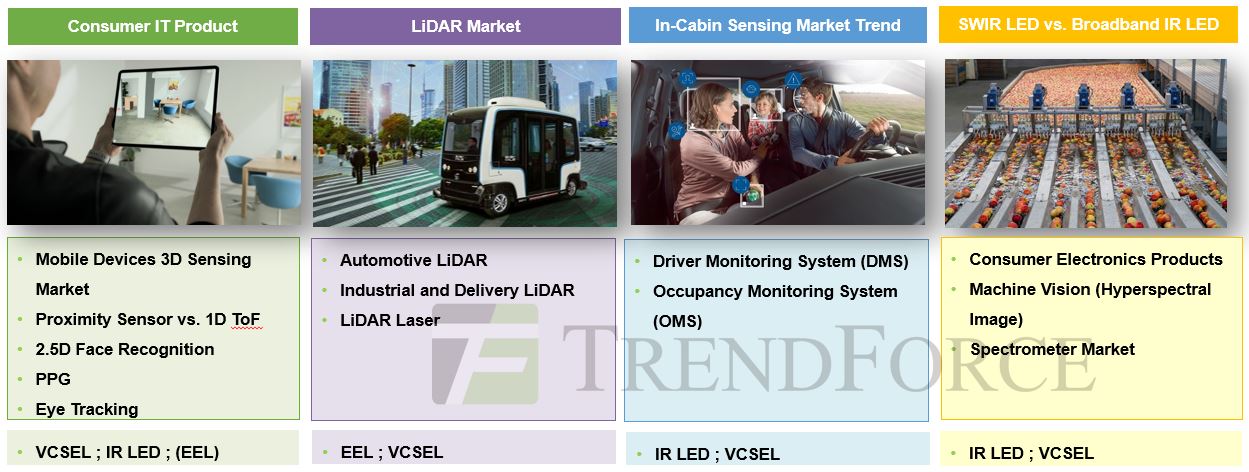

According to TrendForce 2021 Infrared Sensing Market Trend- 3D Sensing, LiDAR, SWIR LED, as the market growth of major applications including 3D sensing for mobile devices (smartphone, tablet and AR), automotive in-cabin sensing (DMS and OMS), LiDAR markets (ADAS, autonomous vehicle, industry, delivery and smart city), eye tracking, security surveillance and PPG continuously boost demands, the infrared sensing market scale in 2025 is expected to reach USD 3.862 billion. The following major applications all have above-average growth momentum!

3D Sensing for Mobile Devices

World facing 3D sensing functions include rangefinder, blur photo effect (background removal included), 3D object recognition, spatial modeling and augmented reality. So far, the integration of 3D sensing with 5G connectivity has been introduced in smartphones and tablets to provide AR-assisted interior design, home renovation, home additions, and even integration with video games. 3D sensing solutions may even see cross-industry commercial opportunities in the future. Hence, the introduction of 3D sensing in augmented reality glasses in the future is more worth looking forward to!

LiDAR

According to TrendForce, the LiDAR application markets include ADAS, autonomous vehicle, industry, delivery and smart city.

Under the impact of COVID-19 pandemic, the development of automotive industry did not go as expected. Yet, major car makers have released new energy vehicles. High-end traditional vehicles and new energy vehicles are mostly equipped with ADAS. In addition, because LiDAR is considered to be the necessary sensor to reach the autonomous vehicle L4 and L5, car makers have adopted LiDAR in advance to create database and increase accuracy. In addition, automotive LiDAR is also used in autonomous bus, Robo-Taxi and truck.

With the booming development of e-commerce, e-commerce and express companies have adopted unmanned delivery machine, bicycle messenger and autonomous truck in order to reduce the cost and increase the efficiency of last mile delivery. Thereby, delivery robots with automatic navigation and autonomous decision-making functions enjoy high demand.

Furthermore, due to the impact of COVID-19 crisis, the industrial automation market development did not go as expected. Most manufacturers postponed the original plans based on their budgets. Yet, some manufacturers have actively developed industrial automation due to manpower shortage in the future. Although 1H21 will still be affected by COVID-19 pandemic, the European and the US markets will have a chance to boost the demand for industrial automation in 3Q21 following the postponement of development caused by the pandemic in 2020.

Automotive In-Cabin Sensing (Driver Monitoring System and Occupancy Monitoring System)

The National Transportation Safety Board (NTSB), Euro NCAP and European Union actively promote driver monitoring system (DMS) and occupancy monitoring system (OMS) in car models. Responding to the policy, vehicle manufacturers will drive the entry of first-tier DMS system manufacturers and component suppliers. Priority will be given to the installation of driver monitoring systems in the OE markets of passenger and commercial vehicles. Car makers include Audi, BMW, Cadillac (GM), Ford, Mazda, Infiniti (Nissan), Lexus (TOYOTA), Mercedes-Benz, Subaru, Volkswagen, Volvo, Maxus, Great Wall Motors, BORGWARD, Geely and Hyundai. Indirect ToF can detect longer distance and obtain 3D depth information. It is believed that indirect ToF technology will be introduced into new car models in 2022-2023. In addition, Tesla has already introduced DMS/OMS into the Model 3.

Eye Tracking

Eye tracking technology is extremely useful in solving motion sickness, enhancing immersion and improving interaction. Through foveated rendering, the GPU load can be reduced by 50-60%. Since 2020, eye tracking starts to be used in AR products. In addition, the market scale will grow with increasing shipments of augmented reality and virtual reality products in the future.

Infrared Niche Market- SWIR LED

Short Wave InfraRed LED (SWIR LED) is on wavelength of 1,050-2,500nm. The major SWIR LED market applications include FoD recognition, proximity sensor, blood glucose / alcohol monitoring, machine vision (hyperspectral imaging), etc. Machine vision (hyperspectral imaging) adopts SWIR light source and InGaAs camera to bin the spectroscopic properties according to different materials. SWIR LED suppliers contain DOWA, USHIO, Hamamatsu, Showa Denko, Epistar, Epileds, etc. Amongst those, DOWA can provide SWIR LED products with higher brightness than average level in the industry.

With focus on the major infrared sensing markets in 2021, TrendForce discusses and analyzes market scale, opportunity and challenge, product specification and supply chain from the prospective of terminal market, with an aim to provide a more comprehensive understanding of infrared sensing markets for readers.

Author: Joanne, Research Manager at TrendForce

2021 Infrared Sensing Market Trend- 3D Sensing, LiDAR, SWIR LED

Release: 01 January 2021

Format: PDF

Language: Traditional Chinese / English

Page: 175

Chapter I. Infrared Sensing Market Scale vs. 3D Sensing Market Scale

1.1 Infrared Sensing Market Scale

Scope of Report

2021-2025 Infrared Sensing Market Scale Analysis

2019-2020 (E) Infrared Player Revenue Ranking

Infrared Sensing Market- Power and Sensing Distance

1.2 3D Sensing Module vs. Light Source Market Scale Analysis

Future Outlook for 3D Sensing Market Opportunities

Future 3D Sensing Market Opportunity Analysis- By Application Market Segments

2021-2025 3D Sensing Module Market Scale Analysis

2021-2025 3D Sensing VCSEL / EEL Market Scale Analysis

LiDAR Application Market Overview

2021-2025 LiDAR Market Scale Analysis

VCSEL vs. EEL

2015-2020 VCSEL Market Strategic Alliance for 3D Sensing Market

2018-2025 (E) VCSEL Product Trend

Chapter II. Consumer Electronics Application Trends

Biometric Method Pros vs. Cons and Price Analysis

2020-2021 Mobile Biometric Sensing Market Penetration Analysis

Optical Sensing Market Overview in Mobile vs. Wearable Devices

2.1 3D Sensing Market

3D Sensing Application Market

Mobile Devices 3D Sensing Functions

3D Sensing Technology Overview

2020-2021 3D Sensing Module Player and Product Analysis

Structured Light Depth Camera Cost and Supply Chain

2019-2021 Structured Light Product Projections

Active Stereo Vision Depth Camera Cost and Supply Chain

Direct ToF vs. Indirect ToF Technology Analysis

APPLE World Facing Direct ToF Depth Camera Cost and Supply Chain

2020-2022 Time of Flight Product Estimates

VCSEL Product Design to Fit Eye Safety Assurance

VCSEL Testing and Burn in Requirements

2018-2020 Mobile Devices 3D Sensing Branding Supply Chain Analysis

2020-2021 Mobile Devices 3D Sensing Branding Supply Chain Analysis

2020-2021 Smartphone 3D Sensing Module Market and Penetrate Rate

2020-2021 Mobile Devices 3D Sensing VCSEL Market Value and Volume

2020-2021 Mobile Devices 3D Sensing VCSEL Market Value and Volume

2020-2021 Mobile Devices 3D Sensing VCSEL Market Value and Volume- By 3D Sensing Solutions

Future Outlook for 3D Sensing Market Opportunities

2.2 P+L Sensor vs. 1D ToF

2020-2021 Proximity Product and Price Analysis

2020-2021 Under Display Color and Proximity Sensors Product Trend

STMicroelectronics 1D ToF Entered Samsung Note 20+ Supply Chain

2020-2021 Proximity Sensor vs. 1D ToF Market Value and Volume

2.3 2.5D Facial Recognition

2.5D Face ID Concepts and Product Advantages

IR LED Specification and Price in 2.5D Facial Recognition Application

2.5D Facial Recognition Market Supply Chain

2021-2025 IR LED Market Value in 2.5D Facial Recognition Application

2.4 Photoplethysmography (PPG)

Physiological Parameter Measurement vs. Disease Analysis

Heart Rate and Oximetry Optical Sensing Principle

APPLE Watch Pulse Oximetry Sensor Product Specification Analysis

APPLE Smart Watch Applies Pulse Oximetry Sensor-Supply Chain Analysis

PPG Supply Chain Analysis

Photoplethysmography (PPG) Module Design

2020-2021 Smart Watch / Bracelet Shipment vs. PPG Market Value and Volume

2.5 Eye Tracking

Augmented Reality vs. Virtual Reality- Technologies Coverage

Eye Tracking Market Demand

Eye Tracking IR LED Product Specification and Price Analysis

2021-2022 Augmented Reality Market Key Factor Analysis

Eye Tracking Market Supply Chain Analysis

2021-2025 AR and VR Shipment vs. IR LED Market Value Analysis

2.6 Optical Fingerprint on Display

Optical and Ultrasonic Fingerprint on Display Technology Analysis

OLED Optical Fingerprint on Display Technology

2020-2022 OLED Optical Fingerprint Technology

LCD Optical Fingerprint on Display Technology

Chapter III. LiDAR Market Trend

LiDAR Product Definition

Global LiDAR Player List

Scanning LiDAR Execute Process

Flash LiDAR Execute Process

Scanning LiDAR vs. Flash LiDAR Player Analysis

Scanning LiDAR vs. Flash LiDAR Technology Analysis

Scanning LiDAR vs. Flash LiDAR Analysis

LiDAR Application Market Overview

2021-2025 LiDAR Market Scale Analysis

2020 (E) LiDAR Player Revenue Scale Analysis

LiDAR System Architecture and Cost Analysis

LiDAR Product Specifications Analysis and Price Survey

3.1 Automotive LiDAR Market

2021-2025 Automotive LiDAR Market Scale

ADAS vs. Autonomous Vehicle

Automotive Sensing Analysis- LiDAR, Radar and Camera

Automotive LiDAR vs. Automotive Radar Market and Technology Trend

Autonomous Vehicle Market Strategic Alliance Analysis

LiDAR Usage Volume Analysis

Passenger Car and Truck- AV L3 vs. L5 LiDAR and Sensor Requirements

Autonomous Truck Market Player Analysis

Autonomous Bus Market Trend

Autonomous Bus Market Supply Chain Analysis

Autonomous Bus- AV L4 LiDAR and Senor Requirement

Robo-Taxi- AV L4 LiDAR and Senor Requirement

Pros and Cons of the Integration of LiDAR and Headlamp

3.2 Industry and Delivery LiDAR Market

2021-2025 Industry vs. Delivery LiDAR Market Scale

Industry LiDAR Market Application Overview

Industrial Robots Product Analysis

Delivery LiDAR Market Application Overview

AGV / AMR Market Value Chain Analysis

AGV / AMR LiDAR vs. LiDAR Laser Requirement Analysis

3.3 LiDAR Laser Market

LiDAR Three Major Components and Market Requirements

LiDAR End Product Requirements and Light Source Analysis

LiDAR Laser Product Portfolio and Player Analysis

905nm LiDAR Laser Diodes Product Analysis

905nm vs. 1,550nm LiDAR Laser Advantages and Applications

Photodetector Analysis

1,550nm Photodetector Analysis

2021-2025 LiDAR Laser Market Value- Application vs. Light Source

2019-2020 (E) LiDAR Laser Player Revenue Ranking

LiDAR Laser and Photodetector Player List

Chapter IV. In-Cabin Sensing Market Trend

Driver Monitoring System (DMS) vs. Occupancy Monitoring System (OMS)

DMS / OMS To Be Mandatory For New Cars in 2022

DMS vs. OMS- Sensing Analysis

ADAS Integration with DMS / OMS Functions

DMS vs. OMS- Features Analysis

DMS- Product Introduction Design

DMS- Product Specification and Case Study

OMS- Product Introduction Design

DMS vs. OMS- Integrated Sensing Requirement Analysis

2020-2021 Infrared Light (IR LED / VCSEL) Product Specification and Price

2021-2025 Infrared Light (IR LED / VCSEL) Market Value in DMS / OMS

DMS vs. OMS Market Landscape Analysis

DMS vs. OMS Market Supply Chain

Chapter V. SWIR LED and Broadband IR LED Market Trend

5.1 SWIR LED Market Trend

Short Wave InfraRed (SWIR) Product Definition and Market Strength

SWIR Application Markets - By Wavelength

SWIR LED Epitaxy and Chip Technology Analysis

SWIR LED Product Specification and Price Analysis

SWIR Image Sensor Analysis

2021 Machine Vision (Hyperspectral Image) Market Trend

Machine Vision (Hyperspectral Image) Application Market Opportunity

Machine Vision (Hyperspectral Image) Market Case Studies- 1

Machine Vision (Hyperspectral Image) Market Case Studies- 2

Machine Vision (Hyperspectral Image) Market Case Studies- 3

Machine Vision (Hyperspectral Image) Market Case Studies- 4

Machine Vision (Hyperspectral Image) Market Supply Chain Analysis

Possibilities of Non-Invasive Blood Glucose Monitoring Market

Non-Invasive Optical Blood Glucose Measurement

SWIR LED Market Opportunity and Potential Client List

5.2 Broadband IR LED Market Trend

Spectrometer Market Overview

Spectrometer Market Definition

Spectrometer Market- Broadband IR LED Product Trend

Spectrometer Market- Multispectral Sensors Product Trend

Spectrometer Market Case Studies

Possibilities of Spectral Sensing Market in Mobile Applications

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|