TrendForce’s latest projections show global shipments of AMOLED smartphone panels are anticipated to surpass 840 million units in 2024, reflecting a remarkable growth of almost 25% from 2023. With leading smartphone manufacturers increasingly embracing AMOLED technology, shipments are predicted to surpass 870 million units in 2025, representing a YoY increase of 3.2%.

Traditionally, Korean panel makers have dominated the AMOLED panel supply chain. However, in recent years, Chinese suppliers have ramped up their production of flexible AMOLED panels, ensuring a consistent supply to cater to surging market demand. Additionally, these Chinese companies have been forging partnerships with smartphone brands, which has led to a notable increase in AMOLED panel usage in smartphones, rising from 51% in 2023 to 56.9% in 2024. TrendForce posits this penetration rate is expected to grow by 2% to 3% each year—potentially reaching 68% by 2028—thereby establishing AMOLED panels as the standard display in the smartphone industry.

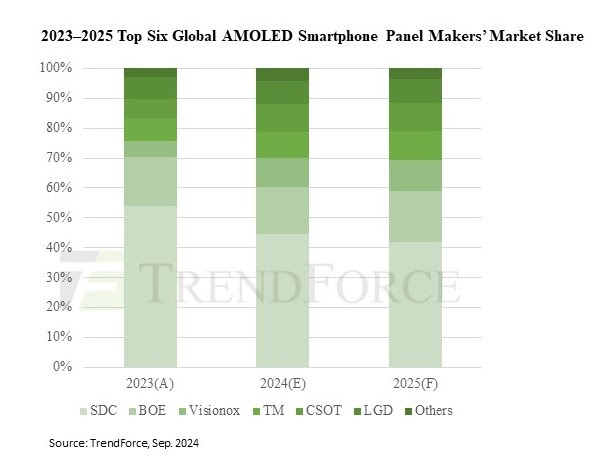

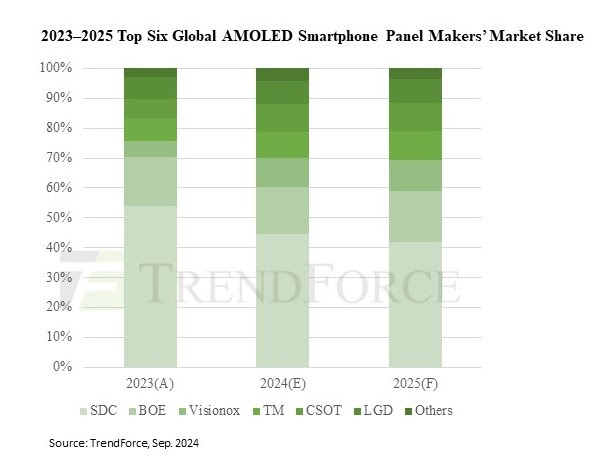

Korean panel makers mainly cater to Apple and Samsung, with their shipments to other brands declining annually, primarily offering limited quantities of rigid AMOLED panels. On the other hand, Chinese panel makers have experienced a consistent rise in AMOLED panel shipments. BOE has emerged as the top supplier of AMOLED smartphone panels in China, with projections indicating shipments will reach approximately 130 million units this year.

Alongside strong partnerships with local smartphone brands, BOE has been progressively increasing its shipments to Apple, having successfully passed the validation process for the upcoming iPhone 16 series in 2024 and is gearing up for mass production as planned. This achievement highlights that after years of development, BOE's products and technology are slowly earning recognition from major international brands like Apple, potentially opening doors for greater inclusion in Apple's future offerings.

TrendForce points out that other manufacturers of AMOLED smartphone panels are experiencing swift growth. Thanks to robust sales of Huawei's latest models in 2024, Visionox is projected to achieve shipments of 80 million units. Furthermore, both TIANMA and CSOT have begun to ramp up their AMOLED smartphone panel shipments this year, with a strong possibility of exceeding their past records.

It is anticipated that Chinese panel makers will represent 47.9% of global AMOLED smartphone panel shipments in 2024. By 2025, their total shipments are predicted to exceed those of their Korean counterparts, achieving a projected global market share of 50.2%.