The latest report from

LEDinside, a division of

TrendForce, finds the total value of the global

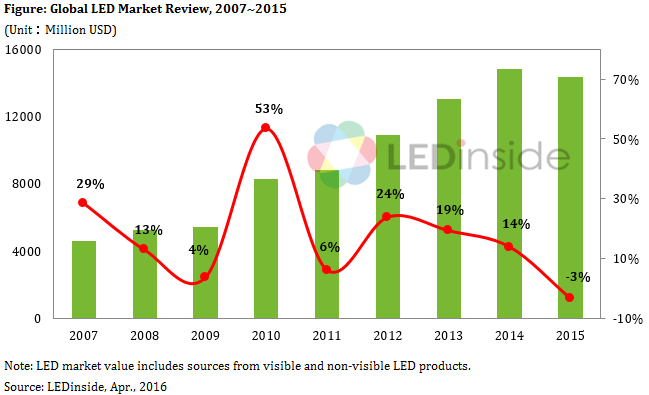

LED market (include both visible and non-visible LED products) arrived at US$14.32 billion in 2015, representing YoY growth of -3%. The market witnessed its first annual decline in value last year mainly because of the price war among the LED manufacturers, with the ASPs of some mainstream LED packages suffering a drop of 40% or more compared with 2014. The rising U.S. dollar also resulted in falling revenues for many manufacturers.

LEDinside Research Director Roger Chu explained that there were three major factors behind the negative growth in market value for 2015:

1. Decrease in LED usage volume due to technological advancements: The introduction of flip-chip LED technology into the TV application, for example, has caused further reduction of LED usage volume for LED backlight units.

2. The rise of OLED as the replacement technology: With the maturation of OLED technology, an increasing number of branded smartphone vendors are considering using OLED panels to differentiate their products. Since OLED panels are self-illuminating and do not require LED backlight units, they will eventually simplify mobile backlight design.

3. Oversupply: The current price war in the LED market is the result of the industry experiencing oversupply and excess capacity. While the usage volume of

LED lighting products continue to expand, falling prices constrain the growth of the overall market value.

On the whole, Chu expects the demand for LEDs to keep growing in 2016. Most applications, such as general lighting, automotive lighting and LED displays, will see increases in the LED usage volume. LED backlight will be the exception as the emergence of OLED technology will cut the LED usage volume for this application.

The ongoing supply-demand imbalance means that LED manufacturers are still under pressure to lower their prices this year. However, the market already experienced an excessive level of competition last year, resulting in many LED products selling at a loss (some prices are even near the products’ cash costs). Further price declines will therefore be limited.

The LED industry faces the end of more than a decade of high growth as demand slows down in various applications

The LED industry has always enjoyed high growth since the beginning because different applications have emerged to sustain the overall demand. LED backlights, for instance, is used to illuminate various devices, from the keyboards and screens of mobile phones to LCD TVs and even the touch displays of smartphones and tablets. Likewise, LED lighting has made significant market penetration. LEDinside’s data reveal that the global LED market value, on average, has been growing at a CAGR of about 20~30% over the past ten years and more. The first negative YoY growth appeared in 2015 and was mainly attributed to slow down in major application markets.

Gold Member

LED Supply Chain - Backlight / Lighting / Automotive / Display / UV LED / IR LED

Major LED Package Ranking in Applications

|

LED Industry Demand and Supply Data Base |

Demand Market Forecast:

2015-2020 market demand in backlight, lighting, automotive, display, UV, infrared, SSL like and son on |

Excel |

1Q (February) / 3Q (August) |

Supply Market Analysis:

1. Chip market revenue (external sales, total sales)

2. WW new MOCVD chamber installation volume / WW accumulated MOCVD chamber installation / WW new and accumulated MOCVD by K465i

3. Epi wafer market demand (total / by size) |

LED Chip Market Analysis:

Top 10 Chip vendors' MOCVD installation, wafer capacity, and revenue |

LED Package Market Analysis:

LED package vendors' revenue and LED revenue

Top 10 LED package revenues in backlight, lighting, COB, automotive, and display |

|

LED Industry Price Survey |

Price Survey - Sapphire / Chip / LED Package / Bulb

|

Excel |

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November) |

|

LED Market Demand and Supply Analysis |

Demand Market |

PDF |

2Q (May) / 4Q (November) |

|

Backlight |

|

General Lighting |

|

Automotive |

|

Display |

|

Infrared LED Market (2Q) / UV LED Market (4Q) |

|

Supply Market |

|

MOCVD Market |

|

Wafer and Chip Market, URT |

|

Supply and Demand Sufficiency Analysis |

If you would like to know more details , please contact:

|

Joanne Wu +886-2-8978-6488 ext. 912 joannewu@trendforce |