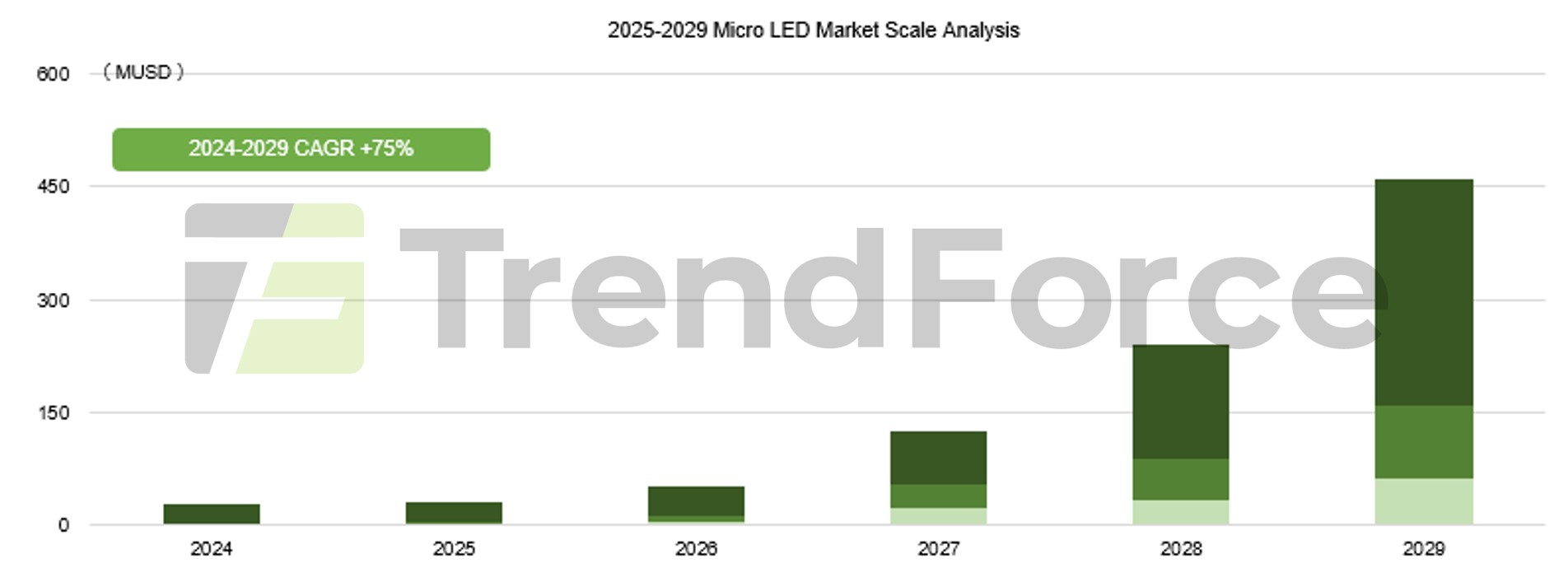

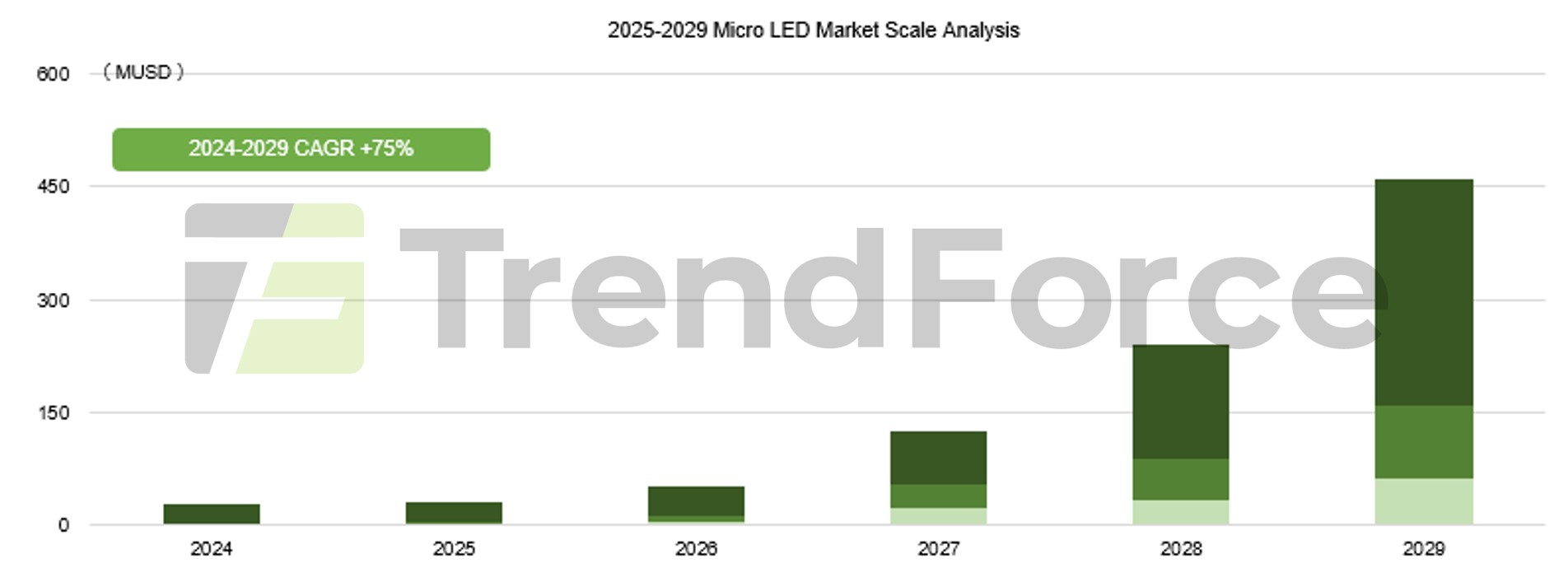

According to TrendForce’s “2025 Micro LED Display and Non-Display Application Market Analysis” report, Micro LED has gradually begun to land in various display applications and penetrate the market. Benefiting from continuous optimization of key manufacturing processes and yields improving for large displays, the launch of new AR glasses and smart-watches, and increasing adoption in automotive applications, the market momentum is expanding. As a result, Micro LED chip revenue is expected to grow significantly, reaching USD 460.8 million by 2029.

In non-display applications, Micro LED is also expanding into the optical interconnect, which has recently gained strong attention because of AI server demand. This may create opportunities for resource investment, technological advancement, and increased chip demand. Overall, although Micro LED technology originated in consumer electronics and niche markets, whether it can establish a stable foothold will depend on how it competes with existing technologies and aligns with commercial needs.

Wearable Displays

In September 2025, Garmin launched the world’s first Micro LED smartwatch, the Fenix 8 Pro, with AUO serving as a key supply-chain partner. The device integrates PlayNitride’s Micro LED chips (approximately 15×30 μm), Raydium’s Micro LED driver IC, and delivers a 1.39-inch display. This not only demonstrates the early network of the Micro LED ecosystem beginning to take effect, but also marks an entry point for high value-added applications, driving technology maturity and cost optimization.

At this stage, Micro LED still faces major challenges related to high power consumption and high cost, resulting in limited short-term competitiveness against OLED, which is more mature and cost-advantaged. However, in the long term, Micro LED can meet the extreme outdoor brightness requirements of sports watches and offers potential for integrating bio-sensing functions, making it well-suited for health monitoring, outdoor navigation, and sports analytics. Nevertheless, both manufacturing cost and product positioning on the user experience level will require continued optimization and a longer market incubation period before large-scale adoption can be realized.

Micro LED for Optical Interconnects

In the field of optical communication, as the demand from data centers grows higher, finding more cost-effective light sources naturally becomes the industry‘s driving force. As an optical interconnect light source, Micro LED boasts low power consumption efficiency, higher data transmission density, better temperature stability, and may experience a trend of rapid cost reduction for several consecutive years, due to economies of scale and benefiting from the push of the display industry.

Author: Emerson, Thea, Joanne / TrendForce

TrendForce 2025 Micro LED Display and Non-Display Application Market Analysis

Release: 29 May / 30 November 2025

Languages: Traditional Chinese / English

Format: PDF

Page: 110-130 / Semi-Annual

Chapter 1.Micro LED Market Share Analysis - Display Applications

-

2025-2029 Micro LED Market Share Analysis

-

2025-2029 Micro LED Market Scale Analysis - Large-Sized Displays

-

2025-2029 Micro LED Market Scale Analysis - Wearable Displays

-

2025-2029 Micro LED Market Scale Analysis - Automotive Displays

-

2025-2029 Micro LED Market Scale Analysis - Head-Mounted Displays

-

2025-2029 Micro LED Market Share Analysis

-

2025-2029 Micro LED Wafer Market Demand Analysis

Chapter 2.Micro LED Display Applications Market Analysis

2.1 Large-Sized Displays

-

Micro LED Chip Shipment Rate and Brand Target

-

2021-2029 6-inch Micro LED COC Price Trend

-

Micro LED TV / Video Wall Manufacturing Analysis - Samsung

-

Micro LED TV / Video Wall Manufacturing Analysis - LG Display

-

LTPS Manufacturer Technology Progress

-

Side Wiring Analysis

-

AUO Business Strategy

-

SAMSUNG’s Product Series - COG(Side Wiring / TGV Glass)vs. COB(PCB)

-

Micro LED(COG)TV Product and Progress - SAMSUNG / LG / Vistar

-

Micro / Mini LED(COG)TV Product and Progress - Tianma / BOE / Ledman

-

Micro LED TV / Video Wall Player’s Supply Chain Analysis

-

SAMSUNG 114-inch 4K P0.51 Micro LED TV Cost Analysis

-

LG 136-inch 4K P0.78 Micro LED TV / Mini LED Video Wall Cost Analysis

-

BOE Mini LED Video Wall Cost Analysis - Active Matrix vs. Passive Matrix

-

Micro LED / OLED Transparent Display Application Scenarios

-

2025 Micro LED Transparent Display Cost Analysis

-

2023-2025 OLED Transparent Display Market Size

-

Micro LED Dual Transparent Display Development

-

High-End ACF Supports Pad Up to 30µm2

-

Large-Sized Micro LED at the Crossroads of Bonding Technology

2.2 Wearable Displays

-

Garmin 1.39-inch Micro LED Watch Display

-

Garmin Micro LED Watch Manufacturing Analysis

-

Micro LED Watch Comparing

-

Micro LED - Sensor Integration Challenges

-

Garmin & Apple Micro LED Watch Display BOM Cost Analysis

2.3 Automotive Displays

-

Panel Makers’ Automotive Display Deployment - AUO & INNOLUX

-

Panel Makers’ Automotive Display Deployment - BOE & Tianma

-

Automotive Display Technology Overview

-

2025 Micro LED Automotive Transparent Display Cost Analysis

2.4 Head-Mounted Displays

-

Micro LED AR Shipment Analysis

-

Micro LED AR Product Specifications and Supply Chain Analysis

-

Light Source Specifications and Price Sweet-Spot Analysis

-

Challenges in Advancing from X-Cube to Single-Chip Full-Color for LEDoS

-

Drivers Behind Transition from X-Cube to Single-Chip Full-Color

-

Solution for LEDoS

-

Lateral Comparison of Full-Color LEDoS Technology-InGaN

-

Technical Challenges on CMOS for LEDoS from Backplane Designs

-

to System Integration

-

CMOS Driving Backplanes of Microdisplays Marching to 12-inch

Chapter 3. Micro LED Optical Interconnects

-

Development of Data Center Networks Entering the Era of SiPh CPO

-

Competitive Advantages and Shortcomings of Micro LEDs in Short-Range Optical Communication

-

Micro LED Optical Communication: Driver for High-Performance Computing

-

Analysis on Competitive Pros and Cons of Micro LED in AOC Applications

-

Competitive Structure of Technology from Micro LED’s Targeted Markets

-

Optical Communication Technology - Micro LED / VCSEL / InP (SiPh) / EML

-

Micro LED Optical Interconnects Opportunities and Challenges

-

Optical Communication Technology - Transceiver / SiPh / Micro LED

Chapter 4. Micro LED Technology Development

-

Tandem Micro LEDs Become Key Technology for Reducing Power Consumption

-

Comparing Display Technologies Featuring

-

Tandem Light-Emitting Components

-

Optimizing Micro LED Efficiency and Light Beam Angle through

-

Geometric Engineering

Chapter 5. Micro LED Manufacturer Dynamic Updates

-

2025 Micro LED Manufacturer Capacity Analysis

-

Micro LED Industry - Capital Investments, Mergers & Acquisitions,

-

Joint Ventures, and Supply Chain Partnerships

-

HC Semitek

-

San’an

-

CSOT

-

VIJO

-

Kulicke & Soffa

-

Veeco

-

Saphlux

-

LatticePower

-

Ennostar

-

Micraft System Plus

-

Instrument Systems

-

MICLEDI

-

Porotech

-

Vuereal

-

Aledia

If you would like to know more details , please contact: