(Author: Judy Lin, Chief Editor, LEDinside)

|

|

Show girls at an automotive parts manufacturer Casa. (All photos courtesy of LEDinside) |

LED automotive lighting market has gained traction over the last few years, and each year manufacturers are developing more advanced products to meet market demands. At Taipei AMPA 2016, which took place at Taipei Nangang Exhibition Center and Hall 1 TWTC Exhibition Hall 1 Area A from April 6-9, 2016, LEDinside observed several distinctive market trends:

|

|

Xtel's replaceable LED light source modules for both automotive and motorcycle headlights. |

1) Rise of replaceable LED light source modules for headlights

More manufacturers are developing LED light sources modules resembling traditional halogen or HID bulbs that could be easily replaced in malfunctioning headlights, said Duff Lu, Research Manager of EnergyTrend, a sister research arm of LEDinside. This is a far step away from integrated headlight designs in the past, which required throwing out the entire headlight when it broke down.

|

|

A close up of Xtel's LED replacement light source for headlights. The company showcased several models at the show including LED H8/9/11/16 and LED H4. |

Manufacturers including Xtel and MacAdam are employing this design concept in to their headlights. With more than 30 years of experience in automotive lighting manufacturing, industry veteran Xtel featured its patented LED H8/9/11/16 and LED H4 replaceable LED light sources for headlights at its booth this year. The replaceable LED light sources developed in 2015 can be applied in both automotive and motorcycle headlights, said John Chen, Sales and Marketing Director, Xtel.

|

|

Close up of one of Xtel's LED replacement light source for headlights. |

The luminaires have entered mass production phase, and are currently shipped to Japan, said Chen. Due to LED headlights higher costs compared to traditional halogen and HID lights, developed countries are more willing to use the light source in contrast to developing countries in Southeast Asia, he added.

|

|

Eagle Eyes booth. The company's OLED taillight prototype can be seen as several small red dots in the center left corner of this photo. The company prohibited journalists from taking pictures of its products. |

2) Eagle Eye starts deploying OLED taillight market strategy

When Audi showcased its OLED taillight at the Frankfurt Lighting Show last year, LEDinside was not expecting the trend to catch on quickly in the aftermarket (AM). The shift from high-end luxury car brands to low and mid class cars is projected to be a gradual one similar to HID automotive lights progress. Some car light manufacturers in the AM sector, though, are starting to position themselves in the sector.

|

|

Eagle Eyes booth seen from afar. The company also showcased an adaptive LED headlight prototype, which LEDinside has not included in this article. |

Taiwanese car light manufacturer Eagle Eye featured a functioning prototype OLED taillight at its booth. “An advantage of OLED is it offers more flexibility in the taillight design, and is capable of delivering more uniform lighting distribution than that achievable with current technology,” said the company’s Sales Third Section Chief Jamie Lin. He declined to speak about the OLED panel supplier or when the company planned to mass produce the lights, only saying it will depend on when they could effectively lower manufacturing costs.

Theoretically, LED light guide plate designs, which have become the mainstream design in LED taillights over the last two years, can achieve uniform lighting effects similar to OLED panels. Yet, LEDinside observed not all LED light guide plate taillights at the show delivered uniform lighting distribution. LED point light source could still be seen in some manufacturers’ products.

|

|

Andy Wu of DKI International pictured with the company's featured LED taillight product at Taipei AMPA 2016. |

Taiwanese LED taillight specialist DKI International revealed it was in the process of developing OLED taillights, indicating more companies are becoming aware of this trend. “We are in the process of developing OLED taillights, and have contacted Osram and are in talks about potential OLED panel supplies,” said Andy Wu of DKI International.

While manufacturers recognize OLED taillights is an emerging trend, Wu noted OLEDs were still too costly. He projected it will take another five to 10 years before OLED panel prices will decline to the same levels of LEDs.

|

|

Sirius LED headlights for automobiles can also be used for motocycle headlights, such as the one seen here in motorcycle parts specialist Magazi's booth. |

3) Motorcycle LED headlight market catches attention of some

Another niche market gaining traction among Taiwanese lighting manufacturers is motorcycle headlights, where LEDinside observed Sirius Light Technology (Sirius) and traditional sedan lighting manufacturer LH Group were starting to tap into motorcycle LED headlights sectors.

|

|

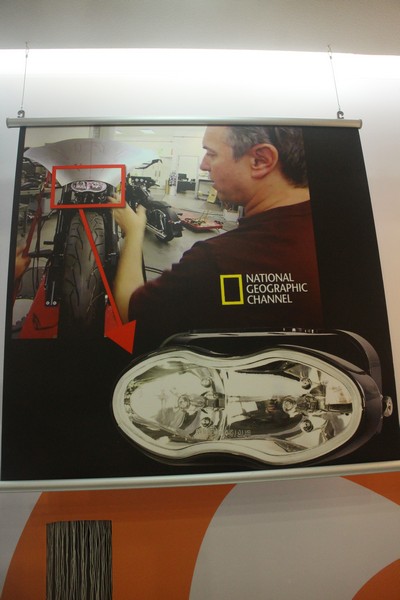

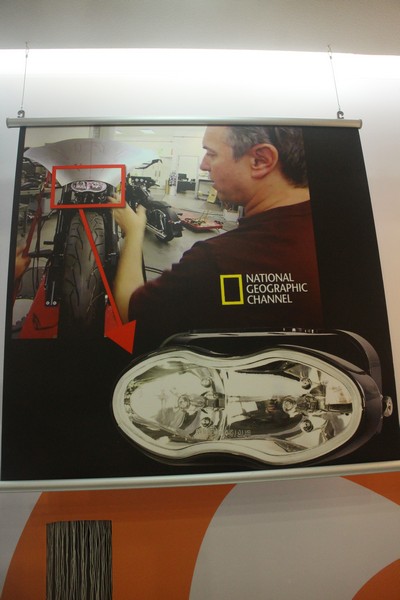

Sirius automobile LED headlight seen used as a motorcycle headlight in a National Geographic Channel program. |

Sirius, one of Taiwan’s LED automotive lighting maker, showcased an interesting poster of their LED headlight for cars being installed into a motorcycle on a National Geographic Channel program at their booth. The installation happened by accident, said Kathleen Tsai, Sales Vice Manager, Sirius. Observing growth in the motorcycle lighting market, the company is collaborating with a motorcycle parts company to develop motorcycle headlights.

|

|

|

|

Top two photos: Sirius LED headlights. Bottom: These LED headlights can be used for motorcycle headlight applications such as in this Magazi motorcycle. |

According to Tsai, the company is targeted consumer group is those in the 20 to 30 age range that are willing to spend on motorcycle. For manufacturers already in the automotive lighting sector making motorcycle lights is less costly because the size of the lights are smaller, and could reduce molding costs. Additionally, price sensitive consumers could be more willing to spend on the lights, since they are less costly than car lights.

|

|

|

|

Top two photos: The LH Group's LED headlights for motorcycles. Bottom: LH Group's motorcycle LED taillights. |

LH Group showcased two LED headlights for motorcycle applications that it had developed in 2015, company representatives said they started making the headlights because clients were requesting for the lights. LED taillights for trucks was also a major highlight at the company booth this year.

|

|

Jun Yen, Head of JW Optical. |

4) JW Optical boosts profits with differentiated LED fog light design

To differentiate from market competitors and boost profits, some manufacturers are adding a twist to conventional luminaire designs. JW Optical showcased a LED fog light it developed in 2015 that is capable of switching from white to a yellow tint at the trade show. “The lights use a single LED, we use our patented luminaire technology to change the emitted color,” said head of the company Jun Yen. The luminaire is protected by patents in U.S., Taiwan, China, Japan and Germany.

The lights are especially designed to improve drivers’ visibility on the road during poor weather conditions such as fog, snow, rain and smog, added Yen. White LED fog lights might not always be the best choice in these weather conditions, especially during snowy weather where white light reflected from the snow could cause overt glare and discomfort to drivers’ eyes. Additionally, it meets standards outlined under the UN Convention on Road and Traffic, which gives drivers the option to choose from white or yellow fog lights.

|

|

|

Top: JW Optical's LED fog lights during white color mode. Bottom: JW Optical LED fog lights when switched to yellow. |

According to Yen, the company has shipped the lights to U.S. and Japan. The LED fog lights, which mostly use Cree LEDs are being sold at above US $100 per light. “A lot of manufacturers are selling LED fog lights for $8 to $10,” he added.

In a separate interview Kathleen Tsai, Sales Vice Manager, Sirius explained some manufacturers can sell LED fog lights at extremely low prices by purchasing components from China, setting up production line there, or outsourcing production to Chinese companies. Additionally, these luminaire might not meet automotive lighting standards or acquired accreditation from related organizations.

5) Show hard hit by upcoming Guangzhou International Fair for Motorcycle and Parts Exhibition

Most LED manufacturers LEDinside spoke to at the show were concerned about the dwindling volume of international manufacturers, reported decline in visitors ranged from 30% to 50%. Due to the show’s geographical location, most visitors are mostly from Japan and Southeast Asia, while a handful are from Middle East and U.S. Manufacturers pointed out The Second Guangzhou International Fair for Motorcycle and Parts Exhibition to take place from April 15-17, 2016 had caused the decline in visitors and recommended TAITRA should move the show to an earlier date to avoid it from coinciding with the Guangzhou fair.

Asked about their thoughts on the recent IIHS study findings that LEDs are still undeforming compared to HID lights, most automotive lighting manufacturers agreed that is the case. Manufacturers noted it might take a while for LED automotive lighting to fully mature. “LED headlight is still mostly market hype,” said John Chen, Sales and Marketing Director, Xtel. “HID still outperforms it in cost/performance ratio.” Jun Yen, head of JW Optical also agreed noting easing profits in HID lights and government policies has driven the development of LED automotive lightings. “It will take another five to eight years before LED automotive lighting fully matures,” he added.

With LED automotive lighting industry still in progress and lack of specific LED light source standards in the AM, manufacturers are continuing to develop innovative products, such as replaceable LED headlight sources which are in a legally gray area. Others are seeking to differentiate from market competition by entering niche automotive lighting markets first, such as Eagle Eyes and DKI strategy in the OLED taillight sector. Sirius and LH Group’s growing interest in the motorcycle lighting market is another sign. JW Optical’s strategy has been creating a new niche market by making yellow LED fog lights that could be suitable for snowy weather conditions. In either case Taiwanese automotive lighting companies are eagerly seeking niche markets to differentiate their products.