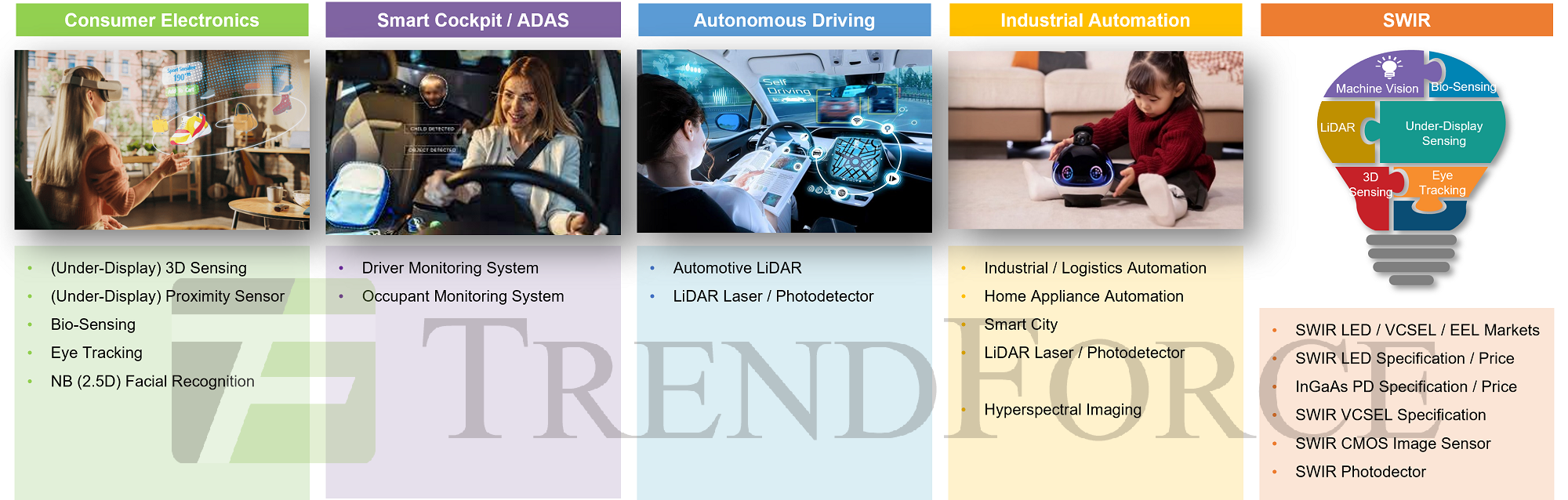

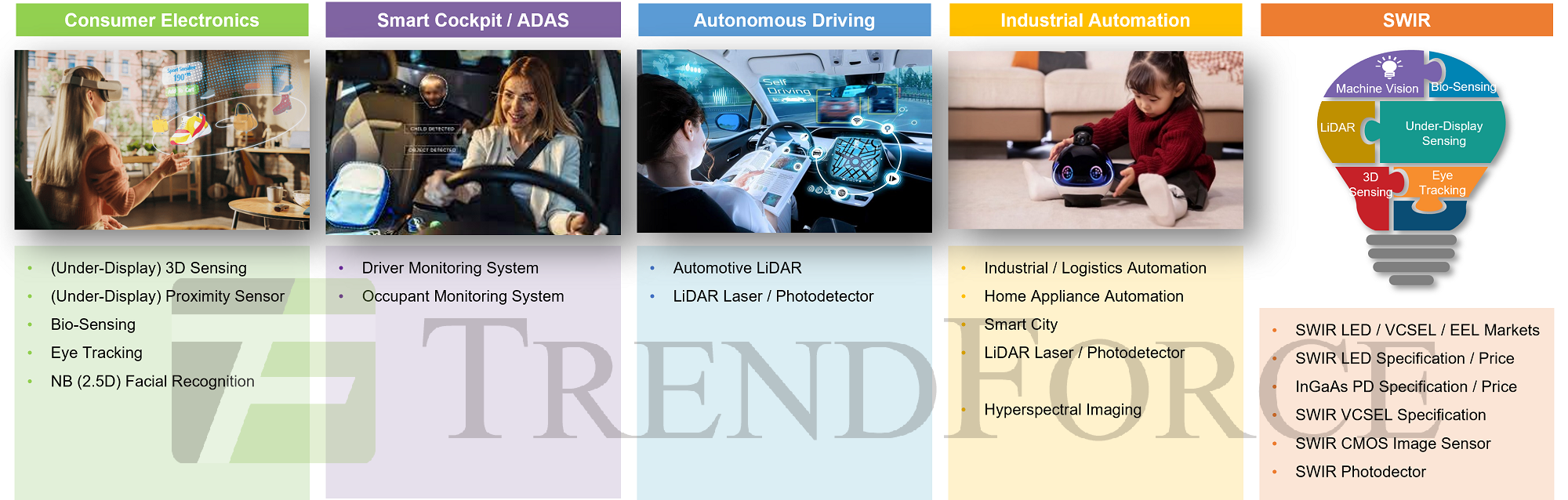

TrendForce 2024 Infrared Sensing Application Market and Branding Strategies focuses on four fast-growing application segments, namely the 1) Consumer Electronics, 2) Smart Cabin / ADAS (DMS / OMS), 3) Autonomous Driving, and 4) Industrial / Logistics / Home Appliance Automation. Additionally, TrendForce will explore business opportunities and analyze technical specifications associated with SWIR light sources (LED / VCSEL / EEL) and SWIR CMOS image sensors / photodetectors as their technologies become increasingly mature.

According to the report “TrendForce 2024 Infrared Sensing Application Market and Branding Strategies”, several topics will be the focus between 2024 and 2028, as end-market brands’ plans showed. These topics are: (under-display) 3D sensing, under-display proximity sensors, bio-sensing (skin-detect sensors and PPG), smart cockpit / ADAS- DMS / OMS, autonomous driving, industrial / logistics / home appliance automation, and smart city.

Consumer Electronics

Both Apple and Samsung will improve bio-sensing accuracy for their watches starting in 2024. Specifically, Samsung will install skin-detect sensors in its TWS, the Galaxy Buds, in 2024, while Apple is likely to adopt Micro LED and next-gen bio-sensing technology in 2026.

As for smartphones, Apple will adopt MetaLens technology to reduce the size of structured light in 2024, reapply under-display proximity sensors to the iPhone 17 Pro in 2025 and under-display 3D sensing in 2027. Both under-display proximity sensors and under-display 3D sensing will be powered by SWIR VCSELs, which help reduce sunlight / ambient light interference and the probability of white spot formation. According to TrendForce‘s survey, the PCE of 1,130nm VCSEL reached the level of >30% in 2H23. Specifically, ams OSRAM's 1,130nm VCSEL delivers absolutely outstanding product performance.

Moreover, leading brands including Apple, Sony, Meta, Microsoft, Google will continue announcing AR/VR products, giving rise to 3D sensing and eye tracking.

Smart Cockpit / ADAS- DMS / OMS

The EU’s General Safety Regulation recommends the installation of ADDW systems in new passenger cars, trucks, and buses starting on July 7, 2024 and mandates the system installation in all such new vehicles starting on July 7, 2026. The US NHTSA requests automakers, tier 1 suppliers, and autonomous driving technology developers to provide reports on crashes involving ADAS / autonomous driver Level 2 and above, which will prompt businesses to install event data recorders and DMS in L2 vehicles. Car makers’ compliance with proposed policies will give rapid rise to the DMS / OMS market.

ADAS / Autonomous Driving

Car makers plan to continue using LiDAR in 2024-2025 for ADAS / autonomous driving Level 3 (Highway Pilot), aiming to enhance driving safety and AEB performance. Leading players include Volvo, General Motors, Audi, Stellantis, Volkswagen, BMW, Hyundai, Hongqi, Changan, and Li Auto.

Industrial / Logistics / Home Appliance Automation and Smart City

Considering the existing labor shortage, manufacturers in Europe, the US, and Japan have been targeting at industrial automation. Installing LiDAR traffic flow systems in smart cities enables transportation authorities to collect accurate real-time road use data, analyze them, and figure out how to improve traffic flow for four wheelers, thereby ensuring safety for scooter riders and pedestrians. Businesses have also installed LiDAR systems in home appliances (i.e., robot vacuums and companion robots) to realize SLAM.

The diversity of said topics will expand the market scale of infrared sensing applications, which is likely jumping to USD 3.090 billion in 2028 with a 6% CAGR between 2023-2028, as TrendForce forecast. Based on the branding strategies, TrendForce analyzes the market scale, opportunities, challenges, product specifications and prices as well as supply chains related to infrared sensing applications. This report provides comprehensive insights that help our readers to develop marketing strategies for the infrared sensing market.

Author: Joanne / TrendForce

TrendForce 2024 Infrared Sensing Application Market and Branding Strategies

Release: 01 January 2024

Format: PDF

Language: Traditional Chinese / English

Page: 172

Chapter I. Infrared Sensing Market Scale Analysis

-

Scope of the Report

-

2024 Infrared Sensing Application Market- Product Analysis Overview

-

2024-2028 Infrared Sensing Market Scale Analysis- IR LED / VCSEL / EEL

-

2021-2023(E) Infrared Sensing Player Revenue- IR LED / VCSEL / EEL

-

2024-2028 Consumer Electronics 3D Sensing Market- Module vs. VCSEL

-

2024-2028 Automotive / Industrial LiDAR Market- LiDAR vs. LiDAR Laser

Chapter II. Consumer Electronics Market Trend

-

Consumer Electronics Market- Infrared Sensing Technology Overview

-

Apple / Samsung Consumer Electronics Roadmap

2.1 3D Sensing Market

-

3D Sensing Technology Overview

-

Direct / Indirect Time of Flight Technology Analysis

-

iPhone 14 Pro Structured Light Depth Camera Cost and Supply Chain

-

iPhone 15 Structured Light Depth Camera Cost and Supply Chain

-

iPhone 15 Pro LiDAR Scanner- Product Design / Cost / Supply Chain

-

VCSEL Technology Roadmap

-

Under-Display 3D Sensing Technology- Schedule and Feasibility Analysis

-

Apple Vision Pro- 3D Sensing Technology Analysis

-

Consumer Electronics 3D Sensing Market Opportunities

-

3D Sensing in Wearable Devices (Watch) Market

-

3D Sensing Application Innovation Drives VCSEL / EEL Technologies

-

2018-2023 3D Sensing Product Specification and Supply Chain

-

2024-2028 VCSEL Market Scale- Consumer Electronics 3D Sensing

-

2018-2028 VCSEL Price Analysis

2.2 Proximity Sensor

-

2024(E) Proximity Sensor Product Specification and Price Analysis

-

NIR / SWIR Under-Display Proximity Sensor- Pros and Cons Analysis

-

iPhone 14 Pro Under-Display Proximity Sensor- Teardown Analysis

-

iPhone 14 / 17 Pro Under-Display Proximity Sensor Analysis

-

2024-2028 Proximity Sensor vs. 1D/2D ToF Market Scale Analysis

2.3 Bio-Sensing

-

Physiological Parameter Measurement and Disease Analysis

-

Heart Rate vs. Blood Oxygen- Optical Sensing Principle

-

Blood Pressure vs. Body Hydration- Optical Sensing Principle

-

PPG Measurement Location Analysis

-

Apple Watch Series 9 / X- PPG Specification / Cost / Supply Chain

-

Apple AirPods 3 / Pro 2- Skin-Detect Sensor Product / Cost / Supply Chain

-

2026 Apple Micro LED Watch

-

Apple Micro LED Watch Specification and Cost Analysis

-

Samsung Galaxy Watch 6 / 7- PPG Specification / Cost / Supply Chain

-

2024 New Bio-Sensing Market- Brand / Product / Supply Chain Analysis

-

Google Pixel Watch 2- PPG Specification and Supply Chain

-

PPG System Architecture vs. Market Landscape Analysis

-

2024-2028 Bio-Sensing Market Scale Analysis- Apple / Samsung PPG

-

2024-2028 Bio-Sensing Market Scale Analysis- PPG Discrete LED

-

Bio-Sensing Potential Markets

2.4 Eye Tracking

-

AR/VR- Display and Optical Sensing Technologies

-

AR/VR- Eye Tracking Advantage Analysis

-

Eye Tracking Market Landscape Analysis

-

2019-2024 Eye Tracking Product Specification and Supply Chain

-

Meta Quest Pro

-

Sony PlayStation VR 2

-

HTC VIVE Focus 3 / Pico 4 Pro

-

Apple Vision Pro- Eye Tracking vs. Iris Recognition

-

IR LED Product Specification and Price Analysis

-

Will Eye Tracking Come with VCSEL Technology?

-

2024-2028 IR LED Market Scale Analysis- Eye Tracking

2.5 NB (2.5D) Facial Recognition

-

2.5D Face ID Advantages

-

NB Facial Recognition- IR LED Specification and Supply Chain Analysis

-

IR LED Product Specification and Price Analysis

-

Will Notebook 2.5D Facial Recognition Come with VSCEL Technology?

-

2024-2028 IR LED Market Scale Analysis- NB (2.5D) Facial Recognition

Chapter III.In-Cabin Sensing- Driver / Occupant Monitoring System Market

-

Driver / Occupant Monitoring System- Key Factor Analysis

-

Driver / Occupant Monitoring System- Active / Passive Sensing Analysis

-

Driver Monitoring System- Regulations and Policies

-

Driver / Occupant Monitoring System- Feature Analysis

-

Driver Monitoring System- Installation Location

-

Driver Monitoring System- Product Trend

-

Occupant Monitoring System- Product Trend

-

Driver / Occupant Monitoring System- Sensor Fusion Analysis

-

Driver / Occupant Monitoring System- 2D Specification Analysis

-

Driver / Occupant Monitoring System- 3D Sensing Specification Analysis

-

Driver / Occupant Monitoring System- OEM Strategies and Supply Chain

。General Motors

。BMW

。Tesla

。Ford

。Volkswagen

。Stellantis

。Toyota

。Nissan

。Mazda

。Honda

。Subaru

。Hyundai

。XPeng Motors

。NIO

。Li Auto

-

Driver / Occupant Monitoring System- Market Landscape Analysis

-

IR LED Product Specification Analysis- ams OSRAM

-

VCSEL Product Specification Analysis- ams OSRAM

-

IR LED / VCSEL Product Specification Analysis- Stanley

-

VCSEL Advantage Analysis

-

2024-2028 IR LED / VCSEL Market Scale Analysis- DMS / OMS

Chapter IV. LiDAR Market Trend

-

LiDAR Application Market Definition

-

LiDAR Imaging Technology Matrix Analysis

-

LiDAR Imaging Technology Overview

-

LiDAR Imaging Technology Analysis

-

2022-2023(E) LiDAR Player Revenue Scale Analysis

-

LiDAR Product Specification and Price Analysis

-

LiDAR Analysis- Valeo / Luminar / Innoviz / Hesai / Continental / Aeva

-

905 / 1,550nm LiDAR Pros and Cons Analysis

-

FMCW LiDAR

-

LiDAR System Architecture vs. Price Cost Analysis

-

LiDAR Market Landscape Analysis

4.1 Automotive LiDAR Market

-

LiDAR Market Trend Analysis- Gartner Hype Cycle

-

2024-2028 Automotive LiDAR Market Scale Analysis

-

ADAS / Autonomous Driving- OEM Strategic Alliance Analysis

-

2021-2025 ADAS / Autonomous Driving Roadmap and Supply Chain

-

Autonomous Driving Level 4-5 Market Landscape Analysis

-

Automotive Sensing Analysis- LiDAR, Radar and Camera

-

LiDAR Product Requirement- Driving Scenario Analysis

-

4D Imaging Radar Technology Trend

4.2 Industrial LiDAR Market

-

2024-2028 Industrial LiDAR Market Scale Analysis

-

Industrial LiDAR Application Market

-

Home Appliance LiDAR (Robot Vacuums / Companion Robots) Market

-

Industrial LiDAR Laser Product Analysis

4.3 LiDAR Laser and Photodetector Market

-

2024-2028 LiDAR Laser Market Scale- Product Analysis

-

2024-2028 LiDAR Photodetector Market Scale- Product Analysis

-

EEL / VCSEL LiDAR Laser Comprehensive Analysis

-

EEL LiDAR Laser Product Analysis- ams OSRAM

-

VCSEL LiDAR Laser Product Analysis- ams OSRAM vs. Lumentum

-

LiDAR Laser Player Analysis

-

LiDAR Photodetector Analysis

-

LiDAR Photodetector Product Specification Analysis

-

LiDAR Laser and Photodetector Player List

Chapter V. SWIR / MWIR Technology and Market Trend

-

Short Wave Infrared (SWIR) / Middle Wavelength Infrared (MWIR) Definition

-

SWIR LED Product Specification Analysis

-

2023 SWIR LED / Photodiode Product Price Analysis

-

SWIR VCSEL Technology Analysis

-

SWIR VCSEL Specification Analysis

-

SWIR CMOS Image Sensor Analysis

-

InGaAs / GeSi Photodetector Product Specification Analysis

-

GeSi Photonic Technology

-

SWIR LED / VCSEL / EEL Market Opportunities and Potential Client List

-

Middle Wavelength Infrared (MWIR) Market Opportunities and Player List

-

Machine Vision (Hyperspectral Imaging) Market Opportunities

-

Machine Vision (Hyperspectral Imaging) Specification Analysis

-

Machine Vision (Hyperspectral Imaging) in Food Industry

-

Machine Vision (Hyperspectral Imaging) Market Case Study

-

Machine Vision (Hyperspectral Imaging) Market Landscape Analysis

|

If you would like to know more details , please contact:

|