On March 31, a consortium of investors led by GO Scale Capital announced they have bought LED manufacturer Philips Lumileds from its parent company Royal Philips. Under this agreement, GO Scale Capital will pay Royal Philips US$3.3 billion for an 80.1% stake in its automotive lighting and LED components business, and the remaining 19.9% stays under Royal Philips. The transaction is scheduled to wrap up in the third quarter of 2015, pending regulatory approval and ratification of transaction terms. Following the deal, the LED and automotive business will operate under the name “Lumileds”.

“Philips Lumileds is the leader in flip-chip technology that makes high-power LED products possible,” said Roger Chu, research director for LEDinside, a division of TrendForce. “However, LED lighting market in general has shifted toward products of lower prices, so most LED luminaire companies prefer to use the standard and mid-power LED components because of their cost advantage.”

|

|

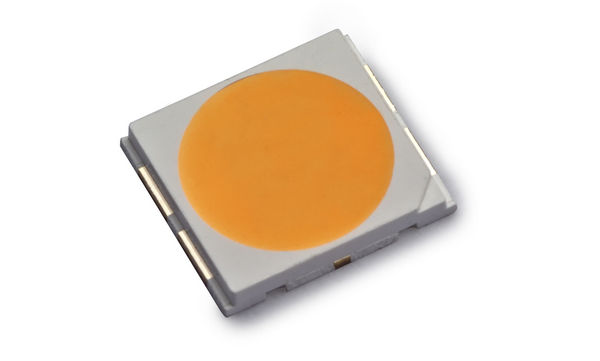

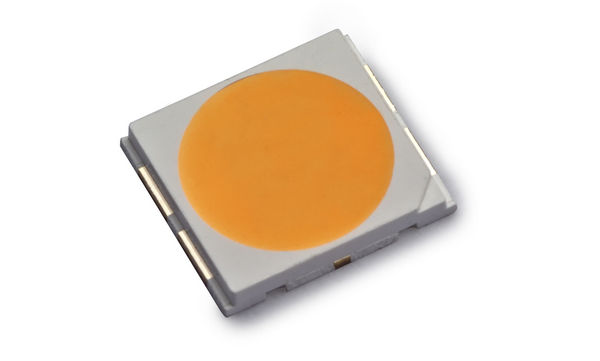

Following Go Scale Capital's acquisition of Lumileds, the transfer of the companies LED patents will give Chinese manufacturers a chance to resolve patent issues, said LEDinside analysts. (Photo Credit: Philips Lumileds) |

With standard/mid-power LED being priced competitively, the growth of high-power LED have slowed. As a result, Lumileds has been under the pressure of losing market shares. Furthermore, Lumileds faces immense challenges. The rise of Asian LED manufacturers led by Chinese companies and the expiration of the YAG white-light LED patent in 2017, for examples, are serious cost problems that Lumileds needs to address. When the lighting business was under Royal Philips, there had been efforts to outsource the manufacturing to Asia. However, the LED market ultimately has been too competitive for Philips Lumileds to make a turnaround, and its parent company made the decision to sell based on Lumileds’ sliding revenue.

Chu provides two important points in his assessment of the impact that the Lumileds’ acquisition by GO Scale Capital has on the LED industry:

1. Chinese LED manufacturers have a chance to resolve patent issues and enter overseas markets

Lumileds is one of the five major IP holders in the LED industry. The acquisition also provides the company an additional 600 patents from Royal Philips. In the future, Lumileds will be able to license its vast patent holding in order to boost its operating results. Chinese LED manufacturers will also be able to break through the patent barriers surrounding the foreign markets. With Chinese investors having the controlling stake in Lumileds, China-based companies will have a greater voice when it comes to resolving patent issues and establishing their presence in the global LED market.

2. GO Scale Capital consolidates its resources and provides Lumileds more strategic partners

GO Scale Capital has made a series of investments in companies positioned on the LED supply chain: Lattice Power (epi wafer), TimesLED (epi wafer), ShineOn (package), SunSun Lighting (LED luminaires), and Alighting (LED luminaires and heat dissipation). Once Go Scale Capital has the controlling stake in Lumileds, it may consolidate all its industry-related interests, inserting its new acquisition into the supply chain.

In the past, Lumileds focused on high-power LED production; and when facing the rise of standard and mid-power LED in the market, Lumileds outsourced its manufacturing like other European and American LED companies. LEDinside expects that this cost-saving measure to continue as Lumileds gains strategic partners in China after the takeover.

|

TrendForce Contacts

Ms. Lilia Huang

Tel: +886-2-7702-6888 ext 640

Mobile: +886-972-803801

LiliaHuang@TrendForce.com

Ms. Sharon Yang

Tel: +886-2-7702-6888 ext 660

SharonYang@TrendForce.com

|

|

About TrendForce (www.trendforce.com)

TrendForce is a global provider of the latest development, insight, and analysis of the technology industry. Having served businesses for over a decade, the company has built up a strong base membership base of 410,000 subscribers. TrendForce has established a reputation as an organization that offers insightful and accurate analysis of the technology industry through five major research divisions: DRAMXchange, WitsView, LEDinside, EnergyTrend, AVANTI and Topology. Founded in Taipei, Taiwan in 2000, TrendForce has extended its presence in China since 2004 with offices in Shenzhen, and Shanghai.

|