LED lighting developed rapidly in Southeast Asia thanks to its infrastructure construction, which was promoted by the development and impact from the Association of South-East Asian Nations (ASEAN), according to LEDinside, a research subsidiary of global research institute TrendForce. ASEAN is an inter-governmental international organization gathering countries in Southeast Asia. Established in 1967, ASEAN covers a population of approximately 618 million people, covering a land area of 4.48 million km², with abundant natural resources, and it is one of the world's fastest growing economic regions.

In view of economic integration, the current main form of cooperation within and outside the ASEAN is Free Trade Area. ASEAN Free Trade Area(AFTA)was officially launched on January 1, 2002. The ASEAN-China Free Trade Area has been fully implemented on January 1, 2010. At this time, mainland China and six ASEAN nations (Singapore, Malaysia, Thailand, the Philippines, Indonesia and Brunei) will reduce their industrial tariffs to 0%. The other four ASEAN nations (Myanmar, Vietnam, Laos and Cambodia) will reach this goal in 2015. In the first three quarters of 2014, total trade between China and ASEAN nations reached about $ 346.60 billion, accounting for 11% of China's total foreign trade. The two sides are planning to update and expand the content and scope of the ASEAN-China Free Trade Area agreement, cutting non-tariff measures, actively proposing a new set of service trade commitments, promoting real openness in the investment field by improving market access and personnel interflow and enhance trade and investment liberalization and facilitation, and striving to raise two-way trade to one trillion US dollars by 2020.

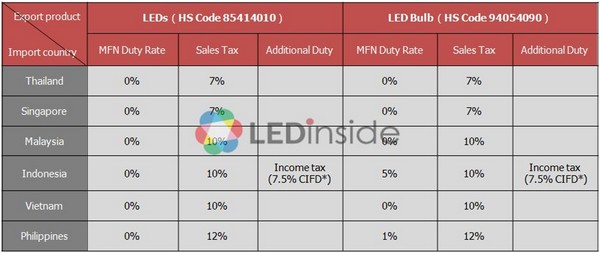

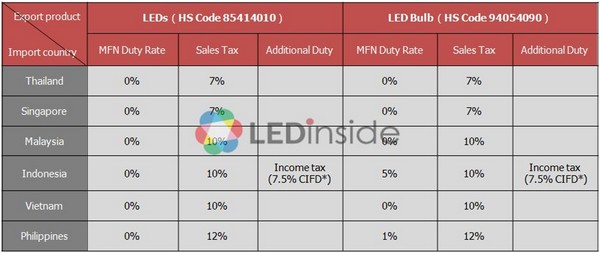

Benefiting from China-ASEAN bilateral trade agreement, Chinese manufacturers enjoy lower tariffs or zero tariffs when exporting LED products to ASEAN nations. For example, as long as the Chinese enterprises obtains certificates proving the products origin are from China, LED component products exported to the ASEAN nations can enjoy zero tariffs. For finished lighting products, taking bulb lamp for example,tariff concessions provide a good environment for Chinese LED manufacturers to enter the Southeast Asian market, and promote further industrial cooperation between China and ASEAN.

|

|

(Source: LEDinside) |

ASEAN not only actively negotiates free trade agreements, but also sets a goal that setting up the "ASEAN Economic Community" in 2015. The establishment of the ASEAN Community envisions the ASEAN to be a single market and production base. Moreover, the Southeast Asian nations achieved rapid economic growth, and invested heavily in infrastructure construction, also policy is very attractive, so the industry is optimistic about the growth of LED lighting in Southeast Asian nations. ASEAN Economic Community (AEC) has a number of specific objectives; the important ones that can promote the Chinese LED manufacturers to enter the Southeast Asian market include free movement of goods, investment and labor, freer flow of capital, and transportation facilities construction.

The establishment of FTA and the Economic Community has brought a great number of favorable policies for Chinese LED manufacturers, which provides entry point for Chinese LED manufacturers to access the ASEAN market, while different manufacturers should adopt corresponding specific strategies. For example, packaging manufacturers should seize opportunity to enter the supply chain of local lighting manufacturers, or invest in building local factories; lighting OEM should put more focus towards the direct export of finished products to the local market, and adopt new transporting way to reduce transportation time and distance. For lighting brands, they can set up a single agent or offices in the Southeast Asian market, and invest in building local factories, regarding Southeast Asia as a manufacturing base. Different manufacturers of LED industry chain should seize the current golden opportunity to enter the Southeast Asian market, broadening the highly anticipated emerging market.

2015 Southeast Asian Lighting Market Report

Chapter One: Report Structure and Key Factors

-

Introduction to Chapters and Study Methods

-

Southeast Asia (SEA) Lighting Market Key Factors

-

Factor Conditions

-

Demand Conditions

-

Related and Supporting Industries

-

Government

-

Firm Strategy, Structure, and Rivalry

-

Chance

Chapter Two: SEA Market Macroeconomics

-

SEA Market Macroeconomics Overview

-

Basic Index

-

Average Electricity Price

-

Power Consumption

Chapter Three: Lighting Market Scale and Trend Analysis

-

Lighting Market Scale and Trend

-

Southeast Asian Lighting Market Scale and Trend

-

Thailand Lighting Market Scale and Trend

-

Singapore Lighting Market Scale and Trend

-

Malaysia Lighting Market Scale and Trend

-

Vietnam Lighting Market Scale and Trend

-

Indonesia Lighting Market Scale and Trend

-

Philippines Lighting Market Scale and Trend

-

Southeast Asia Countries – China Import Scale and Trend Analysis

-

Thailand – China Import Scale and Trend Analysis

-

Singapore– China Import Scale and Trend Analysis

-

Malaysia – China Import Scale and Trend Analysis

-

Vietnam – China Import Scale and Trend Analysis

-

Indonesia – China Import Scale and Trend Analysis

-

Philippines – China Import Scale and Trend Analysis

Chapter Four: Manufacturers Introduction and Strategies Analysis

-

Manufacturers Introduction and Strategies Analysis Overview

-

LED Lighting Industry Chain Structure Analysis

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

Major Positioning Strategies of Southeast Asia Lighting Manufacturers

-

Major Lighting Manufacturers Company Profile

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

Two Local Manufacturers Company Profile for Each Country

Chapter Five: LED Lighting Products Specifications and Prices Analysis

-

Major LED Lighting Products Overview

-

Major Lighting Manufacturers’ LED Bulb Pricing Strategy Analysis

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

LED Bulb Specification and Price

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

Major Lighting Manufacturers’ LED Tube Pricing Strategy Analysis

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

LED Tube Specification and Price

-

Thailand

-

Singapore

-

Malaysia

-

Vietnam

-

Indonesia

-

Philippines

-

LED Street Light Specification and Price

Chapter Six: Lighting-Related Policies and Regulations

-

Introduction

-

Thailand

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Singapore

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Malaysia

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Vietnam

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Indonesia

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

-

Philippines

-

Summaries

-

Structure and Responsibility of Main Energy Agencies

-

Main Regulations and Standards of Governments and Institutes

-

Major LED Lighting-related Encouragement Policies and Standards

Chapter Seven: ASEAN Developments and Impact on Lighting Industry

-

Part 1: ASEAN Introduction and Development

-

ASEAN Introduction and Development

-

ASEAN-China Free Trade Area

-

Global Economic Development Overview

-

Analysis of ASEAN Free Trade Area & ASEAN Economic Community

-

Part 2: ASEAN’s Impact on Lighting Industry

-

ASEAN’s Impact on Lighting Industry

-

FTA’s Impact on China LED Manufacturers - Tariff Preferential

-

ASEAN Economic Community’s Impact on Chinese LED Manufacturers

-

Chinese LED Manufacturers’ Advantages Analysis

-

Chinese LED Manufacturers Recommended Strategies

Chapter Eight: Proposal on Entering into SEA Lighting Market

-

Proposal on Entering into Southeast Asia Lighting Market

-

Lighting Product Positioning Strategy in Southeast Asian Market

-

Specification Strategy

-

Pricing Strategy

-

Strategic Analysis of Entering into Southeast Asian Lighting Market

-

Product Requirements

-

Product Positioning

-

Channels Selection

-

Government Relations

Release: February 2015

Language: English

Format: PDF

Pages: 145