invest into the development of manufacturing technologies for these and other emerging markets to secure our technological leadership and stay ’fit for the future’."

Outlook

Despite the generally more positive outlook for the year 2013, there remains a high degree of uncertainty about the timing of a significant order recovery and Management is consequently unable to offer a precise revenue and EBIT margin guidance for the year at this time.