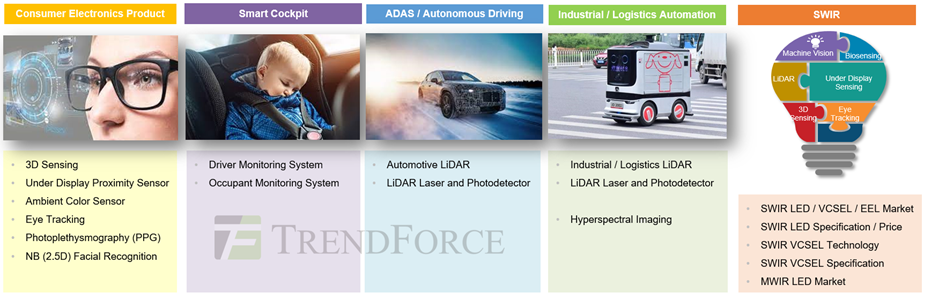

According to TrendForce 2023 Infrared Sensing Application Market and Branding Strategies, brands in the end market will, as per their plans, steadily grow in several aspects during the 2022-2023 period, such as ADAS / autonomous driving, smart cockpit- DMS / OMS, industrial / logistics automation, and bio-sensing- photoplethysmography (PPG) and under display proximity sensors. The infrared sensing market value in 2023 is expected to reach USD 3.096 billion. Specifically, the application market of industrial LiDAR will witness strongest growth, followed by that of under display proximity sensors and eye tracking. Moreover, 3D sensing will likely being combined with ToF to create interactive experiences in AR / VR devices. The said diverse trends will help expand the infrared sensing market, which is estimated to hit USD 4.881 billion.

There are still niche growth products in consumer electronics applications in 2023, such as under display proximity sensors, eye tracking and bio-sensing- Photoplethysmography (PPG). Apple’s iPhone 14 Pro comes with the SWIR–based under display proximity sensor that can resist sunlight / ambient light interference and is free from the white spot effect. In addition, Non-Apple camp, including Samsung Galaxy S series, OPPO’s and vivo’s high-end models have already introduced under display proximity sensors, the components’ market value will soar to USD 489 million in 2022. Under display proximity sensors are likely to be seen in mid- and high-end models, replacing the existing 1D / 2D ToF (Sensing Range Detection), thereby stimulating the value in the future.

TrendForce’s analysis reveals that despite being hit by gloomy macroeconomic development and sales price increases in products, the AR / VR market looks promising in the long run, as brands are willing to try on various applications facilitating the creation of interactive experiences in online learning, business communication, online socials as well as the development of diverse AI-based virtual simulation features. In this way, the development of smart manufacturing, smart transportation, and smart cities will be more efficient, reducing resource waste caused by repetitive experiments in the physical world. The market will see more AR / VR devices with more advanced hardware specifications and platforms in 2023, accelerating the development of relevant applications.

Foveated rendering, a type of eye tracking technologies, helps create realistic and intuitive visual experiences, mitigate motion sickness, strengthen immersion, and enable more straightforward operation. As TrendForce analyzes, following Sony’s and Apple’s adoption of eye tracking for AR / VR devices, the CAGR of IR LED market value for eye tracking is up to 41% during 20227-2027.

There are four major factors deciding the DMS / OMS market development: 1) smart cockpit design, 2) ADAS / safety regulation and policy support, 3) driving safety, and 4) autonomous driving technology. In addition to developing ADAS / autonomous driving technologies, car companies consider DMS a must-have feature for vehicles, aiming to prevent drivers from misusing an ADAS / autonomous driving system and increase driving safety. Euro NCAP plans to introduce regulations on active DMS in 2023 and stipulate them in 2025, it is expected to raise IR LED / VCSEL market value.

Car makers consistently plan to apply LiDAR to ADAS / autonomous driving Level 3 (Highway Pilot) in 2023-2024 to improve safety and AEB performance. Major OEM players will include Volvo, General Motors, Audi, Stellantis, Volkswagen, Changan Automobile, and Li Auto, etc.

As the pandemic in Europe and the US slowed down and led to labor shortages among industrial demand returns, European, American, and Japanese businesses have steadily headed towards industrial automation. Moreover, vehicles were sent to provide services across communities, hospitals, and Fangcang shelter hospitals where logistics demand is high.

TrendForce analyzed the infrared sensing market scales, opportunities, challenges, product specifications and prices, and supply chains via brand manufacturer strategies. TrendForce aims to provide readers with a comprehensive understanding of marketing and sales in the infrared sensing market.

Chapter I. Infrared Sensing Market Scale Analysis

• Scope of Report

• 2023 Infrared Sensing Application Market- Product Analysis Overview

• 2023-2027 Infrared Sensing Market Scale- IR LED / VCSEL / EEL

• 2020-2022(E) Infrared Sensing Player Revenue- IR LED / VCSEL / EEL

• 2023-2027 Consumer Electronics 3D Sensing- Module vs. VCSEL Market

• 2023-2027 Automotive / Industrial- LiDAR vs. LiDAR Laser Market

Chapter II. Consumer Electronics Market Trend

• Consumer Electronics Market- Infrared Sensing Technology Overview

2.1 3D Sensing Market

• 3D Sensing Technology Overview

• iPhone 14 Pro Structured Light Depth Camera Cost and Supply Chain

• iPhone 14 Pro LiDAR Scanner- dToF Depth Camera Cost and Supply Chain

• VCSEL Technology Roadmap- Dot Projector / Flood Illuminator

• Under Display 3D Sensing Technology Feasibility Analysis

• Consumer Electronics 3D Sensing Market Opportunities

• 3D Sensing Application Innovation Drives VCSEL / EEL Technologies

• 2018-2023 3D Sensing Product Specification and Supply Chain

• 3D Sensing Market Landscape Analysis

• Direct / Indirect Time of Flight Technology Analysis

• 2023-2027 VCSEL Market Scale Analysis- Consumer Electronics 3D Sensing

• 2023-2027 VCSEL Price Analysis

• VCSEL Product Design- Eye Safety vs. Testing and Burn in Requirements

• 2022-2023 3D Sensing Module Player List

2.2 Proximity Sensor and Ambient Color Sensor

• 2022-2023 Proximity Sensor Product Specification and Price Analysis

• NIR / SWIR Under Display Proximity Sensor- Pros and Cons Analysis

• iPhone 14 Pro Under Display Proximity Sensor- Specification and Cost

• iPhone 14 Pro Under Display Proximity Sensor- Teardown Analysis

• 2023-2027 Proximity Sensor and 1D / 2D ToF Market Scale Analysis

• 2022-2023 Ambient Color Sensor Product Specification and Price Analysis

• Ambient Color Sensor Product Evolution

• 2023-2027 Ambient Color Sensor Market Scale Analysis

2.3 Eye Tracking

• Augmented / Virtual Reality- Optical Sensing Technologies

• Eye Tracking Application Markets

• 2023 Eye Tracking- Brand Strategies vs. Market Landscape Analysis

• 2019-2023 Eye Tracking Product Specification and Supply Chain

• Augmented / Virtual Reality- Eye Tracking Advantage Analysis

• Virtual Reality Product Analysis- Oculus Quest Pro

• Virtual Reality Product Analysis- Sony PlayStation VR 2

• Virtual Reality Product Analysis- HTC VIVE Focus 3 / Pico 4 Pro

• Augmented Reality / Mixed Reality / NB Product Analysis

• IR LED Product Specification and Price Analysis

• 2023-2027 IR LED Market Scale Analysis- Eye Tracking

2.4 Photoplethysmography, PPG

• Physiological Parameter Measurement and Disease Analysis

• Heart Rate vs. Blood Oxygen- Optical Sensing Principle

• Blood Pressure vs. Body Hydration- Optical Sensing Principle

• PPG Measurement Location Analysis

• Apple Watch Series 8- PPG Specification, Price Cost and Supply Chain

• Google Pixel Watch- PPG Specification and Supply Chain

• Apple AirPods 3 / Pro 2- PPG Specification, Price Cost and Supply Chain

• 2024-2025 Apple Watch Specification Estimates

• PPG Product Specification and Requirement Analysis

• PPG System Architecture vs. Market Landscape Analysis

• 2023-2027 PPG Market Scale Analysis

• PPG Potential Markets

2.5 NB (2.5D) Facial Recognition

• 2.5D Face ID Product Advantages

• NB Facial Recognition- IR LED Specification and Supply Chain Analysis

• IR LED Product Specification and Price Analysis

• 2023-2027 IR LED Market Scale Analysis- NB (2.5D) Facial Recognition

Chapter III. In-Cabin Sensing Market Trend

• Driver / Occupant Monitoring System- Key Factor Analysis

• Driver / Occupant Monitoring System- Active / Passive Sensing Analysis

• Driver / Occupant Monitoring System- Regulations and Policies

• Driver / Occupant Monitoring System- Feature Analysis

• ADAS / Autonomous Driving Integrate Driver Monitoring System

• Driver Monitoring System- Product Trend

• Driver Monitoring System Integrated in HUD

• Occupant Monitoring System- Product Trend

• Driver / Occupant Monitoring System- Sensor Fusion Analysis

• Driver / Occupant Monitoring System- 2D Specification Analysis

• Driver / Occupant Monitoring System- 3D Sensing Specification Analysis

• Driver / Occupant Monitoring System- OEM Strategy Analysis

• Driver / Occupant Monitoring System- Supply Chain Analysis

• Driver / Occupant Monitoring System- Market Landscape Analysis

• IR LED Product Specification and Price Analysis

• VCSEL Product Specification and Price Analysis

• VCSEL Advantage Analysis

• 2023-2027 IR LED / VCSEL Market Scale Analysis- DMS / OMS

Chapter IV. LiDAR Market Trend

• LiDAR Application Market Definition

• LiDAR Imaging Technology Matrix Analysis

• LiDAR Imaging Technology Overview

• LiDAR Imaging Technology Analysis

• 2021-2022 LiDAR Player Revenue Scale Analysis

• LiDAR Product Specification and Price Analysis

• LiDAR Product Performance Analysis

• 905 / 1,550nm LiDAR Pros and Cons Analysis

• FMCW LiDAR

• LiDAR System Architecture and Price Cost Analysis

• LiDAR Market Landscape Analysis

4.1 Automotive LiDAR Market

• LiDAR Market Trend Analysis- The Hype Cycle

• 2023-2027 Automotive LiDAR Market Scale Analysis

• ADAS / Autonomous Driving

• ADAS / Autonomous Driving Market Strategic Alliance Analysis

• 2021-2024 ADAS / Autonomous Driving Roadmap and Supply Chain

• Autonomous Driving Level 4-5 Market Trend

• Autonomous Driving Level 4-5 Market Supply Chain

• Automotive Sensing Analysis- LiDAR, Radar and Camera

• Automotive LiDAR / Radar Market and Technology Trend

• LiDAR Usage Volume Analysis

• LiDAR Product Requirement- Driving Scenario Analysis

• Automotive LiDAR Sensing Integration Trend

4.2 Industrial LiDAR Market

• 2023-2027 Industrial LiDAR Market Scale Analysis

• Industrial LiDAR Application Market

• Logistics LiDAR Application Market

• Home Appliance LiDAR- Robot Vacuum Application Market

• Industrial LiDAR Laser Product Analysis

4.3 LiDAR Laser and Photodetector Market

• 2023-2027 LiDAR Laser Market Scale- Product Analysis

• 2023-2027 LiDAR Photodetector Market Scale- Product Analysis

• LiDAR Laser and Photodetector Player List

• LiDAR System Parameters vs. Major LiDAR Product Matrix

• LiDAR System and Optoelectronic Component Analysis

• EEL / VCSEL LiDAR Laser Comprehensive Analysis

• EEL LiDAR Laser Product Analysis

• VCSEL LiDAR Laser Product Analysis

• LiDAR Laser Player Analysis

• LiDAR Photodetector Analysis

• InGaAs / GeSi Photodetector Product Specification Analysis

Chapter V. SWIR / MWIR Technology and Market Trend

• Short Wave Infrared (SWIR) / Middle Wavelength Infrared (MWIR) Definition

• SWIR LED Product Specification Analysis

• 2022 SWIR LED and Photodiode Product Price Analysis

• SWIR VCSEL Technology and Product Specification Analysis

• InGaAs / GeSi Photodetector Product Specification Analysis

• GeSi Photonic Technology

• SWIR LED / VCSEL / EEL Market Opportunities and Potential Client List

• Middle Wavelength Infrared (MWIR) Market Opportunities and Player List

• Machine Vision (Hyperspectral Imaging) Market Opportunities

• Machine Vision (Hyperspectral Imaging) Specification Analysis

• Machine Vision (Hyperspectral Imaging) in Food Industry

• Machine Vision (Hyperspectral Imaging) Market Case Study- 1

• Machine Vision (Hyperspectral Imaging) Market Case Study- 2

• Machine Vision (Hyperspectral Imaging) Market Case Study- 3

• Machine Vision (Hyperspectral Imaging) Market Case Study- 4

• Machine Vision (Hyperspectral Imaging) Market Landscape Analysis

|

If you would like to know more details , please contact:

|