According to the latest report from LEDinside, a division of the market research firm TrendForce, 2018 Industrial Lighting and High / Low Bay Light Market Report, the global LED industrial lighting market increases significantly as the stability and price of LED products are approaching the traditional metal-halide lamp. Europe takes up the largest market share in 2018, followed by China and America. In view of shipments, Chinese market accounts for the greatest proportion, mainly because the products from Chinese market are in lower prices. The global industrial lighting market scale comes to USD 3.934 billion in 2018, and expected to reach USD 5.687 billion in 2022, with CAGR of 10% during 2018-2022.

Industrial lighting field covers energy, utilities, mining, industrial manufacturing, public infrastructure, telecommunications and other markets. The main industrial lighting products include bay light, floodlight and explosion-proof lamp. In accordance with the research by LEDinside, LED high/low bay light accounts for 86% in the total industrial lighting field, so the study of LED high/low bay is the focus of developing industrial lighting market.

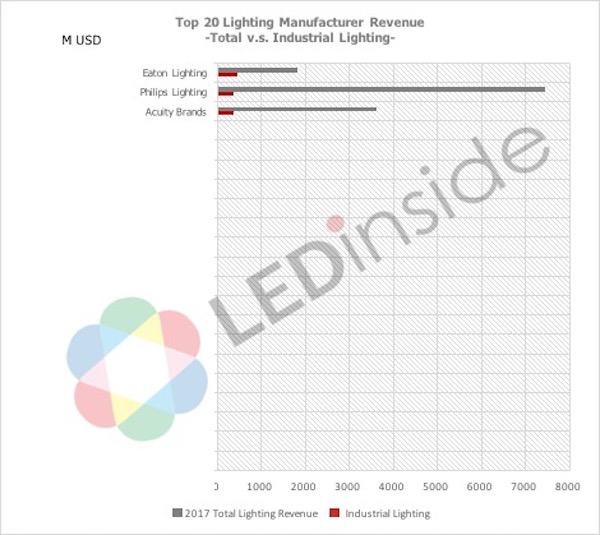

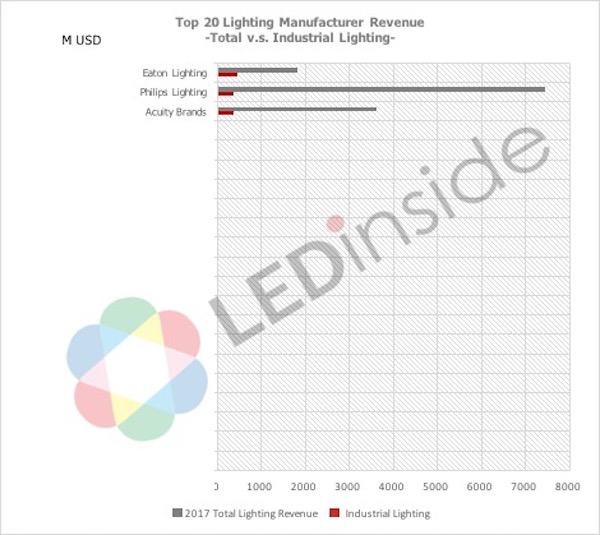

According to LEDinside survey, the top five industrial lighting manufacturers include Eaton Lighting, Philips Lighting, Acuity Brands, Hubbell, GE, Warom Technology, Dialight, Panasonic, Ocean's King Lighting and Toshiba. Dialight and Trevos offer full range of LED industrial lighting products. According to LEDinside analysis, industrial lighting manufacturer business model and company scales can be diversified into three camps, brand group, niche lighting manufacturer, and OEM player.

1. Brand Group Business Strategy: European, American and Japanese lighting manufacturers mostly operate under group brand, with product line covering industrial, commercial, residential, architectural fields. Each company has different specialty, taking Eaton Lighting, Acuity Brands and Hubbell for example, which are the companies specializing in utility field, with revenue of USD 0.3-0.5 billion.

2. Emerging Lighting Manufacturers with Niche Market Channels: The local lighting manufacturers are encouraged to develop lighting products rapidly with policy incentive and subsidy, or through hindering foreign manufacturers in various ways including specifications, biddings and tariffs. Ocean's King Lighting and Warom Technology are the main lighting manufacturers who are involved in industrial lighting business, with annual revenue of USD 130-200 million, the products of the former are mainly used in electricity, railways and military fields, while Warom Technology's products are mainly applied in petrochemical and coal sectors.

3. OEM Manufacturers: The manufacturers represented by SHENHAI Explosion-proof and Zhejiang Zhongpu Explosion-proof Electric focus on OEM, with annual revenue of USD 5-30 million and products covering explosion-proof CFL, explosion-proof floodlight and emergency lamp, mostly traditional lamps at present, while the LED lighting penetration increases dramatically each year.

1Q18 Silver Member Lighting Market- 2018 Industrial Lighting and High / Low Bay Light Market

Industrial Lighting Market Trend and Scale

Industrial Lighting Market Application

Lighting Requirements for General Industrial Sites

2018-2022 Global Industrial Lighting Market Trend and Scale

Industrial Lighting Market Development Strategy

Industrial Lighting Future Development Trend

2017 Major 20 Global Industrial Lighting Player Revenue Ranking

Industrial Lighting Player Strategy and Company Scale Analysis

High / Low Bay Market Scale

LED High/Low Bay Market Scale in Industrial Lighting Field

LED High/Low Bay Market Drivers

LED High/Low Bay Market Restraints

High Bay Light Product Requirements

Industrial Lighting Market- High Bay Lights

HID High Bay Lights v.s. LED High Bay lights

High Bay Light Products Requirements —— Strong Illuminance, Glare-free, Energy Efficient, and Long Lifetimes

Important LED High Bay Light Design Requirement

Important Designs- Light Source Designs

Important Designs- Thermal Dissipation Design

Important Designs- Power Management Design

High Bay Light Specifications and Price

European LED High Bay Light Specification and Price

European LED High Bay Light Manufacturer Price Strategy

U.S. LED High Bay Light Specification and Price

U.S. LED High Bay Light Manufacturer Price Strategy

Japan LED High Bay Light Specification and Price

Japanese LED High Bay Light Manufacturer Price Strategy

Chinese LED High Bay Light Specification and Price

Chinese LED High Bay Light Manufacturer Price Strategy

Case Study

Case I: Product Efficiency and Price Trend of LED Lamp v.s. Halogen Lamp

Case II: Full Life Cycle Cost of High Bay Light —— 400W Halogen Lamp and LED Lamp

Case Study on LED Industrial Lighting and Traditional Lighting

Major Player Strategies

List of the World's Major Industrial Lighting Manufacturers

2017 Major 20 Global Industrial Lighting Player Revenue Ranking

Philips Lighting——Offering Completed Bay Light Product Series in Clean Room

Dialight——Expanding Product Line with Standardized Light Engine Platform

Trevos——Major Industrial Lighting and Indoor Lighting Manufacturer

Eaton Lighting——Acquried Ephesus Lighting to Develop Stadium Lighting

Hubbell——Focusing on Special Lighting Field

Iwasaki Electric——Urban Buildings, Stadiums, Commercial and Industrial Space

Seiwa Electric——Explosion-proof Lighting in Chemical Plants, Oil Refineries

Ocean’s King——Leading Industrial Lighting Manufacturer in China

Warom——The Leading Manufacturer of Explosion Proof Lighting Equipment

Vietnamese Industrial Lighting Manufacturer - Dien Quang

Vietnamese Industrial Lighting Manufacturer – DUHAL

Policy and Regulations

European Standard: Zhaga LED Interface for COB LED and High Bay Light Modules

United States Standards: DLC Standards and Requirements for High Bay Light

United States Standards: PG&E Rebates Policy for Interior High Bay Light

Industrial Lighting Design Criteria ——GB50034-2013 < Architectural Lighting Design Standard>

Customized Report / Consulting Service: LEDinside Keeps the Right to Adjust the Contents, Depending on Industry Development Trend.

LEDinside provides customized reports and consulting service, please call or email us.

If you would like to know more details, please contact:

|

Taipei:

|

|

|

Joanne Wu

joannewu@trendforce.com

+886-2-8978-6488 ext. 912

|

Grace Li

graceli@trendforce.com

+886-2-8978-6488 ext. 916

|