The COVID-19 pandemic heavily impacted the global auto market and in turn damaged the automotive LED industry in 1H20, according to TrendForce’s latest investigations. In 2H20, however, the gradual recovery of vehicle sales as well as the development of NEVs provided some upward momentum for the automotive LED industry, whose revenue for the year reached US$2.572 billion, a 3.7% decline YoY. Automotive LED revenue for 2021 is projected to reach $2.926 billion, a 13.7% growth YoY, thanks to the increasing demand for automotive headlights and display panels. As automakers continue to incorporate LED lighting solutions into new car models, the penetration rate of automotive LED will continue to undergo a corresponding increase as well.

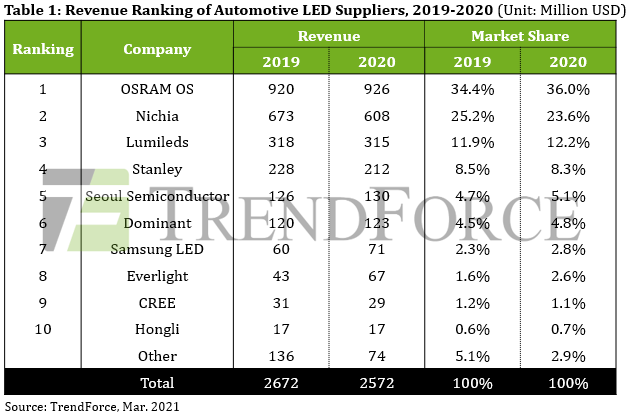

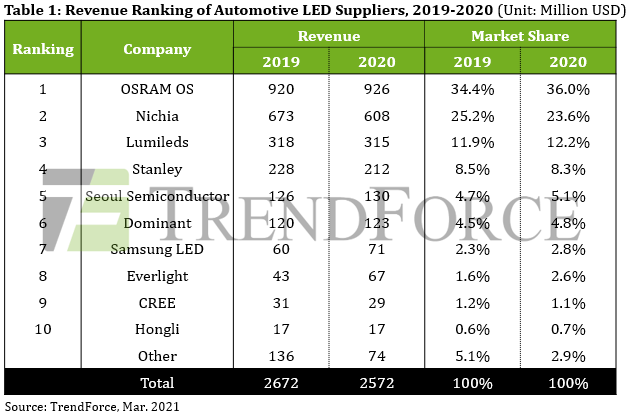

TrendForce analyst Joanne Wu indicates that, in the automotive LED player revenue ranking of 2020, OSRAM Opto Semiconductors, Nichia, and Lumileds remained the top three largest automotive LED suppliers, respectively, with a combined market share of 71.9%. In particular, European and American automakers favored OSRAM’s solutions for their high-end vehicle models and NEVs due to the high quality of OSRAM products. Adoption by these automakers subsequently became the main revenue driver of OSRAM’s automotive LED business.

On the other hand, the pandemic caused Japanese automakers to suspend their operations and therefore had a direct impact on the revenues and market shares of Japanese LED suppliers, such as Nichia and Stanley, in 2020. Nichia and Stanley saw their revenues decline by 9.8% YoY and 7% YoY, respectively, and were the two suppliers among the top 10 last year to have shown relatively noticeable declines. Seoul Semiconductor’s nPola and Wicop LED products were adopted by Chinese automakers, including CCAG, SAIC-GM, and NIO, due to these products’ high brightness and compact sizes. Seoul Semiconductor’s market share reached 5.1% in 2020. Finally, not only did other suppliers, including Samsung LED and CREE, deliver consistent performances in the automotive aftermarket (AM) and performance market (PM) segments, but they also gradually began entering the automotive Original Equipment Manufacturer (OEM) lighting market. Samsung LED and CREE each took seventh and ninth place on the 2020 ranking with a 2.8% and 1.1% market share, respectively.

On the whole, TrendForce finds that automotive demand has been recovering since 4Q20. Accordingly, LED suppliers indicate that their booking orders appear bullish throughout 2021, meaning most LED suppliers now need to extend their product lead times in response. At the same time, LED players indicated that double booking might happen in the near future. Thereby, they will make decisions in light of the actual booking order quantity to see the possibility of increasing prices.

Gold+ Member Report

-

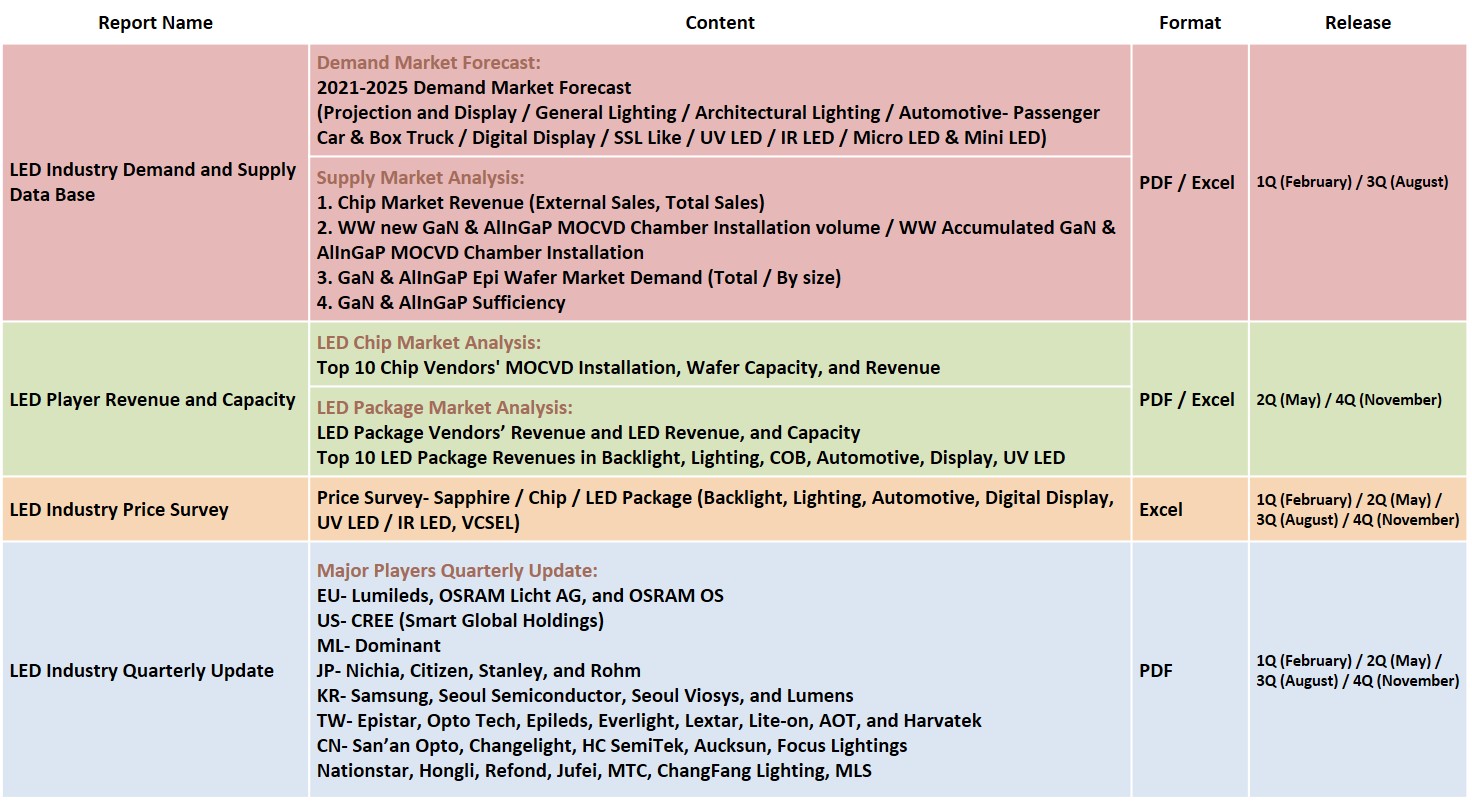

LED Industry Demand and Supply Data Base- Backlight / General Lighting / Architectural Lighting / Automotive Lighting / Digital Display / Projection & Horticultural Lighting / UV LED / IR LED / μLED Mini LED Applications

-

LED Player Revenue and Capacity- Chip Market and Player Capacity & Revenue / Package Market and Player Capacity & Revenue / LED Player Revenue Ranking in Each Application

-

LED Industry Price Survey- Sapphire / Chip / LED Package (Backlight / Lighting / Automotive / Digital Display / UV LED / IR LED)

-

LED Industry Quarterly Update- Major LED Player Quarterly Update (EU, US, Japan, Korea, Taiwan, China)

|

|

If you would like to know more details , please contact:

|