Chris Bailey, Director of Lighting Solutions Center at Hubbell Lighting shows how to assess when to use retrofit or relight lighting products in this article.

The retrofit and relight business is in full swing today. A variety of new LED replacement luminaires, retrofit/conversion kits and lamps are available from a variety of manufacturers and whether we are talking about a T12 to T8 fluorescent conversion or fluorescent to LED, the economic value proposition and project mechanics are well understood.

The most straightforward applications for retrofit kits typically involve replacing antiquated technology with a more efficient lighting solution which reduces the operational costs (energy and maintenance), maintains or improves visual performance and where the initial cost can be justified through a reasonable payback time period. However in recent years, the high-‐impact financial nature of some lighting retrofits has necessitated a greater level of front-‐end coordination with customer operations and accounting personnel. This is especially true when it comes to understanding the dynamics involving repurposing, replacing or modifying fixed assets such as lighting equipment, which for many facilities has been amortized over several decades. As a result, outright replacing luminaires early into predetermined useful life may leave a large balance to be written off as a loss.

Commercial buildings are typically depreciated over 39 years. As a result, fixed lighting systems are frequently depreciated along with the building. Leasehold improvements on the other hand are handled a bit differently and are commonly depreciated over the life of the lease or over the useful life of the asset, whichever is less (ex: 15 years instead of 39 years). This is because you typically only have to undo and redo leasehold improvements every time a tenant moves out.

Depreciation can optionally be accelerated through segregation. This allows you to divide the building into all of its constituent systems, some of which have a life that is much shorter than 39 years. For instance, if your building has a lighting system with a design-‐life of 15 years, you could write it off over a 15-‐year period. While this moves a lot of your depreciation forward and saves you money in the beginning, you have less depreciation to claim in the future.

When it comes time to write off an existing lighting system, this process involves removing all traces of the fixed asset from the balance sheet, so that the related fixed asset account and accumulated depreciation account are reduced.

There are two scenarios under which you may write off an existing lighting system (fixed asset). The first situation, which we will cover here, arises when you are eliminating/removing a fixed asset without receiving any payment in return (ex:accepting resale or recycling value). This is a common situation where existing lighting systems are being scrapped when it is obsolete or no longer in use and there is no resale market for it. In this case, the owner must reverse any accumulated depreciation and reverse the original asset cost. If the asset is fully depreciated, that is the extent of the process. The second situation, which will not be covered here, arises when the customer sells an asset that is or has been depreciated.

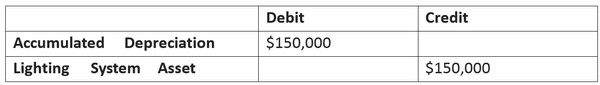

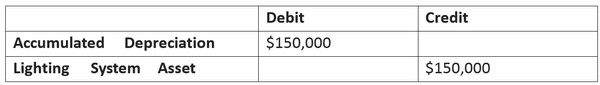

Using the above example, the Best Customer Corporation (BCC) purchases and installs a $150,000 lighting system and recognizes $10,000 of depreciation per year over the following 15 years. At that time, the lighting system is not only fully depreciated, but also ready for the scrap heap. BCC disposes of the lighting system, and records the following entry:

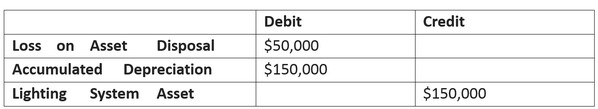

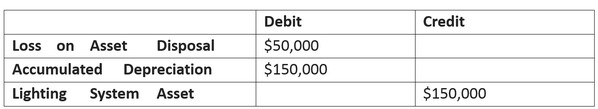

A variation on this first situation is to write off a lighting system (fixed asset) that has not yet been completely depreciated. In this situation, write off the remaining undepreciated amount of the asset to a loss account. To use the same example, BCC disposes of the system after ten years, when it has not yet depreciated $50,000 of the asset's original $150,000 cost. In this case, BCC records the following entry:

Based on the dynamics at play for the customer, it may be more financially reasonable to upgrade a lighting system and avoid the write off. This may be especially true in situations where the lighting system is being depreciated along with the building life and a decision to upgrade the lighting occurs early into this timeframe. The generally accepted accounting principles (GAAP) indicate that if a portion of the original asset is being replaced (ex: lamps, ballast, sockets, reflector, etc.), theoretically, the carrying value of these components should be removed from the accounting records and recorded as a loss in the period of the replacement. This accounting is seldom used in practice because, in general, accounting records for fixed assets are not maintained in the painstaking detail necessary to determine the carrying value of the individual components that comprise each asset. Instead, most companies will capitalize the replacement components (ex: lighting retrofit kit) under the rationale that the portion of the asset besting replace would have been depreciated sufficiently based on the useful life of the "host asset" so that at the time of replacement, little or no carrying value would remain to be removed.

Thank you for using www.freepdfconvert.com service!

Only two pages are converted. Please Sign Up to convert all pages. https://www.freepdfconvert.com/membership