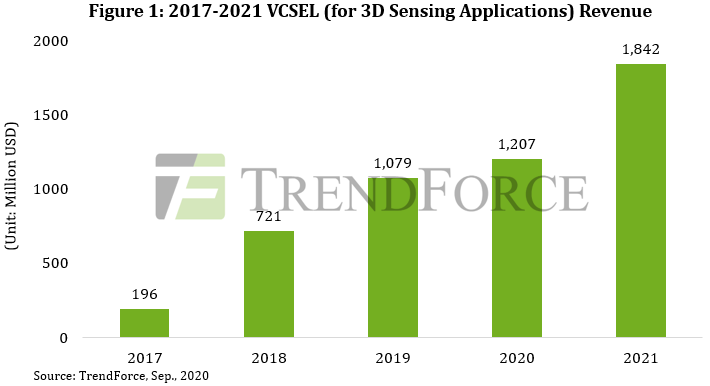

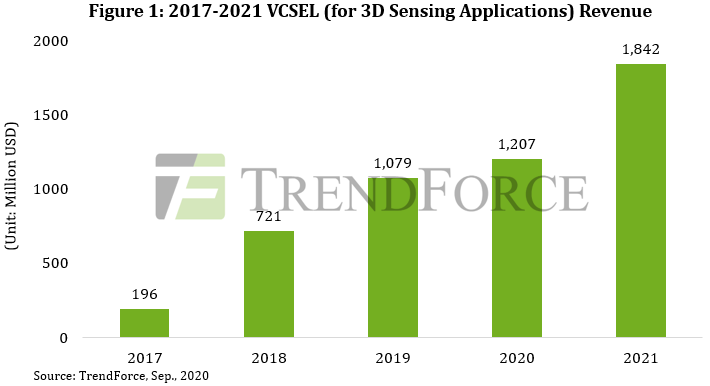

In early 2020, TrendForce forecasted the release of more than 10 high-end smartphone models equipped with 3D sensing solutions this year, which would drive up 3D sensing VCSEL revenue* to US$1.404 billion. However, as the COVID-19 pandemic put a damper on global smartphone shipment, and the Indian consumer market exhibited strong demand for entry-level and mid-range smartphone models, smartphone brand vendors have subsequently slowed down their pace of integrating 3D sensing solutions into high-end models. TrendForce is revising its forecasted 3D sensing VCSEL (for mobile devices including smartphones and tablets) revenue down to $1.207 billion for 2020, a 12% increase YoY.

TrendForce research manager Joanne Wu indicates that 3D sensing functions have become an indispensable part of flagship models as smartphone brand vendors engage in a spec war in this product segment. 3D sensing is mostly integrated into the rear cameras; its primary applications include range finding, background blur, 3D object detection, spatial modeling, and Augmented Reality. In the future, 3D sensing functions are expected to be paired with 5G connectivity, in turn becoming a standard feature of high-end phones. Total revenue for 3D sensing VCSEL is projected to reach $1.842 billion in 2021, a 53% increase YoY.

The current dominant suppliers of 3D sensing solutions include ams, Finisar, OSRAM, II-VI Incorporated, Lumentum, Sony, VPEC, LITE-ON, AWSC, Win Semiconductors, etc. 3D sensing applications in the consumer electronics market include such functions as structured light, ToF (time of flight), and active stereo vision. In particular, ToF functions are integrated into a wide variety of applications owing to their fast response times and long range.

At the moment, Apple and Samsung have each integrated ToF functions in their respective products, such as iPhone and iPad Pro for the former and S20+ and S20 Ultra 5G for the latter. In addition, direct ToF sensors are more power-efficient compared to other 3D sensing solutions. The integration of 3D sensing with 5G connectivity is expected to deliver a more interactive experience for users of mobile devices through functions such as gesture control-enabled AR. Other possible 3D sensing applications are AR-assisted interior design, home renovation, home additions, and even integration with video games. 3D sensing solutions may even see cross-industry commercial opportunities in the future.

*Note: 3D sensing VCSEL revenue in this calculation primarily includes whole IR transmitter (TX) units of 3D sensing model.

2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System

Release Date: 01 January 2020

Language: Traditional Chinese / English

Page: 153

Chapter I. Infrared Market Scale and Application Trend- IR LED, VCSEL and LiDAR Laser

Scope of the Report- Infrared Sensing Market Applications

Infrared Sensing Market Applications- Power and Sensing Distance

Scope of the Report- 3D Sensing Market Applications

2019-2020 3D Sensing Module Market Scale- Mobile Devices 3D Sensing, Automotive LiDAR and Industrial LiDAR

1.1 Infrared LED Market Scale and Application Trend

2019-2020 IR LED Market Scale

2019-2020 IR LED Market Scale- Segment Market Analysis

IR LED Product Performance and Price Analysis

1.2 VCSEL vs. EEL Market Scale and Application Trend

2019-2020 VCSEL Market Scale

2019-2020 EEL Market Scale- LiDAR Laser

VCSEL Manufacturing and Product Strengths

>1,000nm VCSEL Manufacturing Challenge Analysis

EEL Manufacturing and Product Strengths

VCSEL Players M&A and Investment for 3D Sensing Market

VCSEL vs. EEL Player List

Global 30 Players Production Capability and Target Market Analysis

2020 VCSEL / EEL Player Target Market Analysis

2018-2020 VCSEL Product Performance and Price Analysis

Chapter II. Mobile Devices 3D Sensing Market Trend

Major Biometric Method Pros and Cons

2020 Mobile Sensing Market Penetration Analysis

2.1 Mobile Devices 3D Sensing

3D Sensing Technology Overview

3D Sensing Technology Comprehensive Analysis on Cost and Computation Complexity

3D Sensing Technology- Strategic Alliance and Player Status

Mobile 3D Sensing Function- Front Camera vs. Rear Camera

Structured Lighting Depth Camera Cost and Supply Chain

Structured Lighting Depth Camera Structure and Potential Supply Chain

Time of Flight Depth Camera Cost- Front Facing

Time of Flight Depth Camera Cost- World Facing

Time of Flight Depth Camera Structure and Potential Supply Chain

Active Stereo Vision Depth Camera Cost

Active Stereo Vision Depth Camera Structure and Potential Supply Chain

VCSEL Chip and Package Technology Analysis

2020 Structured Light VCSEL Technology Evolution

2020 Direct and Indirect ToF VCSEL Technology Evolution

VCSEL Burn in and Test Requirements in All Phases

2019-2020 Mobile 3D Sensing Value Chain Analysis

2019-2020 Mobile 3D Player Competitive Landscape Analysis

2019-2020 Mobile and Mobile Devices 3D Sensing Timeline and Landscape Analysis

2019-2020 Mobile Devices 3D Sensing Module Market Scale

2019-2020 Mobile Devices 3D Sensing VCSEL Market Value and Volume

2019-2020 Mobile Devices 3D Sensing VCSEL Market Value and Volume- By 3D Sensing Solutions

2.2 Fingerprint Recognition vs. 2.5D Facial Recognition

2019 Optical and Ultrasonic FOD Penetration Rate and Cost Analysis

Optical and Ultrasonic FOD Technology Analysis

2.5D Face ID Principles and Product Advantages

2.5D Face ID Market Demand and IR LED Product Requirements

Chapter III. LiDAR Market Trend

LiDAR Product Definition

Global LiDAR Player List- By Region

Scanning LiDAR Execute Process

Flash LiDAR Execute Process

Scanning LiDAR vs. Flash LiDAR Technology Analysis

Scanning LiDAR vs. Flash LiDAR Analysis

Scanning LiDAR vs. Flash LiDAR Player Analysis

3.1 Automotive LiDAR Market

2020-2024 Automotive LiDAR Market Value

Autonomous Car Market- Merge, Investment, Strategic Alliance Analysis

Autonomous Vehicle vs. ADAS

Automotive Sensing Analysis- LiDAR, Radar and Camera

2020-2024 Passenger Car Market Trend

Passenger Car- Autonomous Vehicle L3 vs. L5 LiDAR and Senor Requirement

2020-2024 Autonomous Bus Market Trend

Autonomous Bus Market Landscape Analysis

Autonomous Bus- Autonomous Vehicle L4 LiDAR and Senor Requirement

Automotive Grade LiDAR Product Overview

Automotive LiDAR Market Restriction Factors

Pros and Cons of the Integration of LiDAR and Headlamp

3.2 Industrial LiDAR Market

AGV and AMR Product Advantages Analysis

AGV vs. AMR Market Landscape Analysis

AGV vs. AMR LiDAR and LiDAR Laser Product Requirement

3.3 LiDAR Laser Market Requirements and Key Players

LiDAR Three Basic Components and Market Requirements

LiDAR End Product Requirements and Light Source Analysis

LiDAR Laser Product Portfolio and Player Analysis

905nm vs. 1,550nm LiDAR Laser Advantages and Applications

LiDAR Photodetector Product Trend Analysis

2020-2024 LiDAR Laser Market Value

LiDAR Laser and Photodetector Player List

Chapter IV. Driver Monitoring System Market Trend

Driver Monitoring System

Truth and Data of Car Accidents

Will Driver Monitoring System Become Vehicle Safety Standard?

Driver Monitoring System Product Design- OE and AM

IR LED vs. VCSEL Product Requirement

Driver Monitoring System Market Landscape Analysis

Chapter V. SWIR LED and Broadband IR LED Market Trend

Short Wave InfraRed (SWIR) Product Definition and Market Strength

5.1 SWIR LED Market Trend

SWIR Application Market Overview

SWIR Application Markets - By Wavelength

SWIR Application Market Opportunities

SWIR Application Cases Analysis

SWIR LED Player and Product Analysis

3-5μm SWIR Market Opportunities and Potential Suppliers

SWIR IR LED Market Opportunities and Potential Customer List

5.2 Broadband Infrared LED Market Trend

Broadband Infrared LEDs Application Market Overview

Broadband Infrared LED Product Definition and Market Advantages

Broadband Infrared LED Player and Product Analysis

Chapter VI. 1D Time of Flight vs. Proximity Sensor

Mobile vs. Wearable Device Sensing Market Trend

2019-2020 Mobile vs. TWS Shipment Forecast

2019-2020 Mobile Devices- Proximity Sensor vs. 1D ToF Market Trend

2019-2020 TWS and Smart Home Appliance Sensing Market

1D ToF vs. Proximity Sensor Market Landscape Analysis

Chapter VII. Optical Communication Market Trend

Optical Communication Market Definition

2020 Key Factors of Optical Communication Market Growth

Major Optical Communication Player and Product Plan

2020-2022 Data Center Ethernet Port Market Scale

2020-2022 Optical Communication Trend in DataCom Market

100Gbps vs. 400Gbps Product Trend

VCSEL vs. Silicon Photonics vs. EEL Product Analysis

2019-2023 Optical Communication VCSEL Market Trend

Optical Communication Market Landscape Analysis