Established in January 2008, Pegatron Corporation leverages years of product development expertise and vertically integrated manufacturing capabilities to provide a seamless one-stop service, spanning from creative design to systematic production. By combining EMS and ODM business models, Pegatron has established itself as a premier global DMS (design, manufacturing, and service) company. Recently, the company has actively invested in the near-eye display sector, aiming to offer clients comprehensive solutions through complete upstream and downstream vertical integration. TrendForce had the privilege of interviewing Paula Chen, Senior Director at Pegatron, to gain an in-depth perspective on the current market landscape and Pegatron’s strategic direction in the near-eye display market.

Light Engine Analysis

The primary challenge in creating AR glasses acceptable to the mass market lies in optimizing the form factor. Chen notes that the volume of the light engine directly dictates the eyewear’s design. An excessively large engine results in bulky temples, severely compromising aesthetics and comfort. Regarding technology, both LCoS and LEDoS are advancing rapidly. While LCoS currently holds advantages in cost and mass production readiness, LEDoS is positioned to become the mainstream technology for lightweight AR glasses in the long run. This is due to its superior potential for miniaturization, high contrast, and brightness uniformity—advantages that will become more pronounced as the technology matures and costs decline.

Optical Waveguide Analysis

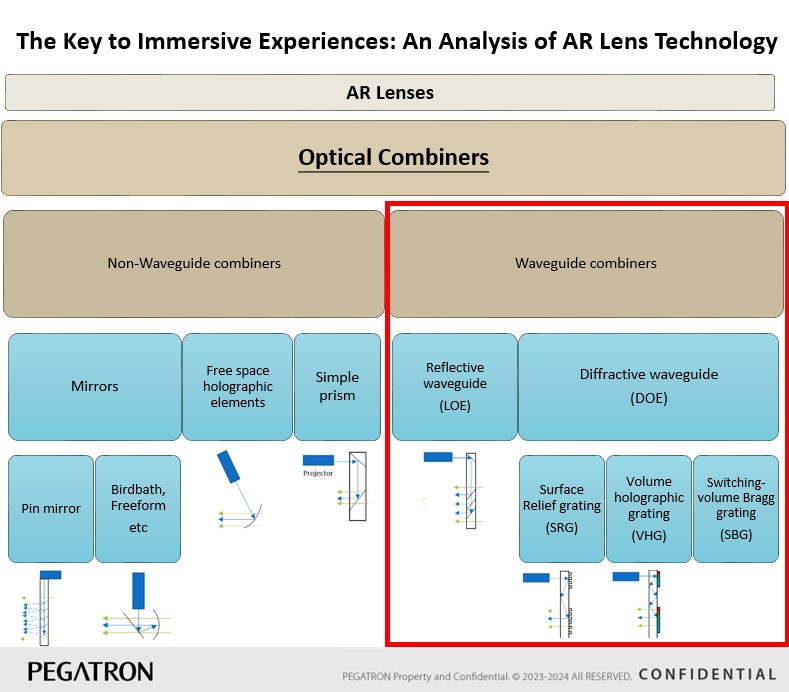

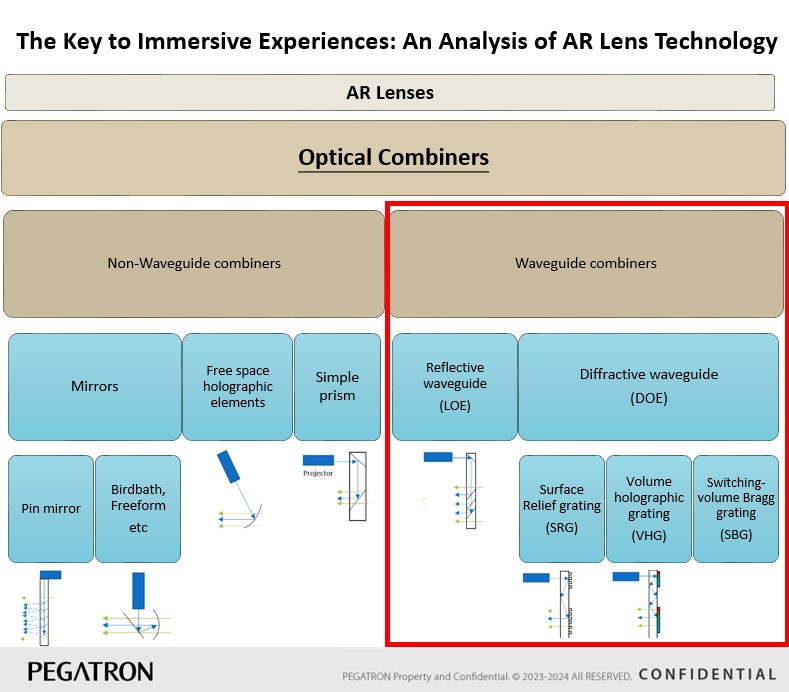

Currently, lightweight AR glasses primarily rely on optical waveguides for image transmission. These can be broadly categorized into reflective (geometric) waveguides and diffractive waveguides. While reflective waveguides offer superior optical efficiency, they rely on traditional manufacturing processes that demand extremely high cleanliness standards. Furthermore, achieving two-dimensional pupil expansion with this technology involves high complexity and low yields, making it difficult to scale for future mass production needs.

In contrast, SRG (surface relief grating)—a type of diffractive waveguide technology—has emerged as the industry standard. Although SRG offers lower optical efficiency than reflective waveguides, it utilizes semiconductor-like processes, such as nano-imprint lithography. This allows for the creation of a master mold followed by rapid replication, similar to a stamping process. Because this method offers high production efficiency and is better suited for consumer-grade mass production, it has become the dominant technology for optical waveguides. In view of this trend, Pegatron and Magic Leap recently initiated a partnership for AR component production. Under this agreement, Pegatron will leverage its manufacturing capabilities to support the scaled production of Magic Leap’s components, including its industry-leading optical waveguide technology.

System-Level Design Analysis

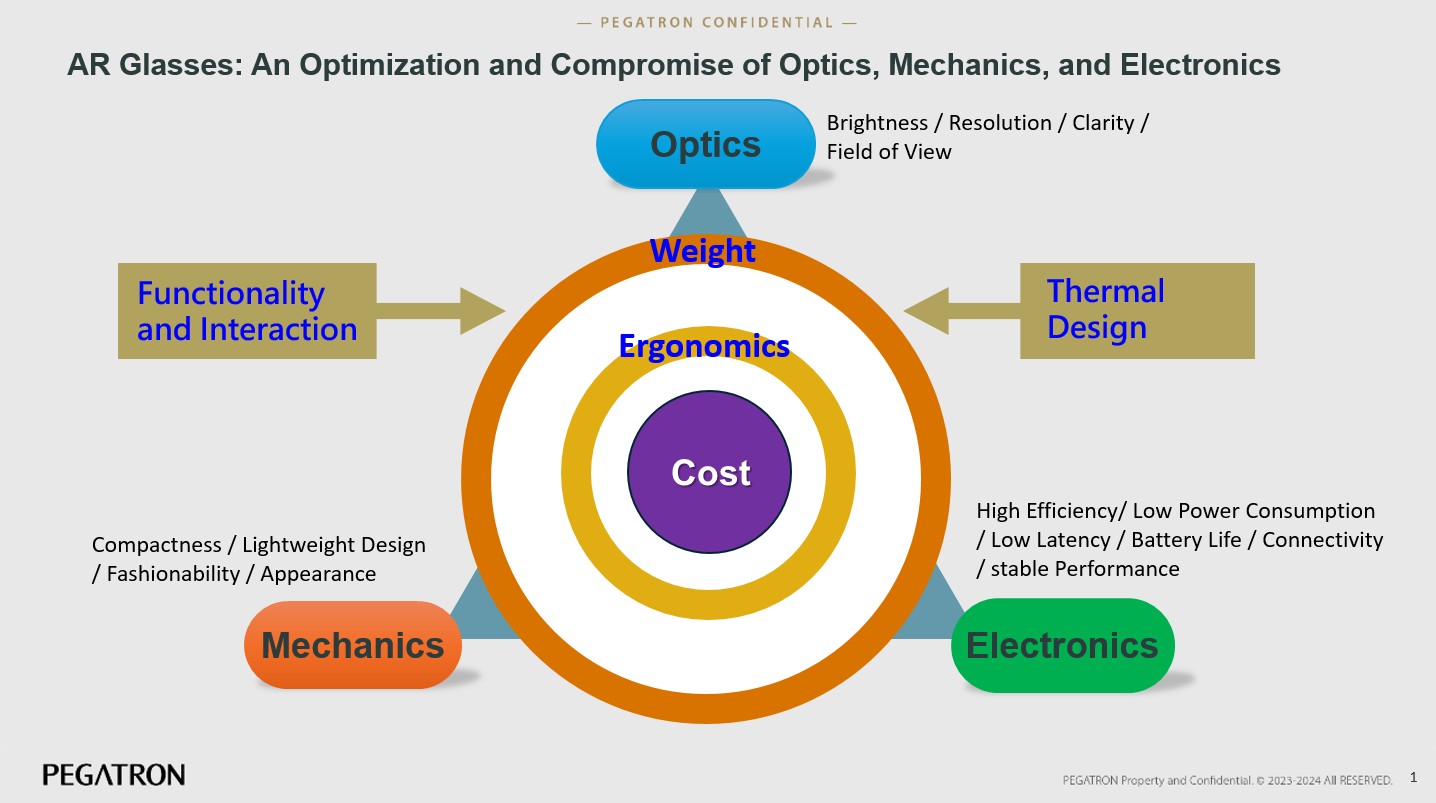

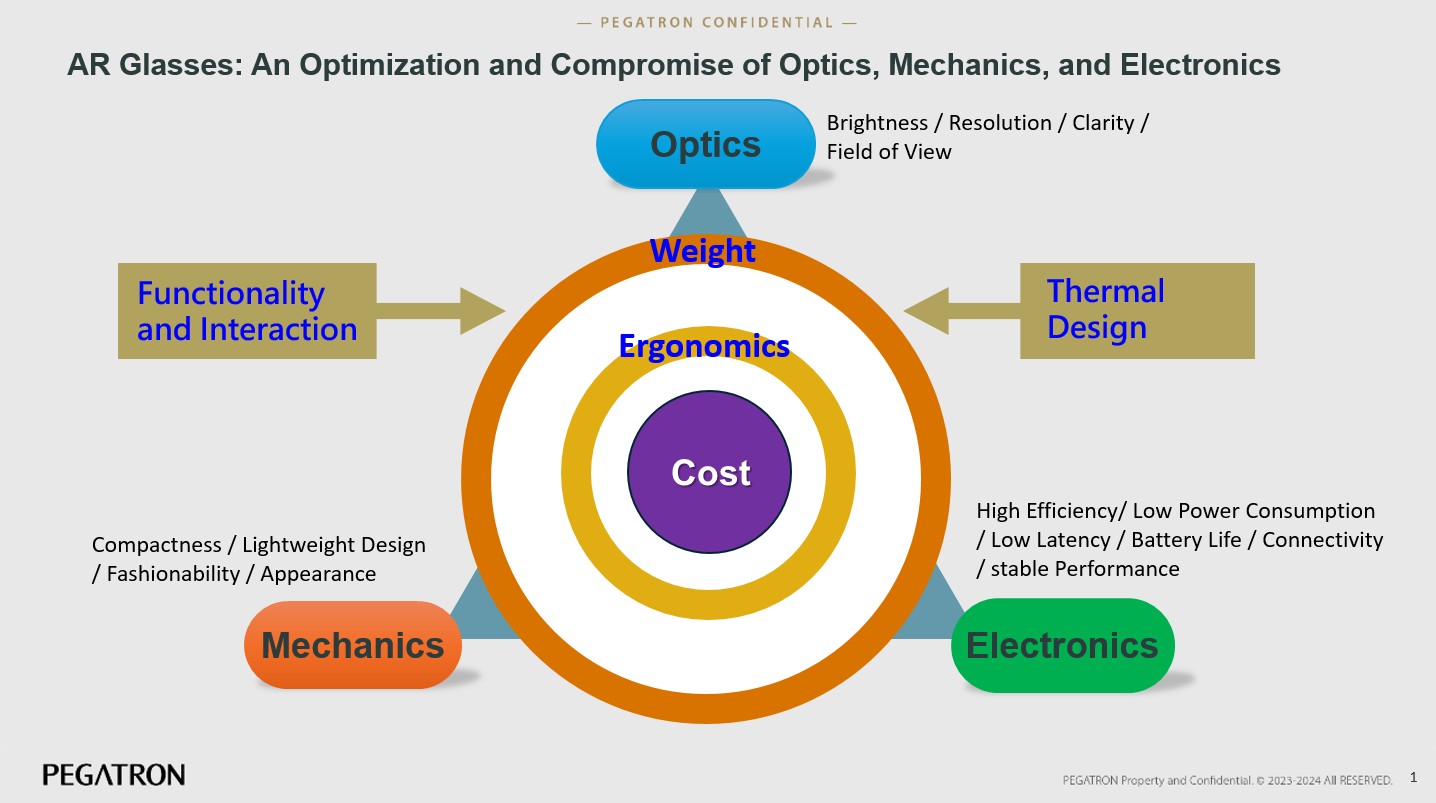

Regarding system design, Chen emphasizes that developing AR glasses is not merely a matter of stacking components; rather, it is an intricate process defined by complex trade-offs. Optical parameters—such as brightness, resolution, clarity, and FoV—act as interdependent constraints. For instance, increasing the FoV expands the area of light diffusion, which causes brightness to decrease geometrically. Similarly, the electrical system involves a constant tug-of-war between computing power, power consumption, and battery life. High performance requires high computing power, which inevitably increases power consumption.

Meanwhile, mechanical design faces the challenge of integrating a multitude of components—including light engines, batteries, circuit boards, camera modules, and hinges—into the limited space of the temples, all while ensuring wearer comfort. Chen notes that without a deep understanding of optical limitations, a manufacturer cannot design effective heat dissipation. Likewise, without knowing battery limits, software architecture cannot be optimized. This reality tests a manufacturer’s ability to execute deep, cross-disciplinary integration. Only by reconciling these conflicting parameters can a manufacturer transform a complex device into a product that consumers are willing to wear all day.

Market Analysis

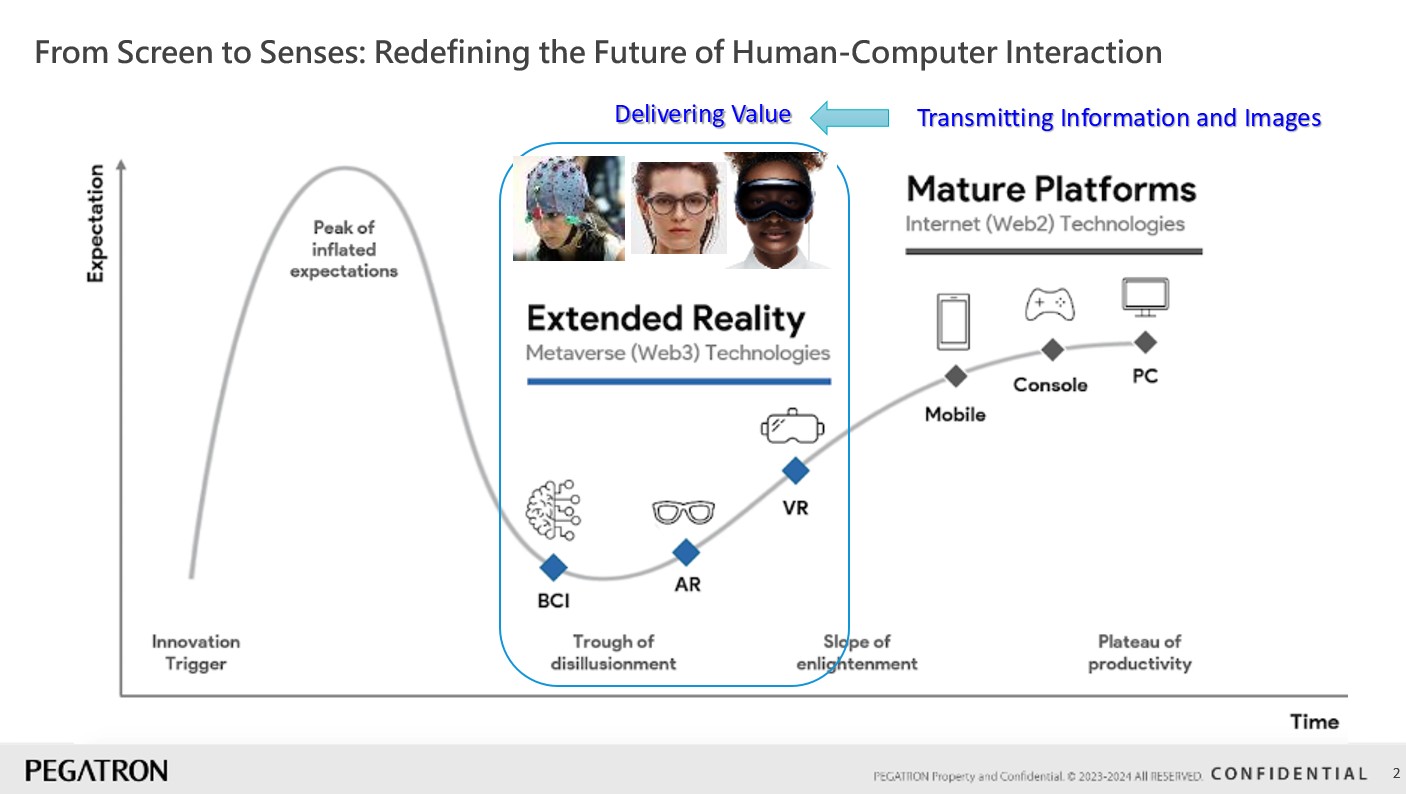

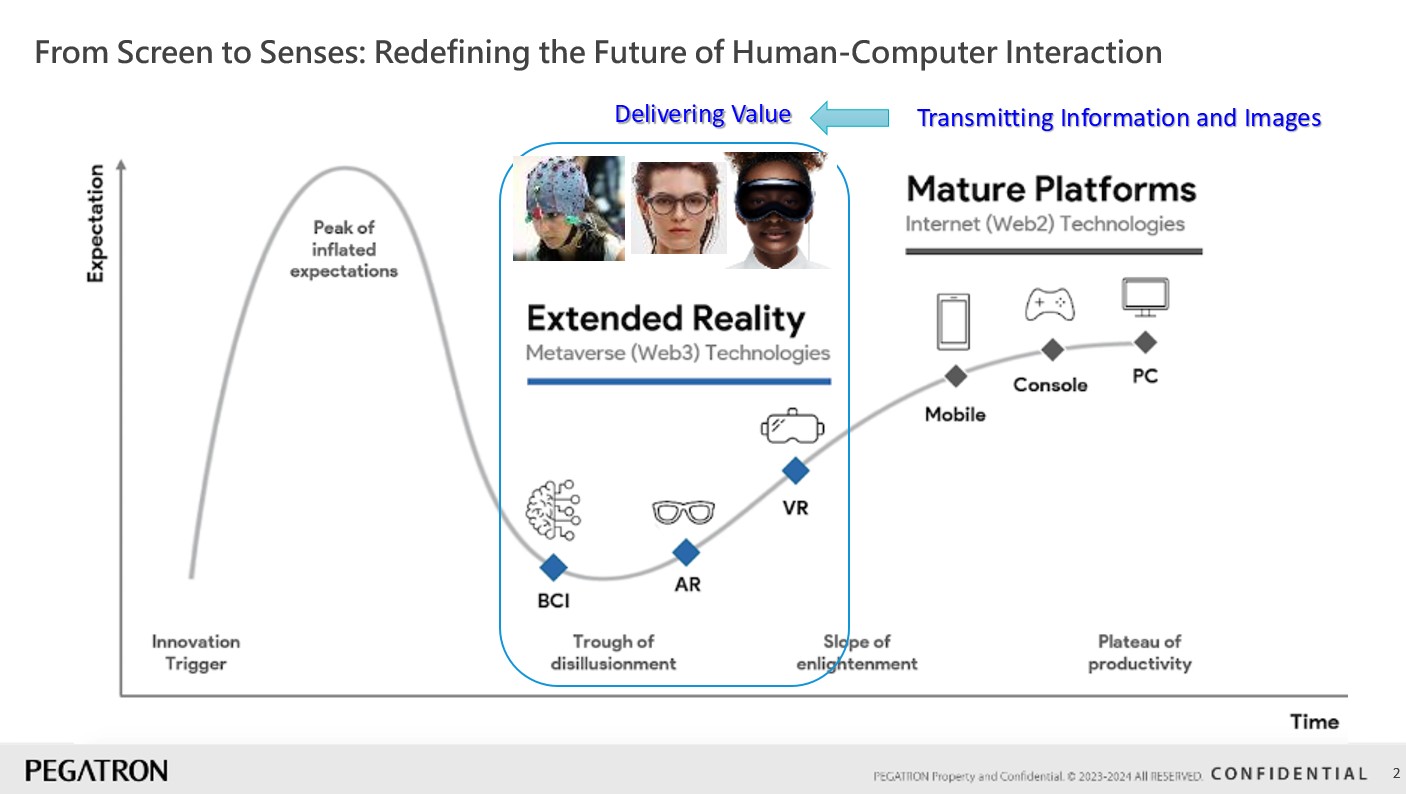

When discussing market potential, Chen offers a vivid analogy: for many, the first action upon waking is to put on glasses to see the world clearly, while for others, it is picking up a phone to check messages and schedules. The ultimate goal of AR glasses is to unify these two actions, providing clear vision while enabling real-time access to information.

Based on market data, global eyewear shipments are currently comparable in scale to smartphone shipments. Chen optimistically predicts that if AR glasses can successfully merge the functions of these two products, achieving a market penetration rate equivalent to just 5% of the smartphone market could yield substantial shipments of 6 to 7 million units. As technology matures and application scenarios expand, the overall market is poised for robust growth.

AR Glasses: From Science Fiction to Practical Application

AR glasses are not the product of a single technology but the result of the integration of optics, electronics, and mechanics. Pegatron’s investments reflect the industry’s expectation that eyewear will become a major gateway for accessing digital information. Although many challenges remain to be overcome, the journey of AR glasses from science fiction movies to daily life is already underway.

Author: Estelle / TrendForce

TrendForce 2025 Near-Eye Display Market Trend and Technology Analysis

Publication Date : 29 August 2025

Language : Traditional Chinese / English

Format : PDF

Page Number: 168

|

If you would like to know more details , please contact:

|